The Bank of England announced that the Financial Policy Committee stands ready to take actions that will ensure “capital and liquidity buffers can be drawn on, as needed, to support the supply of credit and in support of market functioning.”

The FPC lowered the UK countercyclical capital buffer rate from 0.5% to 0% of banks’ UK exposures.

It expects to keep it at that rate until at least June 2017.

The moves reduces regulatory capital buffers by £5.7 billion, freeing up £150 billion for lending to UK households and businesses.

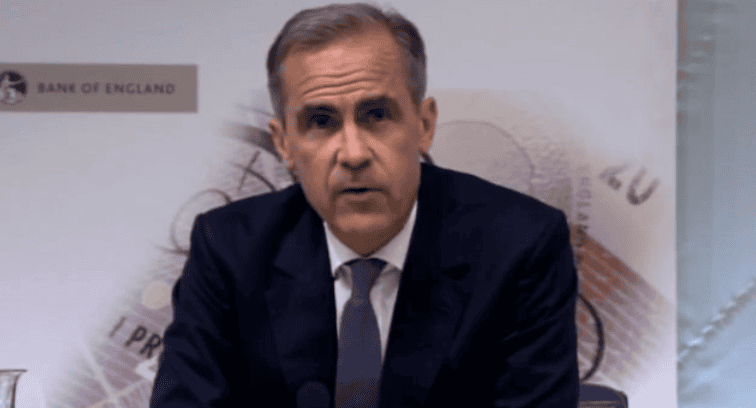

“This is a major change,” Carney said.

“It means that three-quarters of UK banks, accounting for 90% of the stock of UK lending, will immediately – immediately – have greater flexibility to supply credit to UK households and firms.

“Specifically, the FPC’s action immediately reduces regulatory capital buffers by £5.7 billion and therefore raises banks’ capacity to lend to UK businesses and households by up to £150 billion. For comparison, last year with a fully functioning banking system and one of the fastest growing economies in the G7, total net lending in the UK was £60 billion.”

The BoE’s July 2016 ‘Financial Stability Report’ highlighted the following channels through which the referendum could increase risks to financial stability:

The high level of UK household indebtedness;

Fragilities in financial market functioning;

The financing of the UK’s large current account deficit;

Subdued growth in the global economy; and

The UK commercial real estate (CRE) market.

Some of those risks have already begun to crystallise, said Carney

“Our concerns have been borne out” – Bank of England governor Carney responds to Brexit votehttps://t.co/slOCKdj5NP https://t.co/0HRq9SammS

— BBC News (UK) (@BBCNews) July 5, 2016

“The concerns that the historically large current account deficit could be vulnerable to sudden shifts in foreign capital and sharp adjustments in sterling appear to have been borne out. Portfolio flows into UK equities and corporate 2 debt appear to have slowed, and sterling experienced its largest two-day fall against the dollar since floating exchange rates were re-introduced almost half a century ago,” the BoE governor said.

“It is now more likely that adjustments in commercial real estate could tighten credit conditions for UK businesses. Foreign flows of capital into commercial real estate fell 50% in the first quarter of 2016, transaction volumes have fallen further during the second quarter, and share prices of property REITs dropped sharply following the referendum.

“In addition, the number of vulnerable households could increase due to a tougher economic outlook and a potential tightening of credit conditions. In particular, there is growing evidence that uncertainty about the referendum has delayed major economic decisions, such as business investment, construction and housing market activity.”