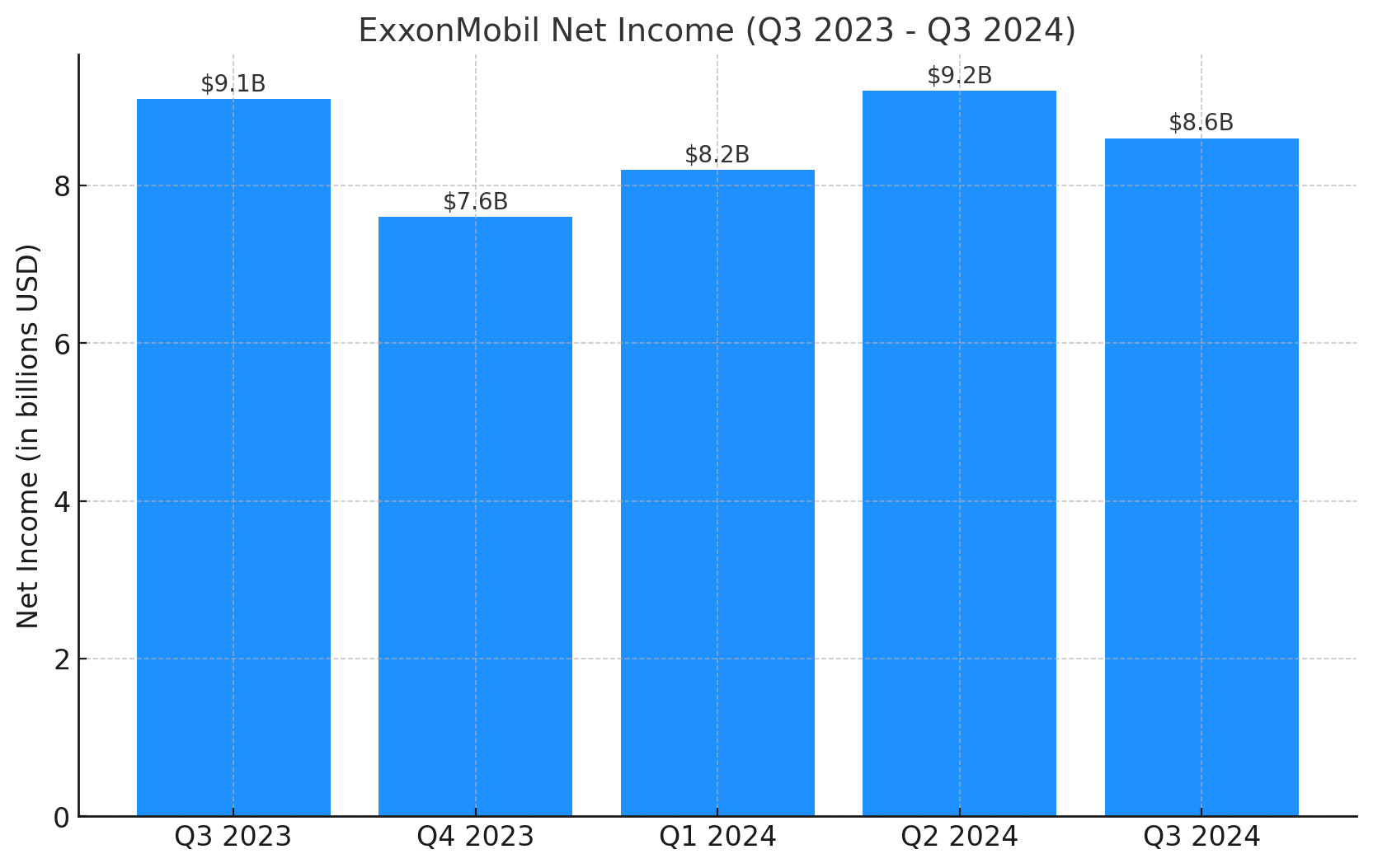

ExxonMobil reported third-quarter net income of $8.6 billion, down 5% compared to last year’s quarter.

Revenue for the third-quarter decreased by only 1% year-over-year to $90 billion, while cash flow from operations reached $17.6 billion.

Despite record production levels, weak refining margins and lower commodity prices impacted the company’s profits. Average oil prices dropped by about 17% compared to last year.

Compared to other oil giants, ExxonMobil has fared relatively well. Earlier this week BP reported a massive drop in net profit in the third quarter of the year, falling to $206 million from last year’s $4.86 billion.

Output up

ExxonMobil’s production increased by approximately 25% year-over-year to an average output of approximately 4.6 million barrels of oil equivalent per day (boepd).

The company’s $60 billion acquisition of Pioneer Natural Resources earlier this year boosted its production in the Permian Basin. The increased output, thanks to the acquisition, contributed to about $8.6 billion in ExxonMobil’s third-quarter profit.

Structural costs slashed

Since 2019, the company has managed to cut structural costs by $11.3 billion as it remains focused on efficiency and sustainability.

“We delivered one of our strongest third quarters in a decade,” said ExxonMobil CEO Darren Woods.

“Our industry-leading results1 continue to demonstrate how our enterprise-wide transformation is improving the structural earnings power of the company. In the Upstream, we’ve doubled the profitability of the barrels we produce on a constant price basis5. In Product Solutions, we’ve high-graded our refining footprint and increased high-value product sales. And across the entire company, we’ve achieved $11.3 billion of structural cost savings since 2019,” Woods added.

Dividend hike

The ExxonMobil board also raised quarterly dividend to 99 cents, a 4.2% increase.

“Our strategy is delivering leading returns of 20% so far this year for our shareholders, and we are continuing that growth with a 4% increase in our quarterly dividend payment announced today. We’ve now increased our annual dividend for 42 years in a row, a claim that less than 4% of the S&P 500 companies can make. Furthermore, we lead industry in total shareholder returns for the past 3, 5 and 10 years,” said Woods.