An Arctic shipping route will not be fully commercially viable until 2035 at the earliest, says The Arctic Institute, i.e. it will be about two decades before we see a lot of traffic along that route. An Arctic shipping route gives sea vessels an alternative to the Suez Canal, for example, exporters shipping from China to Europe can deliver their merchandise more cheaply and faster.

A new study on the commercial opportunities and problems of Arctic shipping by a team of researchers at the Maritime Division at the Copenhagen Business School, found that the shipping season on the NSR (Northern Sea Route) will be too short for investments in ice-class vessels to be commercially viable before 2035.

The Arctic Institute wrote:

“Only after the year 2035 may the Arctic shipping route along Russia’s northern coast become competitive for some ships of comparable size.”

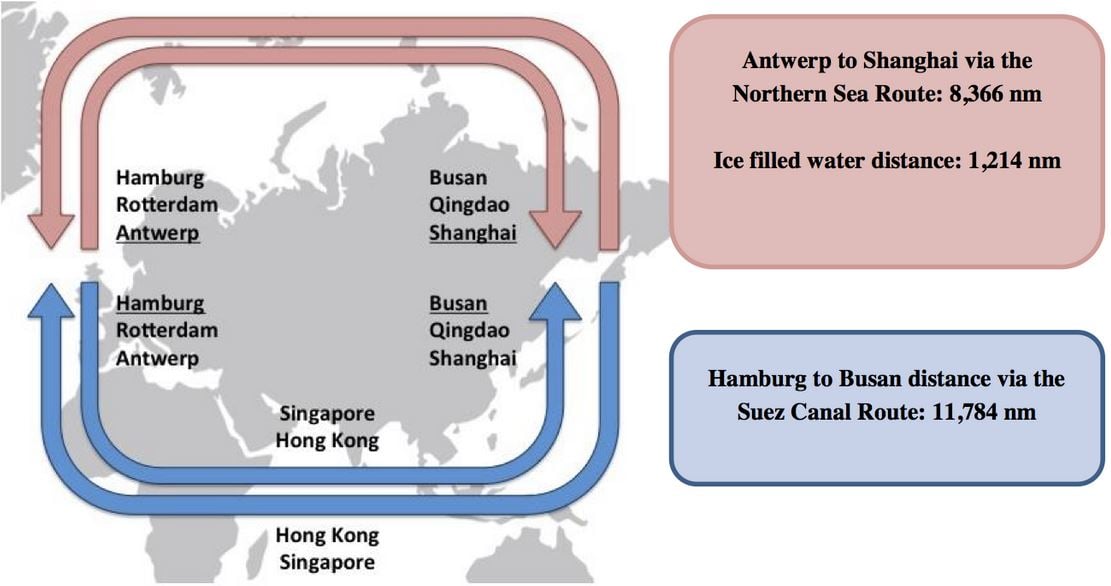

The distance from China to Europe via the Northern Sea Route is considerably shorter compared to the Suez Canal Route. (Image: The Arctic Institute)

The distance from China to Europe via the Northern Sea Route is considerably shorter compared to the Suez Canal Route. (Image: The Arctic Institute)

Northern Sea Route vs. Suez Canal Route

The authors were tasked with determining whether the investment in an ice-reinforced container vessel operating along the Northern Sea Route would be preferable to spending the money on an open-water vessel navigating solely along the Suez Canal Route.

The researchers compared a container ship operating along the NSR with a capacity of 8000 TEU (TEU stands for ‘twenty-foot equivalent unit’ container) to three open-water container vessels operating along the Suez Canal Route (SCR) with container capacities of 8000, 10,000 and 15,000 TEU respectively.

The study assumed that the vessels would navigate along the NSR during the navigation season and take the SCR when the Arctic waters were frozen over (preventing navigation).

New calculation tool used

The Copenhagen Business School (CBS) study used an innovative calculation tool to determine when an investment for ice-reinforced vessels destined to operate along the NSR would become more favourable than an ordinary container ship navigating along the SCR.

Using the calculation tool, the authors worked out the comparative costs per container, factoring in more than a dozen variables including vessel size and specification, capacity and engine type, distance and average speed, transit fees, load factors, and navigation season.

The researchers claim their study is the first of its kind especially designed to compare Arctic and traditional shipping routes.

After taking into account all the variables, it will be at least two decades before the Northern Sea Route becomes economically viable. (Image: The Arctic Institute)

After taking into account all the variables, it will be at least two decades before the Northern Sea Route becomes economically viable. (Image: The Arctic Institute)

Rather than making narrow statements regarding Arctic shipping from a single point in time, the sophisticated methods applied in this study allowed for the creation of detailed scenarios to understand how several different factors and variables might influence the feasibility of using the NSR for shipping when under a given scenario a break-even point may occur.

Consequently, the tool allowed for a detailed look at how, for example, lower or higher fuel prices might affect the economic calculation of shipping via the Arctic.

Northern Sea Route season currently too short

Senior researcher on the study, Peter Grønsedt, said:

“The annual navigation season is currently too short to offset the higher fuel consumption and capital costs of the ice-reinforced vessels compared to SCR vessels. [Furthermore] the navigation season remains too unstable in order to maintain the strict time schedule upon which most liner service relies.”

The study examined several different scenarios, including slow steaming, where ships reduce fuel costs by sailing more slowly. In this respect, the authors concluded that shippers might achieve additional cost savings by utilizing the reduced distance offered by the NSR to operate at lower speeds, compared to the SCR.

At the moment, the ice-free season in the Northern Sea Route is too short. (Image: The Arctic Institute)

At the moment, the ice-free season in the Northern Sea Route is too short. (Image: The Arctic Institute)

“However, the recent fall in oil prices has lowered the incentive of using the Arctic routes despite the reduced sailing distances,” Grønsedt added.

While the results of the study imply that Arctic liner shipping may become economically viable in about two decades’ time, the possibility of regular traffic along the NSR rests on a number of crucial assumptions which are subject to major uncertainties and fluctuations.

These uncertainties include fuel prices, the future decline in sea ice, entry deterrence such as transit and icebreaker fees, port availability, vessel sizes, and icebreaker availability.

Even if the ice-free navigation season were to rapidly get longer and fuel prices rose considerably, the biggest ships on the SCR would probably be able to operate at lower costs due to economies of scale.

Citation: “ARCTIC SHIPPING – COMMERCIAL OPPORTUNITIES AND CHALLENGES,” ØRTS HANSEN, GRØNSEDT, LINDSTRØM GRAVERSEN AND HENDRIKSEN. Copehnhagen Business School (CBS). Published February 2016.

Video – The Northern Sea Route

This New Yorker video shows the ice-class bulk carrier Nordic Odessey as it travels through the Northern Route, which experts believe will become increasingly more navigable as Arctic ice melts.