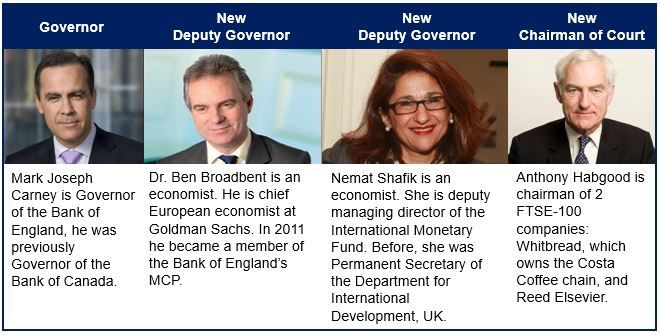

A radical Bank of England shake up has been announced by Governor Mark Carney, with the naming of two new deputy governors with clearly defined responsibilities.

The post of Deputy Governor in charge of monetary policy will be taken up by Dr. Ben Broadbent, while Dr. Nemat Shafik will be Deputy Governor responsible for markets and banking. Both Shafik and Broadbent will also sit on the rate-setting MPC (monetary policy committee).

As Carney introduced sweeping changes to operations and senior management, we warned that risks were accumulating in the housing markets and the global financial system.

His announcement of a radical Bank of England shake up comes just a week after the UK’s central bank was criticized for possibly being involved in the foreign exchange scandal. None of the senior appointments have come from existing Bank of England employees.

Deputy Governor for Monetary Policy

Dr. Broadbent, as Deputy Governor for Monetary Policy, will be responsible for the Bank of England’s research and analysis of the United Kingdom economy in support of MPC decisions, and for the distribution and provision of bank notes that are secure against the threat of counterfeiting.

The UK’s central bank added “Dr Broadbent will sit on the Bank’s Court of Directors, the Monetary Policy Committee, and the Financial Policy Committee. He is also responsible for chairing MPC in the event of the Governor’s absence.”

Deputy Governor for Markets and Banking

Dr. Shafik, as Deputy Governor for Markets and Banking, will report directly to the Governor. She will be appointed to the MPC as “the person who has executive responsibility within the bank for monetary policy operations,” taking the place of the Bank’s current Executive Director for Markets, Paul Fisher.

As soon as her position is formalized, Shafik will hold seats at the Financial Policy Committee (FPC), the MPC, and the Bank’s Court of Directors. The Court will appoint her to the Board of the Prudential Regulation Authority.

Chairman of the Court of Directors

Anthony Habgood has been appointed as the Chairman of Court for a renewable term of four years. Habgood succeeds Sir David Lees, who retires at the end of June.

As Chairman of the Court of Directors, Habgood leads Court in its responsibility for managing all the Bank’s affairs, except for the formulation of monetary policy. According to the Bank of England (BoE), “Court’s responsibilities include determining the Bank’s objectives and strategy, and ensuring the effective discharge of the Bank’s functions and the most efficient use of its resources.”

Habgood will also chair the Oversight Committee of Court, which was set up after the 2012 Financial Services Act.

Chief economist Spencer Dale swaps positions with executive director of financial stability Andy Haldane.

In a speech at Cass Business School, City University, London, Mr. Carney explained that the financial crisis and the Great Recession that followed it was a powerful reminder that price stability, i.e. controlling inflation, is not enough to maintain financial stability.

Carney is changing the structure and culture of the Bank of England.

Bank of England shake up – mission more than inflation

Carney said:

“Words which had alluded to such risks were not followed by actions that might have prevented them being realized. Lessons have since been learned. In the wake of the crisis, the Bank of England would be promised enormous new powers and responsibilities. In the past year those promises have become realities with the statutory Financial Policy Committee (FPC) and the Prudential Regulation Authority (PRA) formally joining the Bank.”

“The question now is how we use our powers to fulfill our responsibilities. In response, the Bank of England is today launching a transformative strategic plan to fulfill its broader mission. We have a new leadership team.”

The BoE has set out 15 initiatives that will reshape it dramatically, which include creating the Deputy Governor role to oversee Markets and Banking, expanding the chief economist’s responsibilities to help improve the central bank’s data collection, and appointing Victoria Cleland as Chief Cashier and Director of Banknotes (Cleland’s name will appear on banknotes).

Carney changing BoE’s structure and culture

In an interview with the BBC, Philip Shaw, chief economist at Investec said of Mr. Carney “He’s serious about making reform, not only to the structure of the Bank, but also in terms of its culture.”

There are so many changes being introduced that by August 1st nearly half of today’s MPC members will either by in different roles or will have gone.

The BoE’s new mission statement – “Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability” – brings in its twin goals into one phrase.

Not enough women at senior levels

The Telegraph quoted Marian Bell, a former MPC member, who said that even though Dr. Shafik’s appointment was ‘encouraging’, the BoE – like much of the City – needs to do more to level the playing field. “The bigger issue is there aren’t enough women at senior levels in many areas and having no women on the MPC was just a symptom of that. The disease is not cured with a small improvement in one of the symptoms.”

“There have been more women before on the MPC. At the peak there were three of us on the nine-member panel, so having gone from a gap of there being none to having one, I don’t think you can see that as an immense turnaround.”