China’s manufacturing increased at its fastest pace in eight months in March, according to a new private survey released on Monday.

China’s manufacturing increased at its fastest pace in eight months in March, according to a new private survey released on Monday.

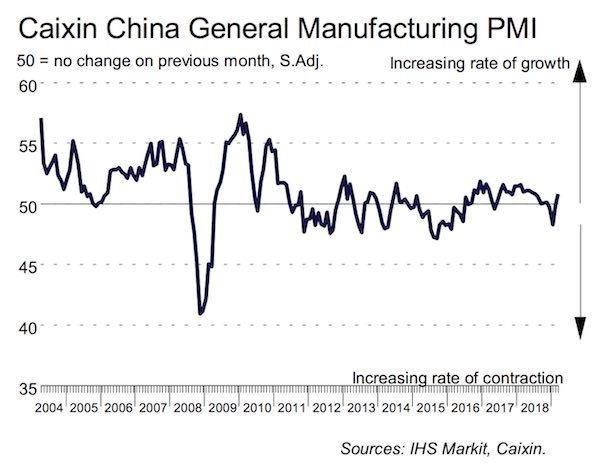

The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) increased to 50.8 in March – the highest level since October. The reading beat what analysts surveyed by Thomson Reuters had forecast of 49.9.

Any reading above 50 indicates growth, while a reading below 50 indicates contraction.

The reading is in line with official PMI data released by the Chinese government on Sunday which showed manufacturing activity rose to 50.5 in March from 49.2 the month before.

The official PMI data looks at large state-owned companied, while the Caixin PMI tends to focus on tracking smaller to medium-sized private companies.

According to IHS Markit, the upturn was supported by a strong rise in new orders and expansion in new export orders after a decline in February.

The rebound in factory activity appears to show that the Chinese government’s infrastructure investment stimulus has already started boosting economic activity.

Commenting on the China General Manufacturing PMI data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Manufacturing PMI came in at 50.8 in March, up from 49.9 in the previous month, indicating a notable improvement in the manufacturing industry.

“The subindex for new orders climbed to its highest level in four months, and the gauge for new export orders returned to expansionary territory, showing that both domestic and external demand rebounded moderately.

“The output subindex continued to rise in expansionary territory. The employment subindex surged to a high not seen since January 2013. Data from the National Bureau of Statistics showed that the surveyed unemployment rate in urban areas for February was the highest since early 2017, causing concerns about the job market. The situation improved significantly in March, indicating easing pressure on employment.

“The measure for stocks of finished goods rebounded in March from the previous month’s near-three-year low, but remained in contractionary territory. The subindex for stocks of purchases returned to expansionary territory, pointing to manufacturers’ increasing willingness to restock. The subindex for suppliers’ delivery times picked up despite staying below 50, indicating an accelerating capital turnover at companies.”