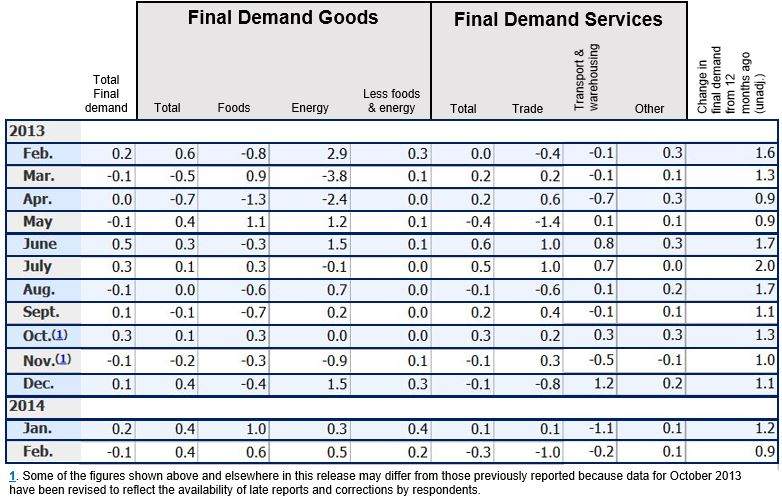

February producer prices fell 0.1% in the United States, according to the US Bureau of Labor Statistics. In January the Producer Price Index (PPI) increased by 0.2% and rose by 0.1% in December 2013.

The February producer prices drop surprised the majority of analysts, who according to AFP had forecast a rise of 0.2%, matching January’s figure. A Bloomberg survey of 73 economists showed that they all had predicted an increase.

The index for final demand (unadjusted) climbed 0.9% for the 12 months ending in February, the smallest 1-year rise since May 2013.

Prices in final demand services down, goods up

February’s 0.1% fall in final demand prices could be traced to the index for final demand services, which declined by 0.3%, the Department of Labor wrote. Prices for final demand goods, on the other hand, rose 0.4% in February.

Within intermediate demand, most prices rose. The index for processed goods increased by 0.7% in February, unprocessed goods prices climbed 5.7%, while the index for services went by 0.2%.

More than four-fifths of the fall in February producer prices occurred in the index for final demand services in footwear, apparel and accessories retailing, which declined 9.3%.

There were also declines in the indexes for brokerage compensation for residential property transactions, vehicle fuels and lubricants, alcohol and food retailing, airline passenger services, and equipment (and related parts and supplies) wholesaling.

There were increases, however, in inpatient and outpatient hospital care, optical goods retailing, and health and beauty care retailing.

Severe weather may have weakened prices

Bloomberg quoted Sean Incrmona, a senior economist at 4cast Inc., New York, who said “(The weakness) could be weather-related as these firms try to clear some inventories. There could be some near-term hit, but generally the picture is pretty stable. It’s a gradual, very gradual step up toward the Fed target over the next couple years.”

(Source: Bureau of Labor Statistics)

The Bureau of Labor Statistics now uses a revamped PPI index that includes 75% of the country’s economy, up from one third of all production from the old measurement which only reflected the costs of goods. Today, PPI also measures price fluctuations for government purchases, construction, exports and services.