Oil giant Chevron Corp posted a 43 percent drop in quarterly profit on Friday, but it was still higher than what analysts expected.

The plunge in crude oil prices is having an impact on the profits of energy companies, but cost cuts and robust refining margins helped Chevron Corp offset the loss in the first quarter of the year.

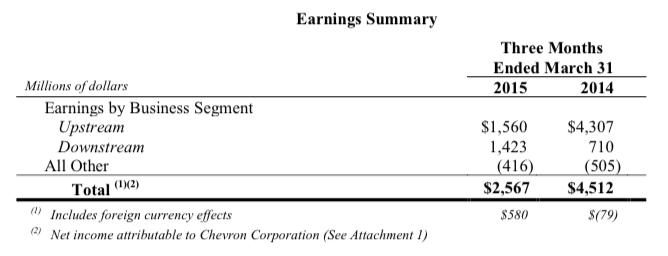

Since last June oil prices have dropped by over 40 percent because of an oversupply. This has harmed Chevron’s oil and gas production business. But, on the flip side, the oversupply of oil helped the company’s refining arm double profit to $1.42 billion.

Chevron reported net income of $2.57 billion, or $1.37 per share, from $4.51 billion, or $2.36 a share, the previous year. This fared better than what analysts had expected of 79 cents a share, according to Thomson Reuters I/B/E/S.

Sales and other operating revenues in first quarter of the year were $32 billion, compared to $51 billion last year.

“First quarter earnings declined from a year ago due to sharply lower oil prices, which reduced revenue and earnings in our upstream business,” said Chairman and CEO John Watson.

“Downstream operations were strong, benefitting from lower feedstock costs and improved refinery reliability.” “We’re responding to the current price environment by capturing cost reductions, pacing new project approvals and further streamlining our portfolio as planned.

We’re taking a number of deliberate actions to lower our cost structure, and I expect these efforts to increasingly show through in our financial results as the year progresses.”

“Production increased over 3 percent in the period, and we are hitting major milestones on our development projects under construction, like Gorgon and Wheatstone in Australia,” Watson added.

“We remain on track to deliver significant cash flow and production growth by 2017.

“In the downstream, we continued to streamline our asset portfolio with the sale of our interest in Caltex Australia Limited.

“This sale is aligned with our previously-announced asset sales commitment.” Cash proceeds of $3.6 billion were received upon settlement on April 2, and a gain on sale of $1.6 billion will be reflected in second quarter 2015 results.”