Billionaire business magnate Carl Icahn has sold his entire stake in Apple, citing concerns about the tech giant’s relationship with China.

The activist investor, who owned 45.8 million shares of Apple at the end of last year and repeatedly called the investment a “no brainer”, said in an interview with CNBC that he was worried “about China’s attitude” toward Apple, adding that the nation “could be a shadow” for the tech company.

His decision to pull out of Apple comes following worse-than-expected second quarter results, which revealed a significant drop in revenue from the Greater China region.

Icahn told CNBC: “We no longer have a position in Apple. Tim Cook did a great job. I called him this morning to tell him that and he was a little sorry, obviously. But I told him it’s a great company.

“In Apple today as opposed to six months or a year ago, in this one, there’s no need for activism because I think they have a great management. But you worry a little bit, maybe more than a little, about China’s attitude.”

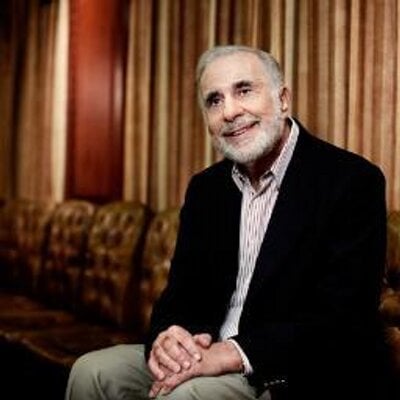

Carl Icahn (pictured above) made approximately $2 billion from Apple stock.

“..If you bought the stock then [three years ago], you got a 48 percent to 50 percent total return. We obviously made a great deal of money, but it was no surprise that we got out of some in February,” he said.

On Tuesday Apple reported its first drop in iPhone sales and its first decline in revenue in 13 years. Revenue and profit for the quarter ended March 26 both missed analysts’ expectations. Sales in China, the company’s second most important market, dropped 26% to $12.49 billion.

Jan Dawson, founder of tech consulting company Jackdaw Research, was quoted by MarketWatch as saying: “Whereas China accounted for half or more of the company’s revenue growth for several quarters, it’s now accounting for half its year-over-year shrinkage,”

Chinese consumers are buying more phones made by local firms such as Xiaomi and Huawei Technology Co. On top of that, earlier this month the Chinese government banned Apple’s iTunes movies and iBooks stores.