If you have a credit card or taken out a loan, you will have a credit report. It is what lenders use to evaluate your ability to repay credit, i.e., how good or bad you are at paying back loans on time.

What’s In Your Credit Report?

What’s In Your Credit Report?

This type of report contains information on your credit history. The information in your report comes from credit providers and credit reporting agencies.

Your credit report has the following details:

- Personal details

- Credit cards

- Previous and current arrears

- Credit defaults and infringements

- Credit applications

- Debt agreements

- Repayment history

- Commercial credit applications

- Report requests

Keep in mind that your credit report will not include your utility bills unless you missed a payment by at least 60 days.

Why It’s Important

These reports are essential because they show a person’s financial history and capabilities. The information on the report can have a sigificant impact on several aspects of your life. It may even determine whether landlords are willing to rent their properties to you or the size of the deposit they require.

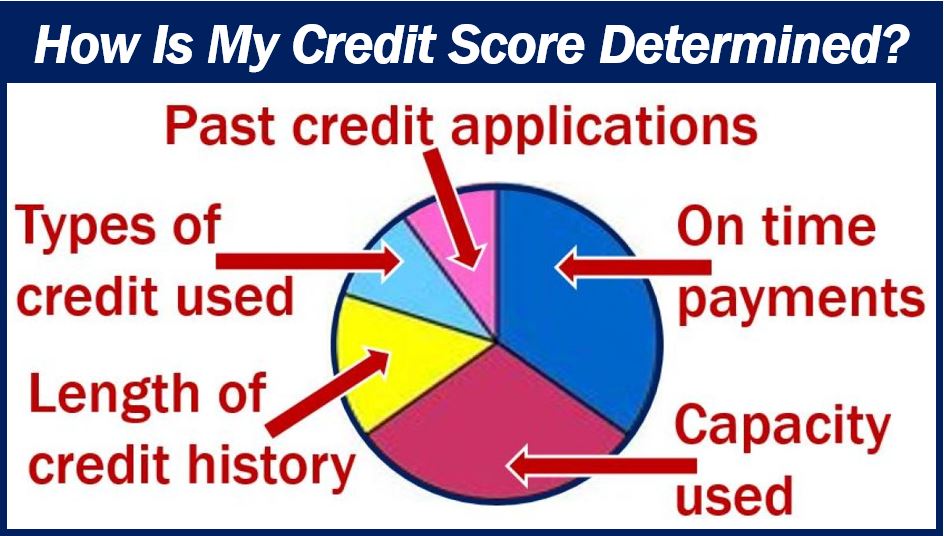

Credit reports that have a long-history of on-time payments will result in a good credit score. On the other hand, a poor financial history will produce a bad credit score, which will make it harder to get approved for standard loans or any type credit, in which case you will have to use a bad credit loan provider.

When To Get a Credit Report

Before you make a huge purchase such as a home, get a credit report two to three months prior. Make sure to review it carefully and check that everything on your report is correct. For any inaccuracies, you can initiate a dispute.

Some financial advisers recommend reviewing your credit report regularly, such as once a year, even if you have no intention or need to take out a loan. This allows you to stay on top of your finances and sort out any inaccuracies or debt settlements that have not been reported. Then, one day, when you need to apply for a loan, you will know exactly what your chances of being approved are.

Credit Report Disputes

For credit report inaccuracies or errors, you can take direct action by contacting your credit agency. Usually, the agency has 30 days to investigate the incorrect information.

Some mistakes that you have to out look for are:

- Your name.

- Your date of birth.

- Is it your current address?

- A debt that is listed twice.

- The amount of debt.

Anybody who is not satisfied with the credit agency’s reponse to your dispute can seek help with the AFCA, which stands for the Australian Financial Complaints Authority. The AFCA can, if necessary, communicate or coordinate directly with the credit reporting agency.

You can also seek the assistance and advice of financial counsellors for a free debt help service. These counsellors can help negotiate any repayment arrangements with your creditors.

Credit reports are essential because lenders and creditors use them to evaluate the ability of a borrower to repay a debt. A good credit score will help you get a lower interest rate on a loan. You will also have a much wider choice of options compared to your counterparts with low scores.

If you have a poor credit score, do not despair. You might not be excluded from the world of loans. Bear in mind that any credit a lender does approve you for is likely to come with a higher-than-average interest rate. However, if you manage to pay your repayment instalments on time, your credit score will gradually improve.

_________________________________________________________

Interesting related article:

- “What is my Credit History?”

- “What is my Credit Score?”