In early trading in Toronto on Thursday, the Canadian dollar plummeted to 90 cents, as the US dollar rallied amid concerns about global economic growth and the prospect of the Federal Reserve raising interest rates.

The US Fed is unlikely to raise its benchmark rate for a few months, which makes makes one wonder why all the analysts quote the American central bank’s possible actions influencing Canada’s currency movements today.

Marc Carney, Governor of the Bank of England, said on Thursday that an interest rate hike is becoming more likely as UK economic data point to a rapidly growing economy, falling unemployment and rising house prices. It is becoming increasingly likely that the pound sterling may rise alongside the US dollar during the months to come.

All currencies linked to commodities are currently suffering. The majority of economists in Toronto are betting on a further slide of the loonie, possibly to 85 cents.

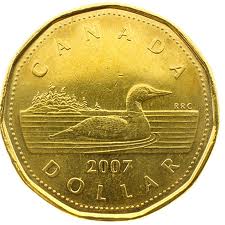

The “loonie” refers to the Canadian one-dollar, gold-colored coin that was introduced in 1987. It bears a bird – the common loon – which is common in Canada.

The US dollar has been rallying for the last three months against all the major currencies.

The Canadian $1 coin has the ‘Common Loon’ (type of bird) on the back, hence the term ‘Loonie’ meaning one Canadian dollar.

With strong US employment and GDP data, contrasting with a worsening economic situation in the Eurozone and mixed signals from China, the dollar has become the investor’s choice.

Fed tightens while ECB loosens

While the European Central Bank looks at lowering interest rates and loosening policy, the US Fed is aiming in the opposite direction. If interest rates look likely to decline on one side of the Atlantic and rise on the other, capital will fly in just one direction.

Timothy Lane, Deputy Governor of the Bank of Canada said on Wednesday that the Canadian dollar may weaken and market interest rates may rise while the Fed bring monetary policy back to normal.

Mr. Lane said:

“Like the Fed, we will balance the risks of acting too soon and stifling burgeoning economic growth against the risks of acting too late and letting inflation overshoot and fueling imbalances in our housing markets.”