Having available cash on hand is crucial for businesses of all sizes, and they’re several ways that small companies can access financing- one of the ways is via business lines of credit.

Unlike a regular loan, a business line of credit offers unmatched flexibility and can be quite handy, especially when you have unexpected cash flow gaps or when you’re looking to capitalize on opportunities that arise.

Unlike a regular loan, a business line of credit offers unmatched flexibility and can be quite handy, especially when you have unexpected cash flow gaps or when you’re looking to capitalize on opportunities that arise.

That’s why so many small businesses have turned towards the business line of credit-this is further underlined by a 2017 report by the Federal Reserve that indicated that the business line of credit was one of the top three popular financing options for small businesses.

But how easy is it to actually get a business line of credit.

At first, it might seem like its quite intimidating, especially for the small and new businesses, but in reality, getting a line of credit is easier than you think.

However, the chances of getting a line of credit will largely depend on a few things, including the type of credit, qualifications, and lender.

To make the process easier, we’ve outlined the steps you need to follow to secure a business line of credit.

Decide on What Type of Business Credit you Need

First things first, you need to determine the type of business credit that you need.

Typically, the two major types of business lines of credit are secured and unsecured. However, lines of credit can further be classified into other categories such as Revolving, asset-backed, home equity, and even business cards.

Whatever model you choose to go with, you should have a clear and concise understanding of its applicability to your business.

This way, even when you forward your application to the lenders, they’ll see that you’ve an understanding of what you are doing and what you hope to achieve.

To this end, you’ll have a higher chance of getting your loan application a success.

Assess your Borrowing Health

Except for credit cards, it’s always more of a challenge to get a line of credit than a loan.

See, though loans still do come with a risk, extending the business credit line comes with more risk to the lender, especially if the package has good terms and rates.

And so, lenders usually set the bar high and will require you to go through an intense financial vetting process.

Some of the crucial financial aspects that lenders are always looking out for include;

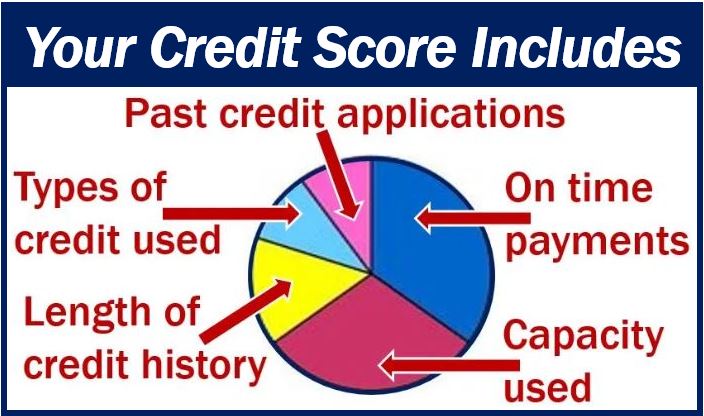

Credit score

Credit score determines how likely you’re to settle a loan. Though many of the lenders won’t necessarily disqualify you for your credit score alone, almost most of them will factor this in their determining the amount as well as the rates.

Time in Business

The longer you’ve been in business, the more lenders are willing to work with you.

Recent bankruptcies

If you’ve been declared bankrupt recently, you’ll have a harder, though not impossible, the task of finding lenders who are willing to grant you access to their lines of credit.

Business Revenue:

Most of the lenders will want to see that you’ve an active cashflow that is sufficient to service your debt.

Collateral

Though it’s not difficult to access unsecured lines of credit, having assets acting as collateral will increase your options and chances significantly. In addition, most of the secured business lines of credit usually come with better rates and terms.

Compare your Options

Once you have a sense of your borrowing health, you will have an idea of where to focus on your search for a lender.

There is an extensive list of platforms that can offer lines of credit, but we shall only focus on a few of the popular ones.

Banks: Banks usually offer a variety of lines of credit with competitive rates and fees, but your business should be financially healthy to secure a loan from a bank.

Online lenders: They’re quite the opposite of banks and are easy to access a line of credit. They don’t have lots of restrictions r requirements like banks and are ideal for businesses with less-healthy financial health.

Credit card issuers: They are manifested through various means such as banks, retailers, or companies, provided they deal with a point of sale transactions.

Application

Similar to a loan, you need to gather all your documents and apply for the business line of credit.

Similar to a loan, you need to gather all your documents and apply for the business line of credit.

The specificities of your application and the documents that you’ll need depend on the type of credit as well as the lender you’ve selected.

Online lenders, for instance, are less –restrictive and might only require you to make an online application to get your loan approved.

Banks, on the other hand, are less-forgiving and will even require your physical presence.

Either way should always be armed with these documents during your application process;

- Tax return

- Basic information about your business as well as personal

- Bank statement, ideally for the last six months

- Identification

- Balance sheets

________________________________________________________

Interesting related article:

- “What is my Credit Score?”

- “What is a Loan?”