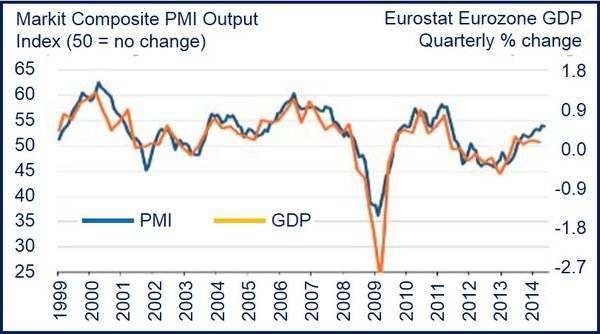

Eurozone steady growth was reported for the month of May, according to the Markit Purchasing Managers’ Index (PMI), which slid to 53.9 from 54 in April. Anything above 50 suggests growth.

Despite a very slight May PMI decline, the Eurozone is enjoying its best calendar quarter since 2011.

Economists are concerned about the performance of the French economy, which is becoming more like the “sick man of Europe” as each month passes, while Germany enjoys strong growth and the rest of the region sees its best period of GDP growth since the summer of 2007.

Growth expected in 2nd quarter

According to Markit:

“An increase in the survey’s measure of new orders to its highest since May 2011 also bodes well for further resilient growth of business activity in June.”

Business conditions have continued to improve in both services and manufacturing, albeit with growth rates moving in different directions:

- In the service sector output and new business hit the highest point since June 2011.

- In the manufacturing sector output and new orders grew at their slowest rates since November 2013.

The manufacturing slowdown was partly due to weaker exports, with new export orders growing at their slowest rates since July of 2013.

(Source: Markit)

Companies taking on more workers

Even so, companies in both services and manufacturing expanded capacity to meet growing demand, collectively hiring new employees at the fastest rate since September 2011.

Manufacturers increased their workforce numbers for the fifth consecutive month, although May’s growth was slower than April’s.

Service providers increased their payroll count for the second successive month.

In both manufacturing and services, however, job creation was “modest”.

The service and manufacturing sectors’ cautious approach to hiring partly reflects that, although increasing:

- Demand is still weak,

- Sales growth was only achieved after heavy discounting.

Prices charged by both sectors continued to decline in May, as they did in April. A slight increase in manufacturers’ prices was more than offset by the sharpest fall in rates charged for services since November.

German economy robust, France sluggish

Strong economic growth in German contrasted again with a disappointing performance in France. In May, Germany enjoyed its best growth rate for three years. As order book growth sped up, German companies took on staff at the fastest rate since December 2011.

Prices charged by companies in Germany in May increased slightly.

The services sector grew robustly, while manufacturing slowed down.

Business activity in France went marginally into decline in May, contrasting with the moderate growth seen in March and April.

For the first time in three months, service sector activity declined in May. Manufacturing contracted marginally, the first month’s fall since January. Orders fell in both sectors.

French companies cut their workforce numbers to the greatest extent since February, and reduced average selling prices at the steepest rate since July 2013.

According to The Conference Board, France’s economic outlook is mixed, with the country’s measure of economic activity declining by 0.1%.

Growth elsewhere

Output growth elsewhere in the Eurozone continued to improve, reaching its highest rate since August 2007. Employment increased (modestly) for the second month running. Prices charged declined slightly.

Chris Williamson, Chief Economist at Markit, said:

“A slight easing in the euro area’s rate of growth was seen in May, but doesn’t change the picture of a region that’s enjoying its best spell of growth for three years, especially when an acceleration in growth of new orders suggests that the pace of expansion could pick up again in June. GDP looks set to rise by 0.5% in the second quarter after the lackluster 0.2% rise in the first three months of the year.”

Deflationary pressures, a major concern

Williamson added that the major issue continues to be deflationary pressures. He believes May’s fall in prices charged by services providers and manufacturers makes it much more likely that the European Central Bank will take action to boost the economy when the Governing Council meets in June.

Williamson said:

“However, policymakers will also be minded of the steady recovery the region appears to be undergoing, suggesting that anyone expecting any aggressive policy initiatives may be disappointed.”

“Of the greatest concern is France, living up to its moniker of “sick man of Europe” by sliding back into contraction as Germany continues to enjoy robust growth and the rest of the region experiences its best expansion since mid-2007.”

According to Eurostat, the European Union’s statistical agency, Eurozone growth slowed in Q1 2014 – GDP grew by just 0.2%.