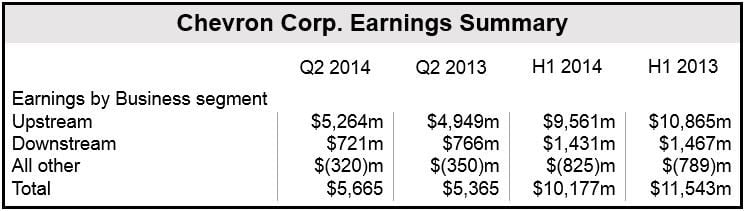

Chevron Q2 earnings increased to $5.7 billion ($2.98 per diluted share) compared to $5.4 billion in Q2 2013, boosted by higher energy prices which helped offset production declines in Kazakhstan, the company announced yesterday.

Currency movements worked against the energy giant this quarter, decreasing earnings by $232 million versus an increase of $302 million in the same quarter last year.

Sales in the second quarter increased slightly to $56 billion from $55 billion in 2013.

Higher prices lower production

Chevron’s Chairman and CEO John Watson, said:

“Current quarter earnings reflected stronger market conditions for crude oil, although some of these benefits were offset by lower production volumes as a result of planned maintenance activity at Tengizchevroil in Kazakhstan.”

“Gains on asset sales also contributed to our results, as we completed important sales under our three-year divestment program.”

Chevron, the second largest oil company in America in market value, announced that its global oil-equivalent production during the second quarter declined to 2.55 million barrels per day, compared to 2.58 million in Q2 2013.

Divestment and investment

In the second quarter the company completed the $1.3 billion sale of its interest in oilfields in Chad, as well as a related stake in a pipeline that runs from Chad through Cameroon to the coast of West Africa.

Chevron is investing over $20 billion on five new projects which it expects will increase production by 20% by the end of 2017.

The $54 billion Gorgon liquefied natural gas facility in Australia should be operational in 2015, executives announced on a conference call with shareholders.

The company restated its interest in developing the Kitimat liquefied natural gas (LNG) project off the western coast of Canada. There had been doubts on whether it would proceed after Apache Corp, the joint venture partner, announced that it was pulling out.

Upstream and downstream

In the oil & gas industry upstream refers to exploration and production, while downstream means the refining of petroleum to crude oil, the processing and purifying of raw natural gas, plus the marketing and distribution of products derived from natural gas and crude oil.

- Upstream earnings increased to $5.26 billion from $4.95 billion.

- Downstream earnings declined to $721 million from $766 million.

(Source: Chevron Corp.)