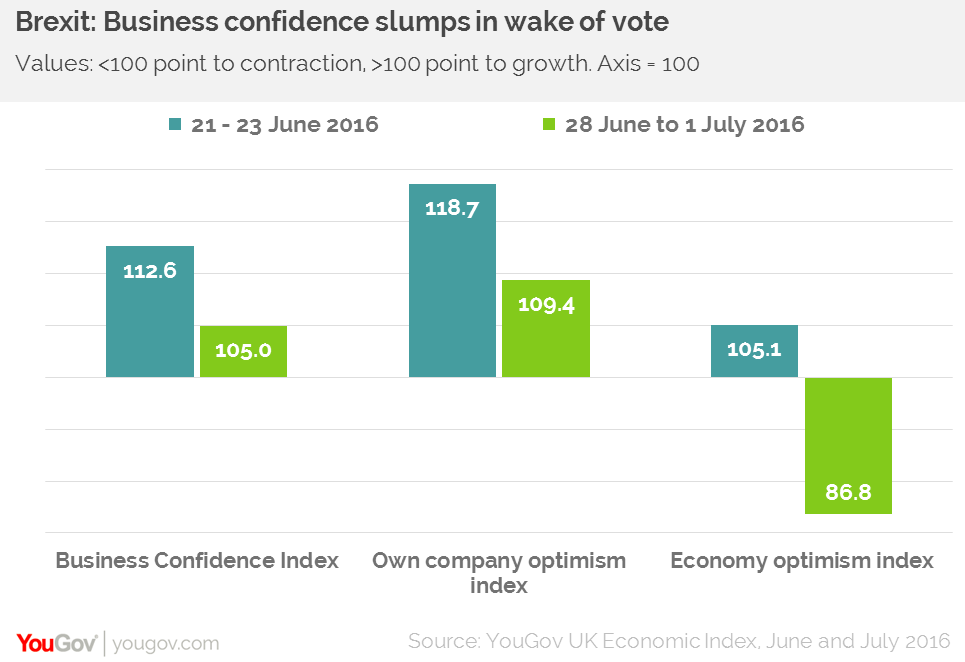

Business confidence in the UK has dropped significantly since the country voted to leave the European Union, according to YouGov and the Centre for Economics and Business Research.

The number of British businesses feeling pessimistic about the British economy doubled in the week after the referendum vote.

Image: Centre for Economics and Business Research

A poll of 1,500 business leaders revealed that 49% were pessimistic about the economic outlook of Britain the week after Brexit, compared to 25% in the week before the vote.

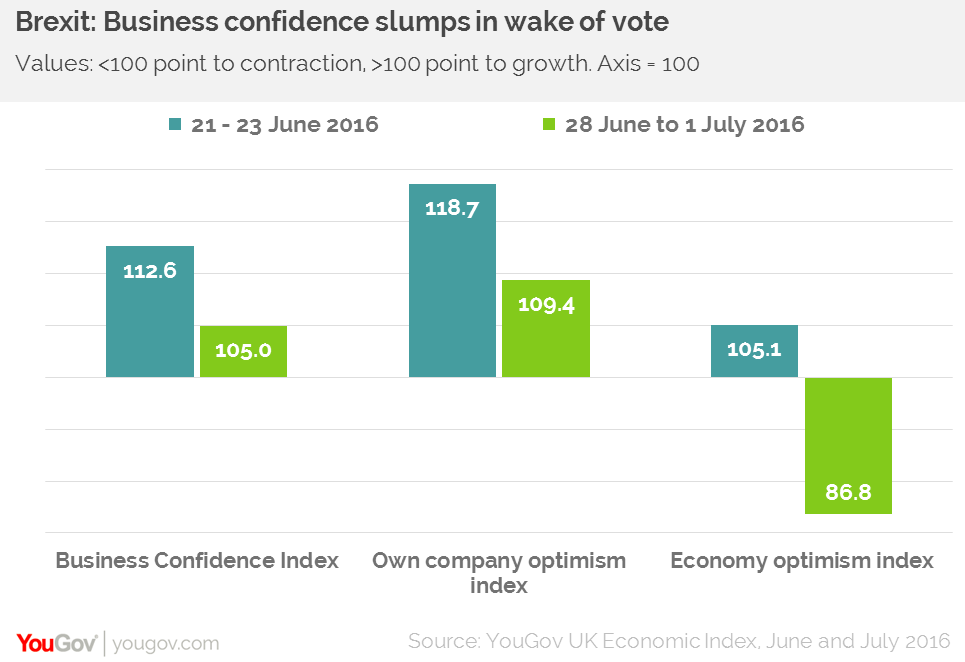

Expectations for businsesses’ own domestic sales and exports “off a cliff”

Meanwhile, the index which tracks expectations for domestic sales dropped from 118.8 to 104.9 in the week after the EU referendum vote, while hopes for exports fell 15 points, from 115.3 to 99.8, and investment dropped off by almost eight points, from 108.0 to 100.1.

Image: Centre for Economics and Business Research

Scott Corfe, director at the Cebr, said: “So far the only evidence we have for how the economy is in the wake of the Brexit vote comes from the markets which are showing a mixed picture. These figures show what is happening on the ground and they suggest a significant shock reaction.

“Not only are businesses feeling much more pessimistic in general about the state of the economy, but their own expectations for domestic sales, exports and investments over the next 12 months have gone off a cliff. Hopefully this is a short term panic reaction and confidence will edge up again once the dust settles.”

UK businesses are “clearly spooked” by the referendum result

Mr Corfe told BBC Newsnight: “Businesses are clearly spooked by the referendum result and they’ve reined in their intentions for capital spending. They’ve reined in their expectations for exports and domestic sales growth.

“And business confidence is a leading indicator for where the economy is heading over the coming quarters. What it suggests is that the economy is in for quite a significant slowdown over the next three to six months.”

The survey was released shortly after Standard Life Investments announced the suspension of its £2.9bn UK commercial property fund, citing “exceptional market circumstances” after Britain voted in favour of leaving the EU.