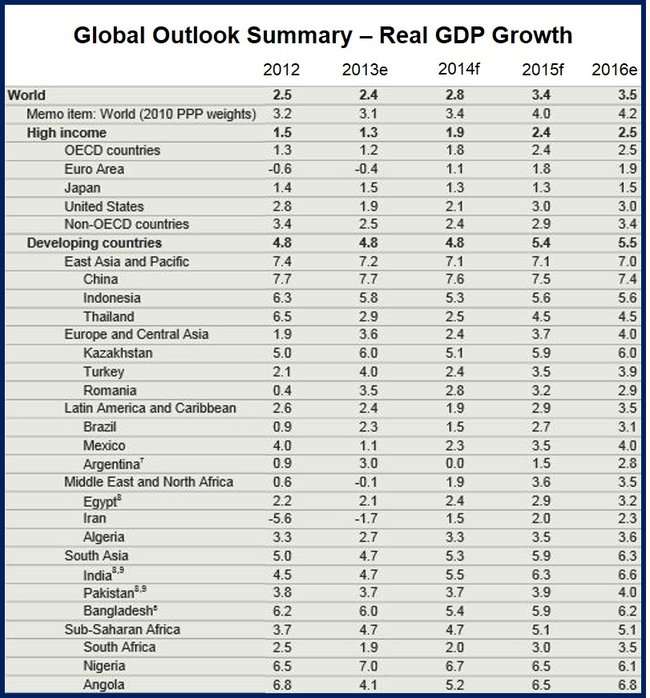

The Developing countries growth forecast for 2014 has been revised down by the World Bank to 4.8% compared to January’s estimate of 5.3%. Economic indicators point to strengthening growth in 2015 to 5.4% and 5.5% in 2016.

The World Bank expects China’s gross domestic product (GDP) to grow by 7.6% in 2014. However, this depends on successful rebalancing efforts. A hard landing would be felt across Asia.

Emerging markets disappointing growth

Emerging markets are headed for a year of disappointing growth, with Q1 2014 weakness pushing back an expected acceleration in economic activity, according to Global Economic Prospects, a World Bank report released on June 10th.

Several factors have contributed to a third successive year of sub-5% GDP growth in the emerging markets:

- An abnormally cold winter in the US resulting in poor Q1 2014 figures,

- Political turmoil in a number of middle-income nations,

- rebalancing in China,

- capacity constraints,

- very slow progress on structural reform.

World Bank Group President Jim Yong Kim said:

“Growth rates in the developing world remain far too modest to create the kind of jobs we need to improve the lives of the poorest 40 percent. Clearly, countries need to move faster and invest more in domestic structural reforms to get broad-based economic growth to levels needed to end extreme poverty in our generation.”

High-income nations

Despite very poor GDP figures in the US in Q1 2014, the economic rebound in the advanced economies is gaining momentum. The high-income nations are forecast to grow by 1.9% this year, and then by 2.4% in 2015 and 2.5% in 2016.

The Eurozone looks set to reach its 1.1% growth target for 2014, while the US economy is predicted to expand by 2.1% (less than the previous estimate of 2.8%).

The World Bank predicts the global economy will gather speed as the year progresses and will achieve 2.8% growth in 2014, and then 3.4% in 2015 and 3.5% in 2016.

While the advanced economies contributed less than 40% of global growth in 2013, this will increase to about half in 2015 and 2016.

The emerging economies will depend on the expected accelerated growth rates in the high-income nations for their economic expansion. The advanced economies are expected to inject an extra $6.3 trillion to global demand over the next 36 months, compared to just $3.9 trillion during the last 36 months.

Fewer negative headwinds

Short-term financial risks are becoming less of a concern, partly because earlier downside risks occurred without causing major upheavals, and also because economic adjustments over the past twelve months have minimized vulnerabilities.

Some of the hardest-hit nations now have smaller current account deficits, and the capital flight that troubled many emerging economies has now turned into returning capital flows. Stock markets in emerging economies have recovered while bond yields have fallen.

Markets remain nervous and speculation over the timing and volume of future changes in high-income macro policy may lead to further episodes of volatility.

Several countries, including Turkey, South Africa and Brazil, where both current account deficits and inflation are high, will remain vulnerable. The recent easing of international financial conditions may once again encourage credit growth, current account deficits and related vulnerabilities.

Kaushik Basu, Senior Vice President and Chief Economist at the World Bank, said:

“The financial health of economies has improved. With the exception of China and Russia, stock markets have done well in emerging economies, notably, India and Indonesia. But we are not totally out of the woods yet. A gradual tightening of fiscal policy and structural reforms are desirable to restore fiscal space depleted by the 2008 financial crisis. In brief, now is the time to prepare for the next crisis.”

Since 2007, developing nations’ national budgets have deteriorated considerably. In nearly half of the emerging economies, government deficits are higher than 3% of GDP, while debt-to-GDP ratios have increased by over ten percentage points since 2007.

