The Eurozone fiscal consolidation that occurred in 2013 was immense, says a new report by Fitch Ratings. It also adds that despite major achievements in debt figures, Eurozone sovereigns continue facing major challenges in stabilizing and minimizing their debt ratios.

According to Eurostat figures released on Wednesday, the Eurozone’s aggregate government deficit-to-GDP ratio declined to 3% in 2013 compared to 3.7% in 2013; close to Fitch’s forecast of 3.1%.

Eurozone fiscal consolidation has come a long way, considering that the aggregate deficit stood at 6.2% in 2010.

Eleven of sixteen Eurozone member states in 2013 reported lower headline deficits compared to 2012. Italy’s remained unchanged at 3% of GDP (gross domestic product). Widening deficits in Slovenia and Greece were caused by bank recapitalization costs. In Slovenia, the deficit surged to 14.7% from 4%, caused by a one-off bank recapitalization cost. Germany was nearly at balance.

Despite Eurozone fiscal consolidation, budget deficits remain large

The aggregate deficit (exc. Germany) stood at 4.3% last year. Although the aggregate deficit dropped to 3% of GDP maximum under the Stability and Growth Pact, seven member states registered higher deficits: Ireland -7.2%, Spain -7.1%, Cyprus -5.4%, Portugal -4.9%, and France -4.3%.

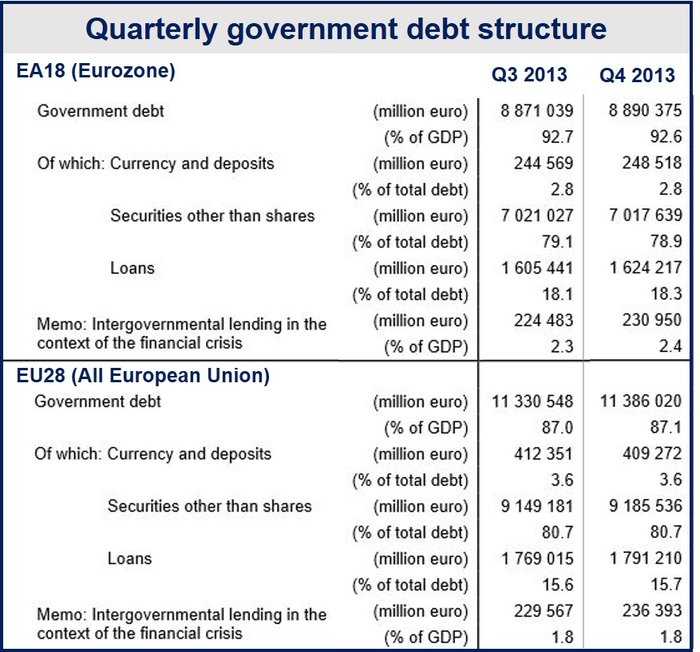

(Source: Eurostat)

According to Fitch Ratings:

“Narrowing budget deficits, particularly structural deficits in the periphery, are one aspect of more generally improving credit fundamentals among Eurozone sovereigns. The continued decline in government deficits is consistent with our projection that the public debt/GDP ratio for the eurozone as a whole will peak this year.”

“Nevertheless, the government debt/GDP ratio remains high, rising to 92.6% at end-2013 from 90.7% at end-2012, according to Eurostat, and up from 66% in 2007.”

Hard hit nations still have higher debt-GDP-ratios

The debt-GDP-ratios are considerably higher than the aggregate level in the nations that were worst affected by the global financial and European sovereign debt crises, and in several countries they are still increasing, Fitch points out.

Several more years of austerity will be required to reign in Eurozone public sector debt burdens “due to the weak medium-term growth outlook for the region.”

Countries with high public debts are much more vulnerable to economic or financial shocks, making it much harder for their governments to alter financial policy.

Fitch says this is one reason it is generally cautious about the Eurozone’s medium-term outlook. Debt reduction will remain challenging, and member states will find it harder to “achieve the kind of growth rates and primary balances that in the past have enabled developed countries achieve very large general government debt reductions.”

There is growing concern among economists that the Eurozone could slide into a Japanese-style deflation that has stricken the country for decades. Annualized inflation fell to 0.5% in the Eurozone in March, from 0.7% in February, moving further away from the European Central Bank’s 2% target.