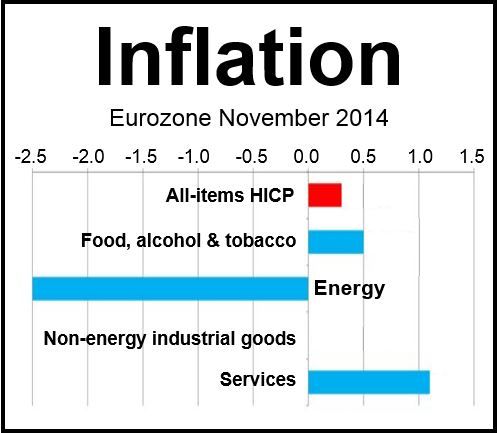

Inflation in the Eurozone slid to 0.3% in November compared to 0.4% in October, bringing the currency bloc dangerously closer to a deflationary spiral of falling prices and economic stagnation.

According to the European Union’s (EU’s) statistics agency Eurostat, the inflation decline was driven mainly by falling energy prices.

The European Central Bank (ECB) has a target of 2% annual inflation for the Eurozone. Throughout the whole of this year, inflation has remained below 1%. The ECB says anything below 1% is within what it calls its “deflation danger zone.”

Since the beginning of 2013, prices have been below the 2% target every single month.

The Eurozone’s anemic economy combined with ultra-low price rises have prompted its central bank to introduce stimulus measures.

There is a growing fear among economists and policymakers that the region is heading for a prolonged period of declining prices and shrinking GDP, which affected Japan for more than two decades.

Source: “Euro area annual inflation, November 2014,” Eurostat.

While energy prices declined by -2.5% in November from October and by -1.1% annually, core inflation remained unchanged from October at 0.7%. Core inflation strips out volatile items, such as energy and food.

Destatis, Germany’s statistical agency, informed earlier this week that inflation in the Eurozone’s largest economy was at a 5-year low.

In its November flash estimate, Eurostat expects November to have an annual inflation rate for services of 1.1% compared to October’s 1.2%, food, alcohol & tobacco of 0.5% from October, non-energy industrial goods 0.0% versus -0.1% in October, and energy -2.5% following October’s -2.0%.