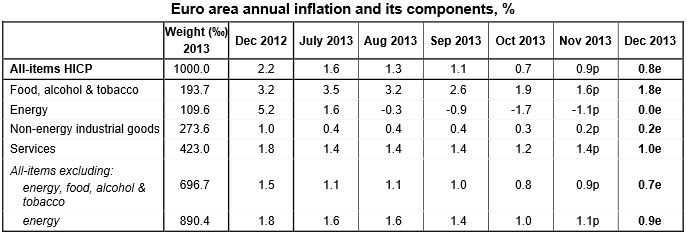

The Eurozone’s inflation rate dropped to 0.8% in December, 2013, from 0.9% the month before, according to Eurostat, the European Union’s statistical agency.

This is bad news for the European Central Bank (ECB), which is aiming to push the inflation rate towards 2% per year.

Of particular concern is core inflation, which does not include tobacco, alcohol, food and energy, which has fallen from 0.9% in November to 0.7% in December, 2013.

The ECB had predicted core inflation of 1.3% for 2014, compared to 1.1% for 2013. There is growing concern that rather than moving upward, core inflation in 2014 will stay at record low levels.

The ECB cut its benchmark interest rate to 0.25%, a record low, in a move to boost the economy and encourage an upturn in inflation. The ECB’s governing council meets on January 9th. Most economists do not expect the central bank to initiate any changes.

Source: Eurostate. e = estimate. p = provisional.

Is the Eurozone entering a period of deflation?

A worry among many economists, politicians, investors and business leaders is that the Eurozone may be entering a period of deflation. Deflation occurs when consumers stop buying things because they expect prices to fall further, this exacerbates the falling price rate and leads to economic decline, as occurred in Japan for over two decades.

If the Eurozone does enter a Japanese-style deflationary economic contraction, the currently painful economic measures many countries have had to take will be compounded. In many Eurozone countries debt, both private and public, is dangerously high. The Economist wrote today “Since, with the exception of index-linked bonds, debt obligations are set in nominal terms, its burden rises in real terms when deflation sets in.”

Mario Draghi. ECB President said last week he and his team saw no urgent need for another interest rate cut, and no signs of deflation either. However, he added that the ECB considers a higher inflation rate for the Eurozone as a top priority.

The BBC quotes Peter Vanden Houte, ING’s chief eurozone economist, who said: “Today’s figures show that it’s too early for the ECB to become complacent about deflation risks, especially in peripheral countries.”

Currency traders, expecting the ECB to take further measures to boost the Eurozone’s economy, increased demand for euros, pushing the currency’s value up to $1.3646 from $1.3618.