Economists at the National Association for Business Economics (NABE) are equally divided on whether the Fed stimulus pullback – tapering back on its bond-buying program to stimulate the economy – is being timed correctly.

Some say the Federal Reserve (Fed) has got things just right, while others believe the monthly reduction of $10 billion should be paused for a couple of months to let the economy gather steam again.

NABE carries out a twice-yearly survey of its 230 members, all of them economists. Their latest poll results after surveying members between January 30th and February 6th were released yesterday, before the new Fed Chairman, Janet Yellen took over from Ben Bernanske.

Many want the Fed stimulus pullback slowed down

The survey should that:

- 43% of respondents believe the Fed will complete its bond-buying tapering in Q4 2014.

- 42% think the Fed should complete it in 2015 or even later.

In December 2013, the Fed reduced its bond-buying from $85 billion per month to $75 billion, and a month later reduced it to $65 billion. The aim of the stimulus program was to bring loan rates down, stimulate spending and boost the economy.

Fifty-seven percent of economists believe the Feds program has been “about right”, while 37% say it was “too stimulative”.

Fed stimulus pullback raising mortgage rates

Mortgage rates have increased since markets expected cutbacks in Fed purchases, and continued to rise when the tapering started.

Most NABE members think the Fed will wait until next year before considering increasing its short-term interest rate above zero (the current rate). In a hearing before Congress, Yellen said the Fed will wait till unemployment is well below 6.5% before it considers changing interest rates.

The Fed had earlier said that when unemployment went below 7% it would consider raising rates. It has since emphasized that that figure has been changed. In January 2014, unemployment fell to 6.6%.

When asked when they though the Fed would raise the federal funds rate, 36% predicted during the first six months of 2015, and 37% during the second half of 2015. Fifteen percent believe it will occur in 2016 or later, while 15% say it will happen this year.

No consensus regarding fiscal issues

NABE Policy Survey Committee Chair Jay Bryson, Global Economist at Wells Fargo Securities, said:

“Respondents to the most recent NABE Economic Policy Survey generally agree about monetary policy, but there is no clear consensus about most fiscal issues.”

“A majority of the NABE Policy Survey panel characterizes monetary policy as ‘about right’ at present, and most survey respondents believe that quantitative easing has been ‘a success.’”

“Only a small percentage of respondents expect the Federal Reserve will fully wind down its purchases of Treasury and mortgage securities before the fourth quarter of 2014. Most panelists expect the Federal Reserve to raise interest rates sometime in 2015.”

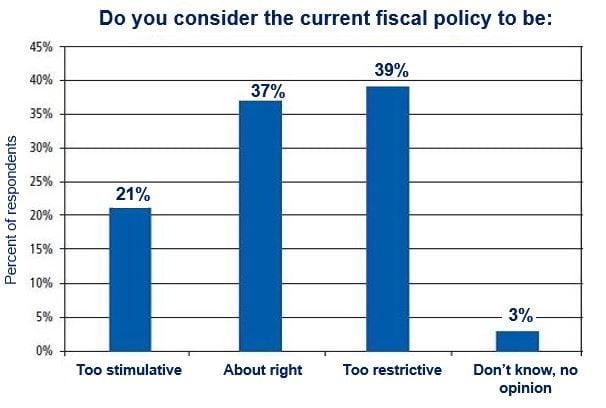

Regarding government spending:

- 21% say fiscal policy is “too stimulative”

- 37% believe it is “about right”

- 39% believe it to be “too restrictive”.

Most non-economists would be surprised at such disagreements within the country’s alleged ‘experts’.

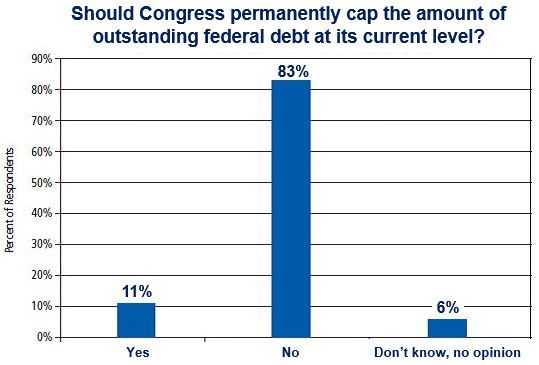

Eighty-three percent of NABE economists say Congress should not place a permanent cap on the debt limit.

Regarding the new federal health-care legislation, 18% see the Affordable Care Act as an economy booster, 42% think it will make no difference, and 30% see it as undermining GDP growth.

Economists’ view on foreign economic policy

NABE survey respondents were in general agreement regarding the European sovereign debt issue. When asked whether they thought the Eurozone had successfully devised a solution to the European sovereign debt crisis, a mere 15% felt it had been solved.

Seventy percent of NABE economist believe the Eurozone crisis will flare up again within the next twelve to twenty-four months.

Regarding the Fed stimulus pullback, 59% expect it will continue causing further volatility in the financial markets of some emerging economies, while 27% felt that “continued tapering is fully discounted in financial prices.”