An amortizing loan or amortized loan is one with scheduled regular payments of both principal and interest. The principal of a loan is the amount the borrower borrowed originally. The interest, on the other hand, is what the lender adds on top.

An amortizing loan contrasts with other forms of lending. In this type of loan, the borrower pays the principal either later on or at the end of the term. For example, with a balloon loan or bullet loan, there is a huge payment at the end.

With a totally amortizing loan, the payments usually stay the same until the borrower pays off the debt. A partially-amortized loan may have a large balloon-type payment at the end.

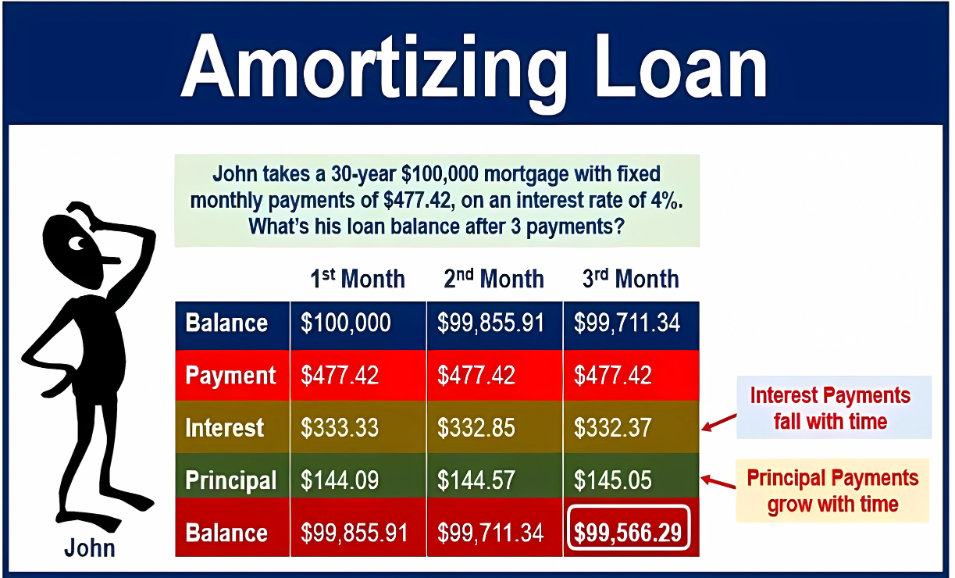

When arranging an amortizing loan, the lender will calculate how much the borrower will have to pay back in total. The total is the principal plus the interest. The lender divides that total by a set number of payments. We call this payment schedule an ‘amortization schedule.’

For example, if you borrow $10,000 to buy a car at an annual interest rate of 10% over one year, the lender calculates the monthly payment using an amortization formula. This results in a monthly payment of approximately $879.16. Over 12 months, you’d repay a total of about $10,549.92, including $549.92 in interest.

In most standard amortizing loans, such as fixed-rate car loans or mortgages, monthly payments remain constant throughout the term. However, in rare cases, like certain loans with daily interest accrual, payments might vary slightly based on the number of days in a month, though this is not typical.

While fixed-rate amortizing loans maintain consistent payments, variable-rate amortizing loans may see payment changes if the interest rate adjusts. In both cases, the loan still pays off both principal and interest over time.

Mortgages are usually long-term loans – they can be thirty years long. In this case, the borrower starts by paying off a higher proportion of interest than principal. However, toward the end, it is the other way round. Even though each installment is identical, the borrower pays off different parts of the mortgage during the term.

Amortizing loan less risky for the lender

As far as the lender is concerned, an amortizing loan is less risky. With loans where the borrower pays the principal at the end, the lender has a longer credit risk. The lender’s risk in such cases is for the full principal during most of the term.

By paying off the principal over time, the risk is lower for the lender.

With an amortizing loan, the borrower will not experience a payment shock later on. With a balloon loan, for example, the borrower might default when the huge payment is due at the end.