Bankmail – definition and meaning

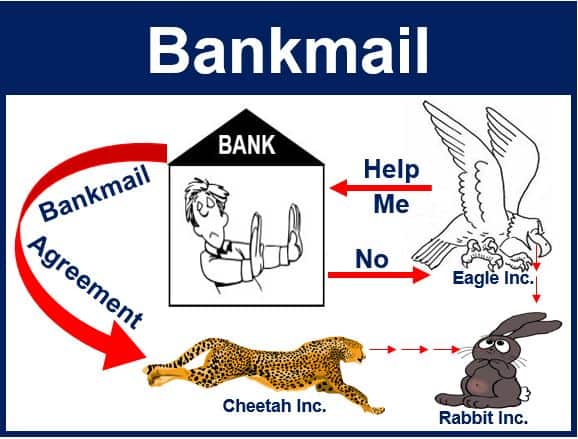

Bankmail occurs when a bank assures a company that it will not finance a rival firm for an acquisition. The agreement may be between the bank and the firm considering carrying out an acquisition. The agreement might also be with the target-company of a hostile takeover.

Businesses use this type of arrangement as leverage in acquisition negotiations. Additionally, they use it as a tactic to make a successful takeover less likely.

Although bankmail does not prevent all takeovers, it provides some breathing space for the company seeking the arrangement. It also provides some leverage.

However, if the predatory company is determined enough, it will probably find a way. For example, that company could go to other banks for financing.

Bankmail may provide breathing space

When a company is making plans for an acquisition, financing is usually a major hurdle. If a business fears an imminent takeover from a rival, entering a bankmail agreement with a bank may help.

The arrangement will force the opponent to find funds elsewhere. In fact, it might even decide to abandon the plan.

While the rival is wondering what to do, the firm that made the agreement has time to move in rapidly and complete the deal.

Bankmail strategy for the prey

As mentioned above, the company that the predatory company is targeting may seek a bankmail agreement. When a company resists an acquisition attempt, we call it a hostile takeover.

According to the Financial Times’ business glossary, bankmail is:

“When a bank agrees with a company seeking to acquire another firm that it will not finance a competing bid from a third party.”

There are several ways the target company can resist the predator. For example, the company can seek a white knight.

A white knight comes in during a hostile takeover and bids for the target company. The target company prefers to merge with the white knight than the predator.