Berkshire Hathaway Inc posted a 10 percent increase in profit for the first-quarter of 2015, driven by solid performance in its insurance and railroad businesses.

The Omaha-based conglomerate, controlled by Warren Buffet, reported net income of $5.16 billion, or $3,143 per share, from $4.71 billion, or $2,862, last year.

Operating profit for the first quarter rose by 20 percent to $4.24 billion, or $2,583 per share, from $3.53 billion, or $2,149, last year.

According to Thomson Reuters I/B/E/S, analysts expected operating profit or around $2,373 per share.

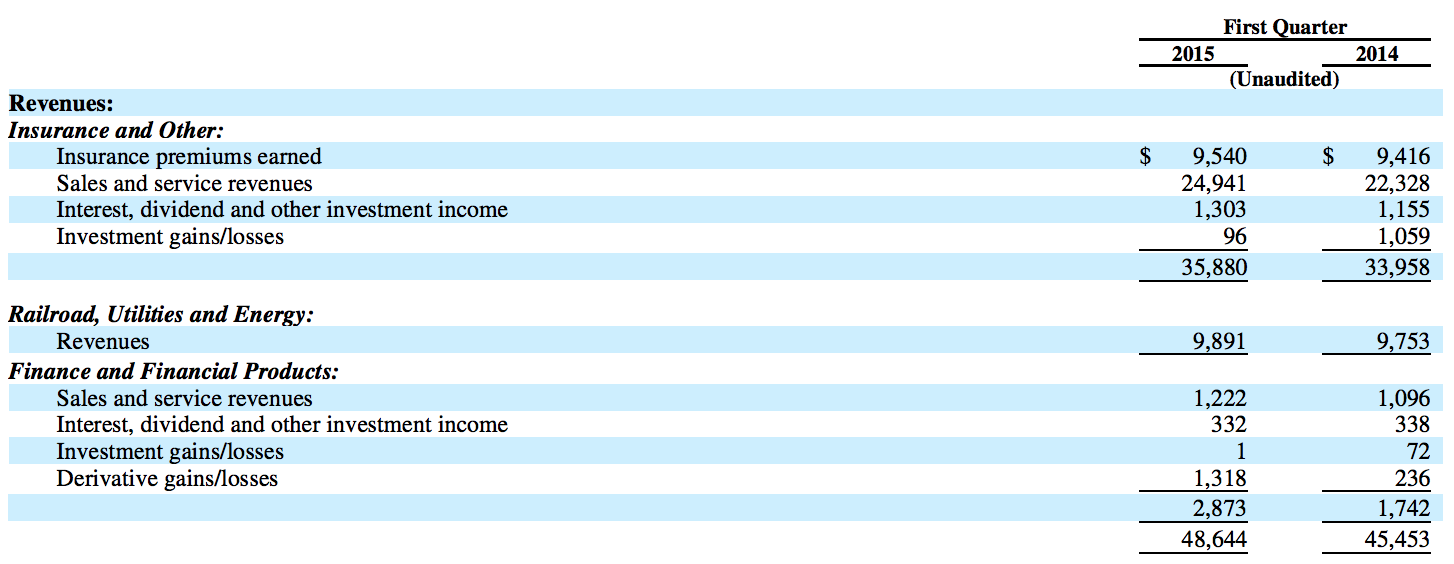

Quarterly revenue increased 7 percent to $48.64 billion.

(In millions USD) – Source: “Berkshire Hathaway Inc. Form 10-Q”

Profit from Berkshire’s Burlington Northern Santa Fe railroad, which operates one of the country’s largest freight networks, rose 44 percent to $1.05 billion. The robust performance was primarily due to investments made in upgrading the system, a higher capacity, lower fuel costs and a less-severe winter.

Net earnings at Berkshire Hathaway Energy dropped 7% in the first quarter to $421 million.

Investing income rose to $875 million in the first quarter, up about 22% from a year ago. Insurance underwriting profit also rose to $480 million in the quarter, up about 4% compared to $461 million last year.

Buffet’s preferred measure of growth, book value per share, increased by 0.5 percent from year-end to $146,963.

Berkshire Class A shares closed up $2,400 at $215,800, and its Class B shares rose $2.15 to $143.36 during trading hours on Friday.