With online shopping raising ground-shipping business, FedEx fourth quarter profit increased. The company reported earnings of $2.46 per diluted share compared to last year’s quarter earnings of 2.13 per diluted share. Revenue increased by 3.5% to $11.84 billion.

Before the opening bell, FedEx shares surged 4% in premarket dealings.

Frederick W. Smith, FedEx Corp. chairman, president and chief executive officer, said:

“An outstanding fourth quarter helped FedEx post solid results for fiscal 2014, and we believe we are well positioned for a strong fiscal 2015.”

“I would like to extend my sincere appreciation to the entire FedEx team for their contribution to our results and their continued commitment to providing outstanding service to our customers and connecting people and possibilities around the world.”

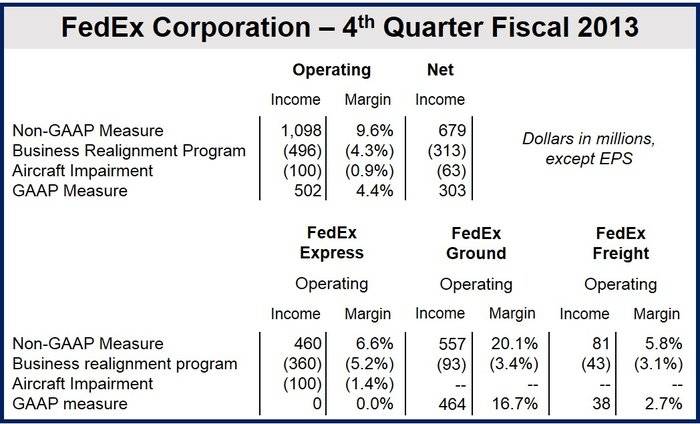

In its fourth quarter ending May 31, FedEx said it earned $730 million, much higher than the $303 million reported in Q4 the year before when write-downs reduced figures considerably.

Ground-shipping business strong

Ground-shipping deliveries expanded by 8% to $3.01 billion, driven mainly by strong online shopping.

Operating income rose 5% to $586 million from an adjusted $557 million a year ago. Operating income last year, including charges, was $464 million.

Operating margin fell from an adjusted 20.1% last year to 19.5%. Last year’s operating margin including charges was 16.7%.

FedEx Express grew more slowly

FedEx Express, which makes up more than half the company’s income, registered much slower growth – revenue increased from $6.98 billion to $7 billion. Customers are tending more towards slower and cheaper services when sending goods abroad.

Operating income increased by 3% from last year’s adjusted $460 million to $475 million. Operating income last year, including charges, was $0.

Operating margin increased on last year’s adjusted 6.6% to 6.8%. Operating margin was 0% last year including charges.

FedEx Freight healthy growth

FedEx Freight revenue increased by 12% to $1.55 billion, compared to last year’s $1.39 billion.

Compared to an adjusted $81 million one year ago, operating income rose by 51% to $122 million. Operating income, including charges, was $38 million last year.

Operating margin jumped from 5.8% (adjusted) last year to 7.9%. Operating margin last year, including charges, was 2.7%.

FedEx Outlook

For the (fiscal) year 2015, the Memphis-based company forecasts earnings to be between $8.50 and $9 per diluted share.

FedEx stressed that its outlook assumes that there will be no net year-over-year fuel impact and that economic growth will be “moderate”.

Capital spending is set to increase by about $4.2 billion, which includes the delivery of new aircraft to support the global courier delivery services company’s fleet modernization program.

Alan B. Graf, Jr., FedEx Corp. executive vice president and chief financial officer, said:

“Fiscal 2014 was a good year for FedEx and we expect fiscal 2015 to be even better. With continued modest economic improvement, our results in fiscal 2015 should benefit from base performance improvement and ongoing execution of our profit improvement initiatives at FedEx Express, continued profitable growth at FedEx Ground and FedEx Freight, and our share repurchase program.”

“We remain committed to improving earnings, cash flows, returns on invested capital and returns to shareowners, with the most recent example of the latter being our announced 33% increase in the quarterly dividend.”

Higher prices for bulky, low-cost items

In May, FedEx said it would start raising prices for larger but lighter packages that use up space and bloat delivery costs, including many goods that people purchase online. United Parcel Service is following suit, having announced yesterday that it will take into account a large package’s dimensions as well as its weight when determining prices.

(Source: FedEx Corporation)

Consumers are using the Internet more to shop for goods they would normally by in shops. This is great news for FedEx in that shipping volume goes up, but not-so-good news because many of those goods are bulky, low-cost items.

Fourth quarter results improved considerably over Q3, when the delivery business was slowed down by abnormally harsh winter conditions.