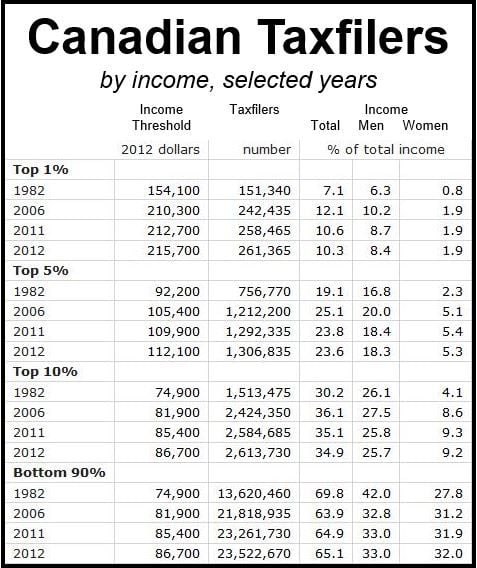

Canada’s super rich had a smaller share of total income in 2012 compared to 2011, Statistics Canada reported on Tuesday. In 2012, the country’s top 1% of taxfilers owned 10.3% of total income, versus 10.6% in 2011. In 2006 they had 12.1% of total income.

The top 5% richest people in the country’s share of nationwide income fell to 23.6% in 2012 compared to 25.1% in 2006, while the 10% richest’s share fell to 34.9% from 36.1% over the same period.

Canada’s shifting trend in income distribution contrasts with what has occurred in the United States, where the top 1% of taxfilers increased their share of total income to 19.3% in 2012 from 18% in 2006.

In the US, the super rich’s (top 1%) share of total income reached a trough of 16.7% in 2009, and then increased by 2.6 percentage points by 2012, while in Canada the share fell by 0.4 of a percentage point during the same period, declining to 10.3% from 10.7%.

Source: Statistics Canada.

Bottom 90% increased their share of wealth

During the 2006-2012 period, Canada’s bottom 90%, 95% and 99% taxfilers’ share of national income increased for the first time (over a prolonged period) since 1982.

Statistics Canada defines the 1% richest taxfilers as those whose total income in one year was at least $215,700 in 2012, which was $3000 higher than $212,700 in 2011. The richest 5% had an annual income of at least $112,100 in 2012, and the top 10% had an income of $86,700+.

Not all Canadian provinces followed the national trend. From 2011 to 2012, Newfoundland, Prince Edward and Labrador saw the top 5% of earners gain a greater share of their province’s total income.

In Quebec, the top 1% gained, as did the top 5% and 10% richest in Saskatchewan and Alberta from 2011 to 2012.