The recent wave of the global crisis has affected the world in different ways. Many different aspects of our social, health, and financial lives have changed in one way or another.

Every crisis has economic repercussions from the household level to firms and well-established institutions. Why? Because people are losing a direct source of income.

For instance, hotels are losing customers due to restrictions while households working in this particular sector lose a direct income source.

Even though the banking sector is often indirectly affected, it is the most vulnerable during a crisis. Although banks can provide their services remotely, they are tasked with financially supporting companies and households during any crisis.

What is a Banking Crisis?

In broad terms, a crisis is any event or series of occurrences that lead to an unstable situation affecting an individual, group of people, or society in general.

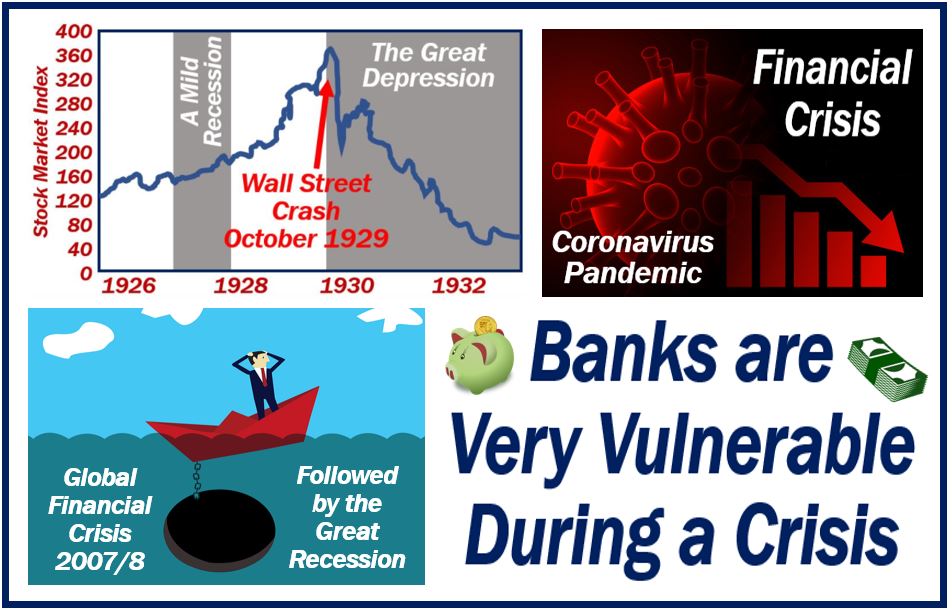

Crises are often associated with abrupt negative changes. Over the years, we’ve witnessed a couple of crises severely impacting the banking sector.

The most recent one is the pandemic. When the pandemic struck in early 2020, the whole world was affected. People lost their sources of income, and companies went out of business. In turn, financial institutions indirectly took the hit.

The most common banking crisis is a bank run. This is when an odd number of depositors rush to withdraw their deposits from the bank because they no longer trust it. Since banks operate on a ‘lending deposits received’ basis, most bank runs render the institutions insolvent. One of the most recent bank runs happened in August 2007, involving the Federal Bank of New York that set off the financial crisis of 2008.

Another banking crisis happened during the Great Depression, generally known as the wider economic crisis. Bank runs and stock market crashes preceded the Great Depression, which took place during the 1930s.

During this period, over 9,000 banks failed, with 4,000 banks closing in 1933 alone. Economic stagnation crisis accompanied with negative GDP (Gross Domestic Product) growth lasting two or more quarters particularly pose a big crisis for banks.

The third example is the International financial crisis. For example, it may happen when a country that maintains a fixed exchange rate is suddenly forced to devalue its currency. Even though devaluation can happen voluntarily, it is often considered involuntary in investor sentiments.

An example is the 1998 Russian Financial Crisis, also known as the Russin Flu. It resulted in the Russian Central Bank devaluing the ruble and defaulting on its debt. This resulted in severe impacts on the country’s economy and banks.

