A backed currency is one that a commodity backs or supports, namely a precious metal like silver or gold. The value of that currency has a direct correspondence with the commodity’s value. Even if that currency is not redeemable in that commodity on demand, there is still a correspondence in value. Historically, the most common commodities used to support a backed currency have been gold and silver.

However, throughout history, we have used many different commodities, including tobacco.

Fiat currencies

All the advanced economies today use various forms of fiat currency. A fiat currency is one that has no commodity backing, but the government still declares it as legal tender. Market forces determine a fiat currency’s value. In other words; demand and supply, rather than the value of a commodity, determine a fiat currency’s value.

Oil

A fiat currency, in some cases, may closely follow the value of, for example, oil. However, it is not a backed currency, but rather one that belongs to an oil-dependent economy.

For example, the currencies of Saudi Arabia, Russia, and Venezuela tend to follow the direction of oil prices. When oil goes up, their currencies rise, and when it drops they also decline.

Backed currency vs. commodity money

A backed currency is one that a commodity, like gold or silver, supports. Commodity money, on the other hand, is different. Commodity money is made of the commodity. A gold coin – made of gold – is an example of commodity money.

Commodity money includes objects that have value in themselves, as well as their currency value.

Examples of commodity money include things made of gold or silver, or gold and silver themselves (without being made into, coins, statues, etc.). We have also used salt, tea, saffron, decorated shells, alcohol, cigarettes, cocoa beans, and barley as commodity money.

Put simply, when we use the commodity itself as a form of currency for doing business, it is commodity money.

Hundreds of years ago, along Mexico’s Caribbean coast, the Mayan traders’ currency was saffron.

Backed currency – a recent phenomenon

Humans have been using metals as money for almost three thousand years. Until fairly recently, historically speaking, gold, silver, and other metals were the basis for money all over the world.

Over the last couple of centuries, money lost its exclusive form of gold and silver coinage. Base metal coins and paper money, with gold at a fixed rate supporting their value, gradually took over.

Linking printed paper notes and base metal coins to gold satisfied the requirement of money supply stability. Gold is ideal because we keep stocks of it that do not change dramatically. The amount of gold there is depends on how much we mine from the earth.

Historically; the above-ground global gold stock has risen at about the same rate as world population growth. Global GDP has also expanded at about the same rate as gold stocks. GDP stands for gross domestic product.

Backed currencies – problems

However, the history of commodity-backed currencies shows that it does not always work well. In fact, linking money to a commodity supply has often led to problems.

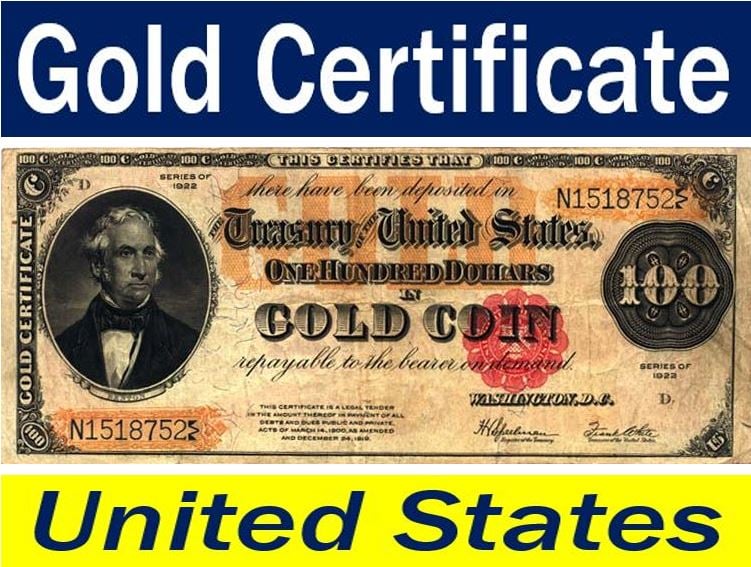

In the 1920s, like most other nations, the USA operated a gold standard. The US had a gold-backed currency.

Despite gold’s theoretical stabilizing influence, huge credit expansion allowed investors to borrow massive amounts of money. They used much of these loans to speculate on the stock market.

Wall Street Crash

This mega-speculation created an asset bubble that burst in October 1929 – the Wall Street Crash. The Wall Street Crash damaged the US economy significantly for several years. In fact, it affected a large part of the global economy.

After the Wall Street Crash, we needed a way to inspire confidence. We also had to find a way to prevent demand in the real economy from evaporating completely. Having a backed currency, namely a gold-backed currency, made this impossible.

Deflation

As the money supply continued declining, deflation set in. By 1931, there was widespread unrest in the United Kingdom following the introduction of austerity measures.

