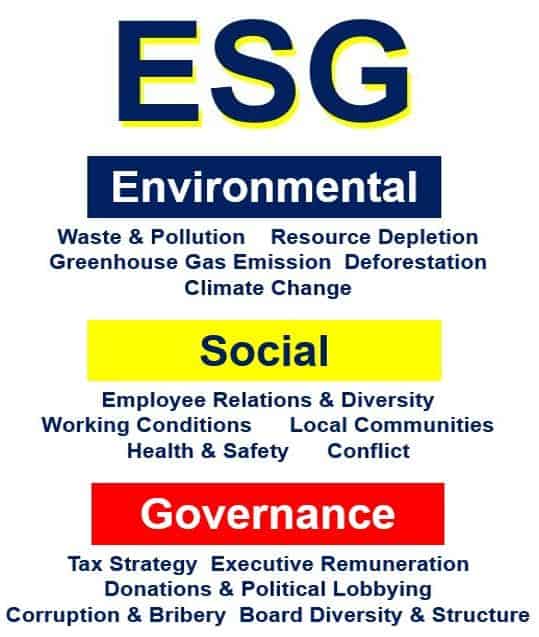

Within the past few years, environmental, social and governance (ESG) metrics – and ESG services at large – have become an integral facet of today’s leading FinTechs. Its rapid growth became clear starting in 2019 and 2020 when a Mastercard report found that venture funds distributed around 2.5 times as much equity into ESG-related FinTechs—going from $700 million to $1.8 billion accordingly.

In this context, how can your business leverage ESG solutions to create greater overall value? The following digital finance solutions from Star highlight how all FinTech players, from startups to traditional firms, can benefit immensely from a technology-driven sustainability focus.

3 ESG services leading the industry

Based on top examples that we compiled from cutting-edge companies and best practices, today’s sustainability solutions can reach new heights with these value-driven strategies:

- Machine learning & Artificial Intelligence (AI). One of the technologies that’s continuously becoming more sophisticated is AI, which includes both deep learning and machine learning. Its application is becoming more and more relevant, no matter the industry, by helping us to deliver superior data quality and analyze this information more efficiently. When used as a FinTech solution, the power of deep learning and machine learning allows for the coalescing of valuable data by instantaneously sifting through millions of documents, texts, spreadsheets, articles, speeches and more. Better yet, for ESG FinTech companies, these services can use sentiment analysis algorithms to determine a company’s sustainability mission and practices by analyzing interviews or speeches from C-level executives and other company personnel. One of the companies championing this version of ESG in FinTech is Sevva – an SaaS platform that specializes in ESG research and ratings for companies to “supercharge” their sustainability ratings, forecasting and analysis abilities. Their model shows the extent of AI’s capabilities which can be perfectly tailored for enterprises large and small.

- DLT – Distributed Ledger Technology. For FinTech services to build and maintain user trust, today’s market demands greater traceability for any and all products–especially their supply chains. Blockchain technology, which is a type of DLT, has the ability to provide the necessary management tools that deliver this high-end transparency. The decentralized databases found in DLT can record all supply chain transactions and simultaneously keep the details in multiple places while also producing credible ESG reporting. One of the top players in this space is Diginex, which brings companies a blockchain-powered platform used for data collection and reporting. Some ESG services even combine this technology with AI to accomplish more advanced supply chain management. Together, these solutions cover all the bases; DLT facilitates with traceability and tracking through smart contracts while AI helps with inventory, supply planning and warehouse management. Machine learning can even help increase efficiency for companies operating in multiple countries by using data sets to sift through foreign language information and streamlining auditing and compliance services. By integrating products like Diginex or designing similar end-to-end solutions, these ESG tools create value by giving investors better access to essential data that lead to equity decisions.

- Alternative data via satellite & drone imagery. ESG in FinTech has truly found a home base within alternative data. The world’s top financial data firms have always been seeking a timelier way to measure different economies – and Spaceknow is doing just that. Using satellite technology known as Earth Observation imagery, Spaceknow provides a novel service that measures all types of macroeconomic data for economies and countries globally. Moreover, their ESG solutions have grown to include tools for the environmental and energy sectors that detail ecological changes for any location over time. These satellite and drone images allow everyone, including ESG FinTech companies, to derive meaningful results by linking geospatial intelligence to sustainability metrics and compliance.

ESG innovation in any context

While we’ve put a spotlight on the universal advantages of recent environmental, social and governance tools, this barely scratches the surface of what can be accomplished through end-to-end financial services technology consulting. By crafting your own technology-powered ESG solution, your digital finance solutions can help lead the charge into an increasingly valuable sustainability market. The experts at Star specialize in co-creating and building trailblazing products with 40 percent faster delivery – making sure your service reaches its full potential.

CTA Discuss your ideas with us

Interesting Related Article: “What is ESG? Definition and meaning“