Estée Lauder Q4 profit more than doubled to $257.7 million ($0.66 per share) from $94 million ($0.22 cents per share) in Q4 2013, driven by strong sales gains among middle-class consumers in emerging markets.

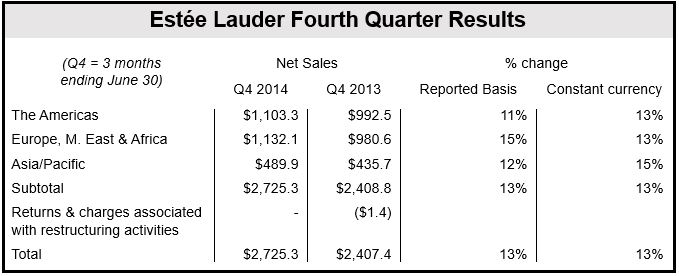

Double-digit sales increases in Asia and Europe helped push up total sales by 13% to $2.73 billion compared to one year ago.

Despite fierce competition in a crowded beauty sector, sales in the Americas jumped by 11%, and by 15% in Europe, the Middle East and Africa.

Sales rose in the following divisions:

- Skincare: +14% to $1.21 billion. Recent product launches from Clinique, as well as reformulated Repairwear Laser Focus and initial deliveries of Clinique Smart Custom-Repair serum contributed to the strong quarter, as did higher sales from La Mer, its luxury skin care brand.

- Make-up: +12% to $1.06 billion. Double-digit growth from its makeup artist brands and recent launches, including All About Shadow from Clinique, and as Pure Color Envy Sculpting Lipstick from Estée helped accelerate growth.

- Fragrance: +13% to $309.3 million. Luxury brands Tom Ford and Jo Malone posted double-digit growth, while the recent launches of Estée Lauder Modern Muse, the Michael Kors Collection and Tory Burch also helped boost the fragrance division.

- Hair Care: +7% to $134.9 million.

Gains across all metrics

CEO Fabrizio Freda said on Friday that the company achieved record-breaking results across several fronts, including EPS (earnings per share), operating cash flow, sales, and operating margin in fiscal 2014.

“The year held considerable changes in terms of overall macro and geopolitical market shifts and we adapted dynamically in what was undeniably a tougher environment.”

He added that Estée Lauder has significantly increased market share in South Africa, Mexico, Turkey and Central Europe.

(Data Source: Estée Lauder)

Outlook for Fiscal Q1 2015 and 2015 full year

Estée Lauder predicts global prestige beauty growth of about 3% to 4% for the full year and between 1% and 2% for Q1 2015 in constant currency.

However, it also warns that a number of retailers have placed their orders in advance of planned technology upgrades. These extra early orders have boosted 2014 results, and will consequently not appear in 2015’s figures. This will have a negative impact of 7% and 3% on Q1 2015 and full-year 2015 results respectively.

Diluted EPS (earnings per share) including the effect of accelerated retailer orders are forecast to be from $0.51 to $0.51, and from $2.89 to $2.99 for Q1 2015 and full-year 2015 respectively. Excluding the accelerated retailer orders impact, EPS is forecast at $0.72 to $0.76 and $3.10 to $3.20 (Q1 2015 and full-year 2015 respectively).

(Data Source: Estée Lauder)

Estée Lauder Companies, Inc. is based in Manhattan, New York. The company employs more than 40,000 people worldwide.