Where to start? You need to choose a car wisely; first, you need to choose several car options to match the price and quality. The credit department will definitely help you get a permit for a car loan within 24 hours. You can choose an option for yourself easily in a couple of minutes and take it on credit.

A car loan is a very good offer for anyone who wants to find the car of their dreams. There is nothing wrong with a loan; you can even close it very profitably if your work is related to a taxi or you are a courier. With the proceeds from the car, you can pay for the same car. Help to buy is waiting for absolutely everyone, even if you are new to this business.

Many people may not be granted a car loan because they make mistakes when applying for a car loan. Many people may not get a car loan because they make mistakes applying for a loan car. Someone inflates the price of a car and thus deceives people. In order not to become deceived, everyone should carefully read the contract before signing it and agreeing to the terms.

Often, cars on credit are even much cheaper than for cash. But very often, there is deception. First of all, they can sell the car for a higher price than it actually is. Therefore, a consultation is necessary. Often people are sold a car that breaks down almost immediately; you need to check it right away.

Car Loan is The Best Solution

Last year the total car loan balance was over 1,17 trillion dollars. Thousands of people have already used all the advantages of auto loans. Keep reading to know if this type of loan is suitable for you.

A huge plus to take the car on credit:

- You can give the money in parts and at the same time enjoy your new purchase.

- It is possible to take out a loan for a long time and give it back in smaller amounts, just a little longer.

- You can quickly and easily find a car that you dreamed of, and you will be helped in this.

- You can quickly cover the car loan by combining the car with the work.

- You can very simply easily issue a loan without any problems.

- The state fully supports and trusts car loans.

- You can quickly get a loan for a car even if you do not have the necessary savings.

- The terms of the loan are very favorable for almost everyone, convenient and fast.

The car loan is the best offer because starting to work with the machine, you will beat off the payment and go further to profit. Moreover, absolutely everyone can take advantage of emergency auto repair loan, without exception, because it is not difficult to take out a loan for repairs; this is a huge plus.

Urgent car repairs are quite a frequent event that occurred in almost everyone. It can be very expensive. It is not difficult to get a loan for urgent repairs of your car; the main thing is to prove that the car really needs urgent repairs. Car loan rates in Canada can range between 0 % and 29%. 86% percent of Americans commute to work every day, so taking out a loan for emergency repairs is very good.

If we consider more cases of a loan, then you can take a loan for urgent repairs of your car. You can ensure your car; then, you can not pay the full cost of repairs. Insurance can help you save your money well and not take out loans. But if necessary, you can afford to take out a loan for urgent car repairs.

Cars now play a huge role in people’s lives, and almost everyone needs transport to move around, so it is very easy to get a direct income, which is why it is profitable for you to take a car on credit and pay monthly. You can contact some credit department there will definitely help you get a permit for a car loan within the next few hours.

You can choose an option for yourself easily in a couple of minutes and take it on credit. A car loan is a very good offer for anyone who wants to find the car of their dreams. There is nothing wrong with a loan; you can even close it very profitably if your work is related to a taxi or you are a courier.

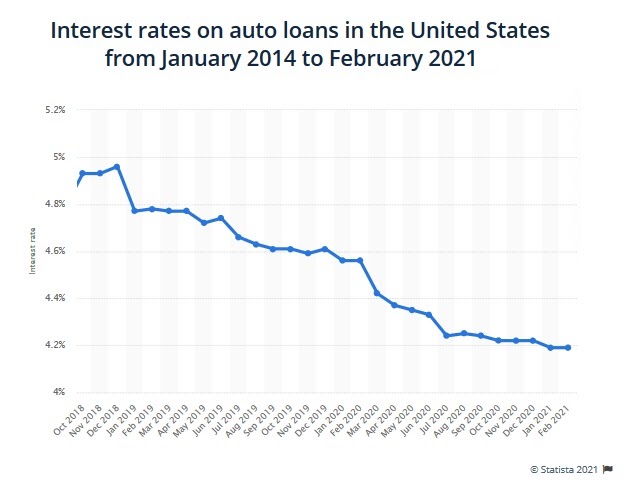

By the way, one more reason to apply for a car loan is the fact that the interest rate is decreasing month by month.

You Need To Think Carefully About The Loan

Before you apply for a car loan, you need to decide what you want and approach this issue seriously because, after registration, you will be required to pay the required amount every month. As mentioned earlier, you can stretch the loan and pay less but longer.

Many people who have taken out a loan do not regret it now, because for example a taxi is very popular and they earn good money on it and quickly close their loans, you will also not regret taking a car on credit. A deferred payment agreement is also possible if it is not possible at the moment to deposit the required amount and allow you to deposit it a little later — this is very convenient for you, as it provides an opportunity to pay when it is convenient.

And allow you to deposit it a little later — this is very convenient for you, as it provides an opportunity to pay when it is convenient. If desired, and if possible, of course, you can also repay the loan before the appointed date; this is also not prohibited. In terms of profitability, the car loan is not inferior to the usual cash purchase, so it is even more convenient. There are a lot of advantages and disadvantages in taking out a loan for a car. There is not a single one, only positive aspects.

Interesting Related Article: “How to Find the Cheapest Car Insurance with No License?“