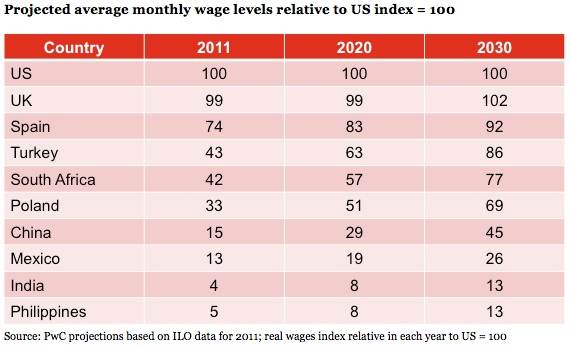

The wage gap between the rich nations and emerging economies, such as India, China and The Philippines will be considerably smaller by 2030, says a new PricewaterhouseCoopers (PwC) analysis.

In relative terms, the Philippines and India will be at the lower end of wage projections.

Even so, by 2030 average wages in India may grow more than fourfold in real dollar terms, while in the Philippines they will probably triple.

Real wages in the United States and the United Kingdom are forecast to rise by approximately one third over the same period, i.e. by 2030 the two countries’ wages will be at similar levels to each other.

The average monthly wage today in India is approximately 25 times smaller than that of the UK. However, by 2030 it will only be 7.5 times smaller.

Average wages in the United States today are about 7.5 times greater than they are in Mexico. That gap could shrink by a factor of 4 by 2030.

By 2030, the average monthly wage in China is forecast to reach about half that of Spain.

Chief economist at PwC, John Hawksworth, said:

“While any such projections are subject to significant uncertainties, the direction of change is clear. The large wage advantages enjoyed today by many emerging economies will shrink as their productivity levels catch up with those in advanced economies and their real exchange rates rise as a consequence.

Places like Turkey, Poland, China and Mexico will therefore become more valuable as consumer markets, while low cost production could shift to other locations such as the Philippines. India could also gain from this shift, but only if it improves its infrastructure and female education levels and cuts red tape.”

What implications might these trends have for future business strategy?

The wage gap is shrinking

- Companies move their manufacturing or service operations elsewhere, as some American, Japanese and West European companies have done.

- Companies move to areas that start off being more expensive but are closer to home, which gains them more control over supply chains so that they may better respond to customers’ changing needs.

- China, Poland, Turkey, Mexico and Brazil, the middle income economies, offshore to countries with lower wages, such as India, Vietnam and the Philippines.

- Current ‘Western’ offshorers (to India and China, for example) reorient their operations to sell their goods and services to increasingly affluent local populations.

PwC partner and Global Human Resource Services leader Michael Rendell, said:

“Change is continuous and there will be even more movement in the coming years. Companies planning for this today will find themselves with significant advantages, particularly in terms of people costs. It’s inevitable that the manufacturing and services industries in countries will transform as the cost base evolves, and also that there will be winners and losers. Governments, regulators and business communities need to be ready for that shift.”