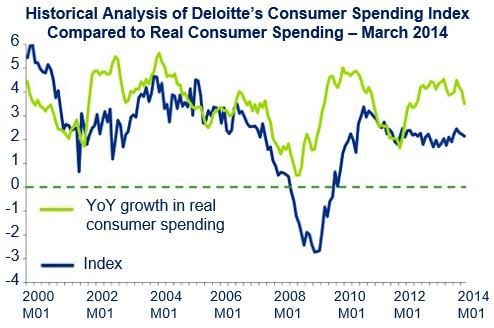

The Deloitte US Consumer Spending Index fell half-a-point in March to 3.51, compared to 4.03 in February. However, the Index is still high enough to indicate positive conditions for consumers.

The Deloitte US Consumer Spending Index predicts future consumer spending by tracking consumer cash flow.

Deloitte’s senior US economist, Daniel Bachman, said:

“The outlook for consumer spending remains healthy. The Index declined primarily due to a slower increase in median home prices. While housing prices are cooling off a bit, possibly due to the weather, there is no indication that the inventory of houses for sale has suddenly picked up.”

The US Consumer Index consists of four components

- Tax burden – for the fourth successive month the tax rate is holding steady at 11.8%.

- Initial unemployment claims – declined 4.1% compared to March 2013, falling to 337,000. However, they rose 1% compared to February’s claim rate of 334,000.

- Real wages – real hourly wages increased 1% compared to March 2013 to $8.86.

- Real new home prices – increased slightly from February to $111,000. Year-on-year they have risen by just 0.8%, compared to a 5.5% rise in the 12 months to January.

(Source: Deloitte Development LLC)

April contains many consumer-boosting factors

Vice-Chairman Deloitte LLP and Retail & Distribution sector leader, Alison Paul, said:

“Although the economy is continuing to improve, retailers should not take their foot off the pedal. The month of April has a number of factors that could positively impact sales, from warmer weather conditions to a later Easter holiday and potentially more dollars in the pockets of consumers due to tax refunds.”

“The key will be for retailers to capitalize on these market conditions and leverage its digital channels to influence sales and entice consumers with seasonal offerings in a personalized and moment-appropriate way.”

A consumer confidence rebound was reported by the Conference Board for March 2014, after falling in February. Consumer confidence reached 82.3, a six-year high versus 78.3 in February (1985=100).

While personal spending rose, personal income remained almost unchanged, the Department of Commerce reported in March.