ESG stands for Environmental Social and Governance and refers to the three key factors when measuring the sustainability and ethical impact of an investment in a business or company. Most socially responsible investors check companies out using ESG criteria to screen investments.

It is a generic term used in capital markets and commonly used by investors to evaluate the behavior of companies, as well as determine their future financial performance.

ESG metrics serve as a benchmark for companies aspiring to align with global sustainability standards.

The Environmental Social and Governance factors are a subset of non-financial performance indicators which include ethical, sustainable, and corporate governance issues such as making sure there are systems in place to ensure accountability and manage the corporation’s carbon footprint.

The number of investment funds that incorporate ESG factors has been growing rapidly since the beginning of this decade and is expected to continue rising significantly over the decade to come.

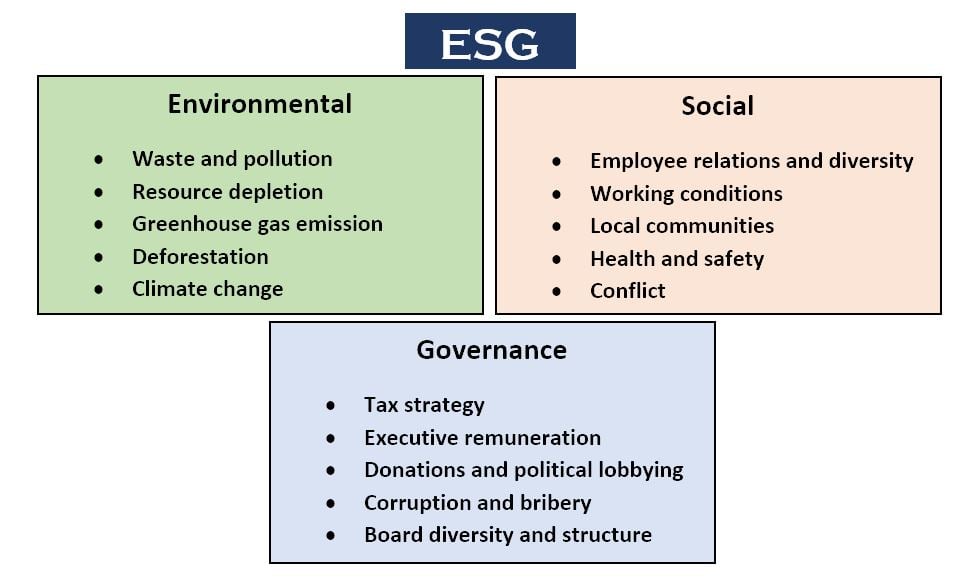

ESG’s three central factors are:

Environmental

Environmental criteria, which examines how a business performs as a steward of our natural environment, focusing on:

- waste and pollution

- resource depletion

- greenhouse gas emission

- deforestation

- climate change

Social

Social criteria, which looks at how the company treats people and concentrates on:

- employee relations & Diversity

- working conditions, including child labor and slavery

- local communities; seeks explicitly to fund projects or institutions that will serve poor and underserved communities globally

- health and safety

- conflict

Governance

Governance criteria, which examines how a corporation polices itself – how the company is governed and focuses on:

- tax strategy

- Executive remuneration

- donations and political lobbying

- corruption and bribery

- board diversity and structure

If you are an investor and would like to buy ESG-screened securities you should consider socially responsible mutual funds and exchange-traded funds.

Experts say that what constitutes an appropriate set of ESG criteria is subjective – it depends on what your priorities are – so you will need to do the research yourself if you really want to seek out investments that precisely match your own values.

ESG and the alternative investment world

ESG standards are gradually becoming a significant part of the alternative investment world. ESG issues are not only important when measuring the sustainability of the non-financial impacts of investments – but they may also have a material impact on the return profile and long-term risk of investment portfolios.

A recent study found that investors who choose ESG-screened investments receive a ‘double dividend’ in the form of lower risk plus a better **rate of return.

** Rate of return is the ratio of the income from an investment over its starting cost.

It has been found that businesses that adopt ESG standards tend to be more conscientious, less risky, and consequently more likely to be successful in their long-term commercial aims.

Traditional investors are becoming increasingly interested in the ESG framework, and many have begun using its criteria for assessing risk in the investment decision-making process.

ESG-screened investments are good investments

The practice of considering environmental, social, and governance issues when seeking out investment opportunities has evolved considerably from its origins.

Several different methods are currently being used by both value-motivated and values-motivated investors in considering ESG issues across all classes of assets.

It is a myth to think that socially responsible investing comes at a cost – that you will make less money – in fact, the opposite is often the case.

In an article published by the *CFA Institute – Environmental, Social, and Governance Issues in Investing: A Guide for Investment Professionals – Usman Hayat, CFA, and Matt Orsagh, CFA, CIPM wrote:

“There is, however, a lingering misperception that the body of empirical evidence shows that ESG considerations adversely affect financial performance.”

“For investment professionals, a key idea in the discussion of ESG issues is that systematically considering ESG issues will likely lead to more complete investment analyses and better-informed investment decisions.”

* The CFA Institute, based in Charlottesville, Virginia, offers the Chartered Financial Analyst (CFA) designation.

In another paper published by the CFA Institute – Integrating ESG into the Fixed-Income Portfolio – Christoph Klein CFA claims that integrating ESG criteria into the fixed-income analysis can reduce idiosyncratic and portfolio risk, while at the same time improving performance by “helping investors anticipate and avoid investments that may be prone to credit rating downgrades, widening credit spreads, and price volatility.”

People’s attitudes are changing

Google and Impax carried out a survey of over 300 investors with £500,000 ($700,000) or more of long-term savings and investments. The aim was to determine what their attitudes to climate change were following the COP21 Conference in Paris.

Below are some of the survey’s findings:

- 70% of respondents said they were concerned about climate change.

- 15.3% said they had taken steps of both investing in sustainable/clean energy stocks plus not investing in fossil fuels.

- 33.5% claimed to currently have investments that are focused on clean energy, energy efficiency, or sustainability.

Writing in the Financial Times, Nyree Stewart quotes Hamish Chamberlayne, an SRI manager at Henderson Global Investors, who said:

“The big picture is that in the next few decades, the global economy is going to transform to a low-carbon economy and it will be one of the biggest investment events of our lifetime.”

“We have a global economy that is roughly $80trn [£56.3trn] and extremely dependent on carbon, so transitioning to an economy where we are much less dependent on carbon will result in enormous disruption to established industries and geopolitical relationships and how the global economy works. In the next 10-20 years there will be huge risks and opportunities.”

This shift is prompting innovative financing models focused on sustainability and long-term ecological balance.