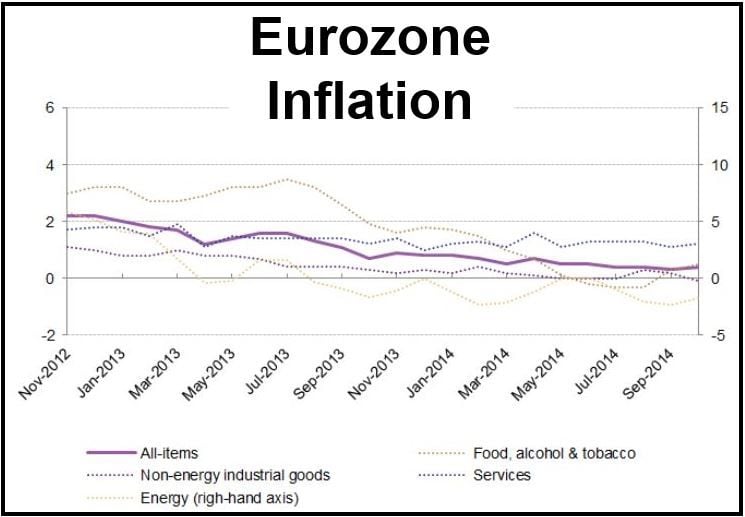

Eurozone inflation increased ever so slightly to 0.4% in October from September’s 0.3%, the EU’s statistical office Eurostat announced on Friday. The data provided some degree of relief for the ECB as it battles to prevent to currency bloc from slipping into a deflationary spiral.

Inflation in the services sector rose to 1.2% compared to 1.1% in September, while food, alcohol & tobacco increased by 0.5% from September’s 0.3%.

Industrial goods (non-energy) declined by -0.1% in October after rising 0.2% in the previous month.

Energy fell the most, -1.8% in October, but less than September’s -2.3%.

Core inflation, which factors out volatile components such as energy and food, was unchanged at 0.8% in October. Eurostat emphasized that these are preliminary data, which will be either confirmed or updated in November.

Most economists saw scarce signs that the risk of deflation has gone completely or that the Eurozone’s economy is starting to pick up again.

The increase in the headline rate was partly due to a volatile component – energy prices – which could go in the opposite direction in the months to come.

On Thursday, Germany’s statistical office Destatis estimated that the country’s consumer price index in October was 0.8% “thus remaining on a low level.” It added that consumer prices in September fell by -0.3% in September (estimate).

According to Destatis data, Germany’s inflation rate surprisingly came in at 0.7% compared to 0.8% in September.

In Italy, prices rose by 0.2% after falling by -0.1% in September. Spain, which is already in a deflationary environment, saw consumer prices fall by -0.2% in October versus a -0.3% decline the month before.

Eurozone member state governments as well as the European Central Bank (ECB) have embarked on a series of stimulus measures since the summer to kick start economic growth and push up inflation. This marginal increase in prices is hopefully a sign that they are starting to work.

Inflation has remained stubbornly below the ECB’s goal of 2% (annual) since the beginning of 2013. Mario Draghi, president of the ECB, sees little risk of outright deflation in the Eurozone, but warns that price rises will remain low for the months to come before starting a gradual increase in 2015 and 2016.

The ECB started purchasing covered bonds last week and says it will begin asset-back securities buying next month.

Euro rises

The euro reversed its recent losses on Friday, rising to a six-week high against the Japanese yen to 140.485 soon after Eurozone inflation data were published.

Against the dollar, the euro increased to $1.2583 from $1.2565.