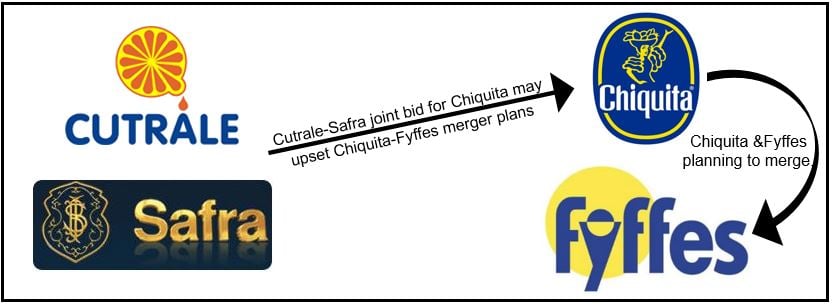

A Brazilian Chiquita bid worth $625 million may upset the planned merger between the American banana giant and Irish fruit multinational Fyffes. Brazilian conglomerate Safra and juice maker Cutrale have offered Chiquita $13 per share, i.e. 29% more than its closing share price on Friday.

After announcing the acquisition offer, Chiquita shares climbed 31% in New York while Fyffes’ plunged 15% in London.

News update, August 15, 2014: The Chiquita Board rejects the Safra-Cutrale bid and reiterate their commitment to the Fyffes merger.

The Cutrale Group is one of the world’s biggest suppliers of orange juice. It owns juice brands in Brazil and Florida and is a major orange-juice concentrate supplier to the Minute Maid and Simply Orange brands, which belong to Coca-Cola. Cutrale’s owner, Jose Luis Cutrale, is a board member of Coca-Cola Femsa SAB (Mexico’s Coca-Cola franchise), the largest franchise bottler of Coke worldwide.

Cutrale controls about one-third of the world’s orange juice market, valued at $5 billion annually.

The Safra Group, based in São Paulo, Brazil, is a global network of companies controlled by Joseph Safra. It comprises banks and financial institutions, agribusiness concerns, industrial operations and real estate firms. It employs 8,000 workers and operates in Latin America, US, Europe, the Caribbean, and the Middle East. The Safra Group has over $200 billion under management.

Cutrale is partnering with banks controlled by Mr. Safra, the second richest person in Brazil with a net worth of $13.2 billion, to challenge the Chiquita-Fyffes merger plan.

Chiquita attracted by Ireland’s lower tax rate

The planned Chiquita Fyffes merger would create the world’s largest banana company, worth about $1 billion. Chiquita Brands International Inc. is based in Charlotte, North Carolina, and Fyffes plc has its headquarters in Dublin, Ireland.

If the Chiquita-Fyffes’ merger goes through, the new entity’s head office will be in Dublin, where corporate tax is 12.5%, compared to 35% in the United States.

The US today has the highest corporate tax rate in the world, hence the growing number of US-based companies seeking foreign deals to move their fiscal head offices abroad.

President Barak Obama has hinted he may take measures to limit the current tax inversion advantages, even if that means bypassing Congress. Shares in several firms currently in the process of finalizing inversion deals have been hit.

Will Del Monte or Dole Food throw their hat in the ring next?

A better deal, say Brazilians

According to the two Brazilian suitors, Chiquita shareholders would be better off with their proposal than Fyffes’.

In a letter to Chiquita, Safra and Cutrale wrote:

“We are confident that this transaction offers compelling and more certain value for Chiquita shareholders as compared with the proposed transaction with Fyffes.”

In a press release, Chiquita wrote:

“Chiquita’s Board of Directors, in consultation with its legal and financial advisors, will carefully review and consider the offer to determine the course of action that it believes is in the best interests of the Company and its shareholders.”

“Chiquita shareholders are advised to take no action at this time and to await the Board’s recommendation. Chiquita will have no further comment on the Cutrale Group and the Safra Group’s offer until the Board has completed its review.”

The worldwide banana market is dominated by four players: Fyffes, Fresh Del Monte, Dole Food Company and Chiquita.