In economies where deficits are still large, such as South Africa, Malaysia, Kenya, India and Ghana, fiscal policy must be tightened.

In order to achieve sustainable income growth, structural reforms in developing nations, which have been placed on a back-burner in recent years, need to be reinvigorated.

Lead author of the report, Andrew Burns, said:

“Spending more wisely rather than spending more will be key. Bottlenecks in energy and infrastructure, labor markets and business climate in many large middle-income countries are holding back GDP and productivity growth. Subsidy reform is one potential avenue for generating the money to raise the quality of public investments in human capital and physical infrastructure.”

East Asia and the Pacific

In 2013, GDP growth was moderate as economies implemented adjustments to address imbalances built up during several years of credit-fuelled expansion.

In 2014, adjustment continues with real credit growth declining from double-digit rates, particularly in Indonesia, Malaysia and China.

The World Bank forecasts approximately 7% GDP growth by 2016, about two percentage points less than during the pre-crisis boom years. The region’s economy expanded by 7.2% in 2013.

Chinese GDP growth is expected to slow down from 7.6% in 2014 to 7.4% by 2016. Excluding China, growth in the region is forecast to expand by approximately 5% in 2014 and 5.5% by 2016 due to stronger external demand, a reduced drag on growth from the political turmoil in Thailand, and an easing of the domestic adjustment in other regional economies.

Europe and Central Asia

Despite the Ukrainian crisis, developing countries in Central Asia and Europe reported a modest recovery in Q1 2014.

In the Eurozone, industrial output picked up, boosted by rising exports.

A steep slowdown in Russian growth, falling metal and mineral prices, and domestic capacity constraints slowed growth in Central Asia in 2014.

The World Bank estimates that the Ukraine situation has reduced economic growth in the middle income nations in the region by one percentage point. As this effect fades, output is expected to pick up from a weak 2.4% growth rate in 2014 (3.6% in 2013) to 3.7% in 2015 and 4% in 2016.

Russia, which is now classed as a high-income nation, will see economic growth of just 0.5% this year, and then 1.5% in 2015 and 2.2% in 2016.

(Source: World Bank)

Latin America and the Caribbean

Weak commodity prices, a slow US economy in Q1 2014, and domestic challenges have kept economic activity weak in the region.

Economic weakness carries over from 2013, weighing on merchandise exports in several nations.

Slower Chinese growth, a slow US economy in Q1 2014, Mexico’s tax hike, plus some other factors led to weak first quarter data for Peru, Mexico, Argentina and Brazil. Panama and Bolivia, however, are expected to see GDP growth in excess of 5% this year.

The Caribbean economies are expected to benefit from regional exports, including strong tourism growth as the advanced economies pick up, as well as improved competitiveness following earlier currency devaluations.

The region is forecast to grow by 1.9% in 2014, and then 2.9% in 2015 and 3.5% in 2016.

The region’s largest economy, Brazil, is expected to grow by 1.5% this year, 2.7% in 2015 and 3.1% in 2016.

Middle East and North Africa

After contracting by 0.1% in 2013, the region is forecast to strengthen gradually. Economic activity in the oil-importing nations is stabilizing.

The Eurozone recovery is helping boost economic activity in several Mediterranean economies.

While the Egyptian economy has started to accelerate, spillovers from the Syrian conflict continue to undermine Lebanon’s economy.

The developing oil-exporting nations show signs of growing strength following earlier disruptions. Even so, aggregate production is still below the 2013 average.

The World Bank writes:

“The outlook for the region is shrouded in uncertainty and subject to a variety of domestic risks linked to political instability and policy uncertainty.”

The region’s developing nations’ economies are forecast to grow by 1.9% in 2014, and then by 3.6% in 2015 and 3.5% in 2016.

South Asia

In 2013, economic growth slowed to an estimated 4.7% compared to 7.3% the year before. Much of it is due to poor manufacturing output and a steep slowdown in investment growth in India.

Growth in Pakistan is considerably below the regional average, but remains broadly stable.

The region is expected to grow by 5.3% this year, and then by 5.9% in 2015 and 6.3% in 2016. Much of the acceleration will be localized in India. Investors have been encouraged by Prime Minister Narendra Modi proposed reforms.

India’s GDP is predicted to expand by 5.5% in FY2014-2015, in the following year by 6.3%, and then by 6.6% in 2016-17.

Sub-Saharan Africa

GDP grew by 4.7% in 2013, mainly due to strong domestic demand. South Africa’s 1.9% growth kept the regional aggregate down. Growth in 2013 was 6% excluding South Africa.

GDP for the region is forecast to grow by 4.7% this year, and then by 5.1% (annually) in 2015 and 2016. Growth will remain weak in South Africa, but will pick up modestly in Angola and remain strong in the region’s largest economy Nigeria.

Experts at the CES Ifo Group Munich, Germany, forecast global economic growth of 2.5% for this year.