While the Canadian overall inflation rate in August stayed the same at 2.1%, its “core” rate surged to 2.1% from 1.7% in July, above the Bank of Canada’s 2% target for the first time since April 2012, according to figures published by Statistics Canada on Friday.

Economists in Toronto and Vancouver had predicted August’s core rate would come in at 1.8%.

The core rate figure triggered debate on whether Canada’s central bank may decide to raise interest rates earlier than planned.

Core inflation is a more reliable measure of the long run trend in the price level, because it excludes items that tend to fluctuate in price. In most countries, as in Canada, the core inflation rate excludes certain food staples and energy prices.

August saw most Consumer Price Index (CPI) components rise compared to July, with the exception of food and fuel/energy prices.

The core rate was partly pushed up because of steep increases in telephone services and passenger vehicle prices.

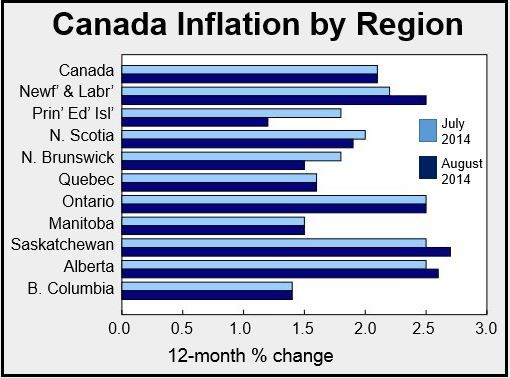

(Data source: Statistics Canada)

Prices rose in all the major components in the 12-month period ending in August, led by higher shelter costs.

Below is a list of the major components and their 12-month change ending in July and August 2014 published by Statistics Canada:

- All-items CPI: July 2014: 2.1%. August 2014: 2.1

- Food: July 2014: 2.9%. August 2014: 2.2%

- Shelter: July 2014: 3.0%. August 2014: 2.8%

- Household operations, furnishings & equipment: July 2014: 1.6%. August 2014: 3.0%

- Clothing & footwear: July 2014: 1.5%. August 2014: 0.5%

- Transportation: July 2014: 1.3%. August 2014: 1.2%

- Health & personal care: July 2014: 0.8%. August 2014: 0.9%

- Recreation, education & reading: July 2014: 1.1%. August 2014: 1.4%

- Alcoholic drinks & tobacco products: July 2014: 4.7%. August 2014: 5.7%

Central bank likely to wait-and-see

Most analysts believe the Bank of Canada will not get overly concerned from one month’s core inflation data. The Canadian economy still has a significant amount of slack.

August’s core inflation rate contained one component, household communications costs, which increased year-over-year by 8.9%. This probably reflected an administrative adjustment in telecommunications providers’ rates, which was a one-off steep rise.

The Bank of Canada predicts overall inflation will be approximately 2% over the next 30 months, while core inflation will stay below its 2% target until 2016.

For the last four years, the benchmark interest rate has remained at a historical low of 1%. It is doubtful this will change until the middle of next year.