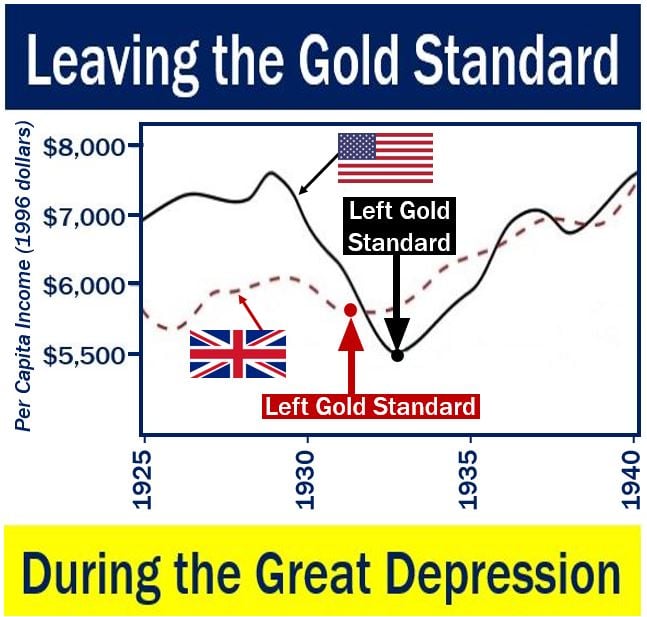

The unrest brought down the government and forced the country off the gold standard. In 1931, the UK no longer had a backed currency.

Recovery from the Great Depression

By no longer having a backed currency, the British government could manipulate the money supply. In other words, it could reflate the country’s economy.

Meanwhile, the US was still on the gold standard. Historians say that was why Britain was able to recover much faster than the US from the Great Depression.

A recession turns into a depression when it has lasted longer than three years.

Backed currency not suitable today

Having a backed currency today in the advanced economies’ current economic systems would not be practical. It would not be beneficial for the economy either. Regardless of how desirable the stability-inducing effects of gold might be, the consequences would be harmful.

The amount of money in circulation in the US is currently worth more than global gold stocks. Even if we recalibrated the currencies, there would still be other serious problems.

In 1848, the US adopted a gold/silver standard. In that year people went crazy seeking their fortune in the California Gold Rush.

If the US adopted a gold-backed currency system today, we would need to control levels of gold mining. We would need to stop mining companies from over-extracting the precious metal.

Most of the world’s gold exists in mines outside the United States. This means that controlling gold extraction would be impossible.

Backed currency – proponents vs. opponents

Proponents

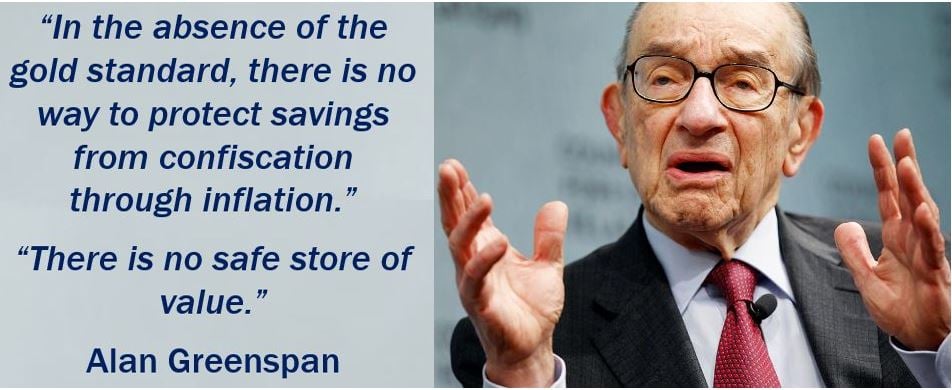

Proponents of a backed currency believe that it would provide long-term economic growth and stability. Furthermore, it would reduce the size of government and prevent inflation, they argue.

The gold standard would reduce the ability of government to print money willy-nilly. The government would not be able to run up massive deficits and push up the national debt.

According to gold standard proponents, the US economy has performed best – historically speaking – under a gold standard.

Many economists disagree with this and point to the Great Depression. The Great Depression occurred when the country had a backed currency.

Opponents

Opponents insist that a gold standard would trigger economic instability, and lead to periodic economic deflation and recession.

With a backed currency, the government would not be able to kick-start the economy during recessions and crises. In fact, we would lose our only effective weapon to reduce high unemployment.

In August 1971, US President Richard Nixon announced that the US would no longer back the dollar with gold reserves. In other words, his country would no longer have a backed currency. Thus ended the last ties between gold and the US dollar.

Between 1971 and 2012, the amount of money in circulation (M1) in the US exploded. M1 grew from $48.6 billion to more than $1 trillion during that period.

Will Cryptocurrencies take over?

Whether we should have a fiat or backed currency may soon be irrelevant, as cryptocurrencies gain traction across the world. An example of a cryptocurrency is Bitcoin.

Cryptocurrencies are digital payment systems with no central bank to regulate them. They came onto the scene in 2009 as open-source software.

A growing number of people are using bitcoin for their purchases. More and more businesses today are accepting payments in the cryptocurrency.

Whether Bitcoin has a promising future is anybody’s guess. Bill Gates, the founder of Microsoft, once said that Bitcoin was brilliant.