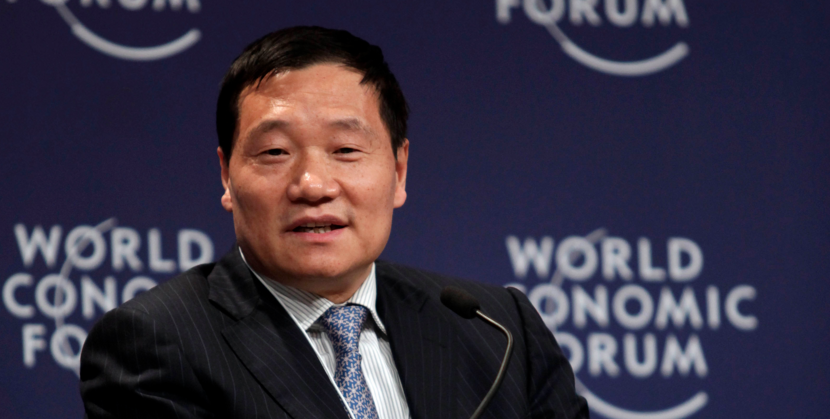

Xiao Gang has been replaced as head of China’s Securities Regulatory Commission (CSRC) as the country tries to tackle volatility in the stock markets.

Xiao, who became chair of CSRC in March 2013, has been replaced by Liu Shiyu. The decision to replace him was made following criticism over the way he handled the Chinese market crash in mid-2015.

On 24 August, the Shanghai main share index lost 8.49% of its value. At one point it lost as much as 40% of its value.

Things haven’t improved much since then.

The Chinese stock market experienced a steep sell-off last month and trading was halted on 4 and 7 January 2016. However, this “circuit-breaker” mechanism (deployed under Xiao’s watch) was scrapped completely after it caused more panic in the markets.

The sell-off on the Chinese stock market set off a global rout, with stocks in Europe and the United States getting hit hard.

Xiao Gang defended the CSRC’s crisis management of the “abnormal volatility in the stock market.” Xiao “promised to crack down on illegal activities, increase market transparency and better educate investors” in a period with “rising uncertainty in external markets, including the global equity-market slump, plummeting commodities prices and currency devaluations in emerging markets.”

Zheng Chunming, a Shanghai-based analyst at Capital Securities Corp, was quoted by Bloomberg News as saying: “Somebody needed to bear responsibility after the suspension of the circuit-breaker system,”

According to The Financial Times, critics also blamed Xiao for failing to identify the stock market bubble that grew from late 2014 until the mid-2015. Margin finance surged in the early months of 2015 – used by investors to borrow money to buy shares.

The new head of the CSRC, Liu Shiyu, was previously the vice-governor of the People’s Bank of China before becoming chairman of the Agricultural Bank of China, the country’s third largest lender. He studied engineering at Tsinghua University and started a career in the state banking industry in the late 1980s.