However, according to the senior vice president of The U.S Russia Investment Fund, this was a lesson to banks on the importance of diversifying their income.

How Does a Crisis Affect Banks?

Banks are so vulnerable during a crisis because of the severe impact financial calamities have on the institutions. Crisis quite often deteriorates the economy of a country and an individual’s finances. Since banks are considered the to-go-to institution for financial emergencies, they are forced to go to deeper lengths to cover the rising financial needs.

First, during the recent global crisis, people lost their jobs. Since people no longer have income, they are unable to repay their loans. If the payment system is completely impaired, the bank will not be making any profits. As time goes, recovery becomes more and more complex, undermining the bank’s capital and profitability.

Second, during the 2008 financial crisis, the banking sector lost a lot of money due to mortgage defaulters, credit and consumers drying up, and even interbank freezing. In the long run, it led to new regulatory actions both internationally and locally.

During this period, part of the problem was attributed to the household bubble burst and income loss. But, the common stocks of the market were crushed. Dividends were slashed, and investors were lost, and even they lost their money. This means banks’ stream of income was strained, forcing closure.

Thirdly, during a crisis, credit demands from banks increase. As firms and individuals ask for additional costs, this results in drawdowns of credit limits by borrowers.

Fourthly, during a crisis, banks face a decrease in the demand for different services. For instance, fewer payments and transactions are made. This reduces the streaming of non-interest revenues such as bank transactions.

Lastly, during a crisis such as the international financial crisis, bonds greatly lose their value. Banks may be forced to sell their bonds at these lower values to increase their liquidity and cover-up for other losses. This is also applicable to other financial institutions like pawn shops, which are forced to auction their collateral item at a lower price to get back their capital.

The time goes by and if you want to know more about the current state of US banks, or receive a guide on personal finance, including mortgages, credit cards, and loans to help you during a crisis, visit myfin.

The Biggest Historical Events in the Banking Sector Due to Crisis

The banking sector has witnessed the biggest defaults, mergers, and acquisitions due to different crises. For example, during the 2008 financial crisis, JPMorgan Chase acquired Bear Stearns and Washington Mutual. JPMorgan Chase acquired Washington Mutual even after it had been placed for receivership. This particular merger saw shareholders being wiped out since the bank was directly purchased from FDIC (Federal Deposit Insurance Corporation).

At the same time, Washington Mutual the biggest bank failure in U.S history. The 2007-2008 crisis led to the bank closing its doors with $307 billion in assets. This occurred a few months after IndyMac was seized.

Another deal that was considered the most successful crisis deal was Wells Fargo’s acquisition of Wachovia. Before the acquisition, Wells Fargo was already one of the most successful banks. The acquisition saw Wells Fargo expand its operations into the Eastern and Southern States of America.

During the 2008 financial crisis, Bank of America also acquired Countrywide financial for $1.4 billion. They even went ahead and acquired Merrill Lynch at a $50 billion all-stock deal that resulted in massive losses for the Bank of America.

Final Thoughts

Crises are inevitable. With different economic crises hitting the world from time to time, we’ve witnessed multiple negative and positive changes in the banking sector. Despite the banking sector is the most vulnerable during a crisis, financial crises have opened doors to some of the biggest mergers and acquisitions in history.

FAQ

What are the predicted long-term effects of the crisis?

It is often difficult to make long-term predictions of the post-effects of a crisis. However, with recessions on the banking systems, some trends are clear. For example, the recent crisis may see the low and zero interest rates stay longer.

Also, it may lead to further growth in the financial technology (fintech) companies, which may put further pressure on banks.

What needs to be done in the recovery phase of a crisis?

The main question that comes after a crisis is who will bear the losses. Once the economy has stabilized and returns to the new normal, non-viable firms can be quickly liquidated, losses to be recognized for banks to be recapitalized where possible.

Also, private investors and governments can step in to avoid any bank failures.

Interesting related article: “What was the Great Recession?“