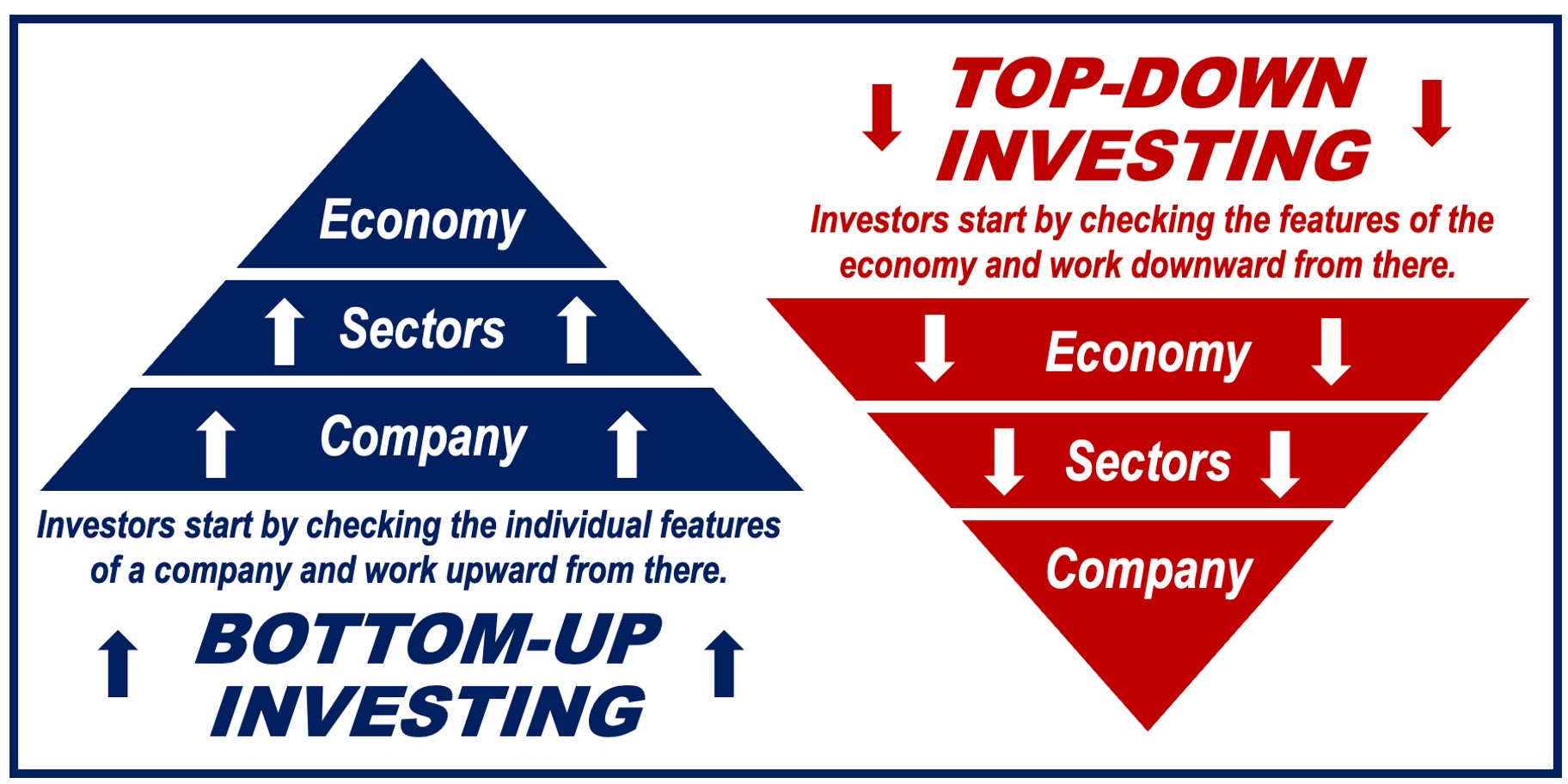

If you, as an investor, first focus on the individual features of a company rather than the economy or industry as a whole, you are a bottom-up investor. You believe that good companies are what matter, rather than how well or badly their industry or the economy is doing.

Good companies can outperform, regardless of the market environment, you and other bottom-up investors say.

The approach is similar to that of somebody finding a diamond in the rough; they concentrate on its shine rather than where they found it.

The Motley Fool has the following definition of the term:

“Bottom-up investing is a type of fundamental investing that looks at a company starting with the company’s own financials and then looks at the wider economy at large. It’s one very important way to evaluate whether or not a company has the ability to be profitable over time.”

Top-down investing

Bottom-up investing contrasts with top-down investing. In a top-down approach, investors look at global economics first and work their way down to individual sectors and then companies.

They look at macroeconomic features first. Macroeconomic features are the large-scale economic factors that affect a country’s economy as a whole, such as inflation rates, employment levels, GDP (gross domestic product) growth, and monetary policy.

Bottom-up investing – the process

The first step is to analyze a company’s fundamentals such as its financial health, product quality, and management team.

A good investor will only consider a business with a strong performance record, competitive advantages, and growth potential. These features are seen as indicators of the company’s ability to thrive in various market conditions.

One of the main advantages of bottom-up investing is that it allows you to uncover hidden gems. These are businesses that may be overlooked by top-down investors.

If you start by focusing at the company level, you can find businesses with the potential for significant returns.

Lots of research required

There is much more to bottom-up investing than simply picking stocks. It requires a lot of work.

You must dig deep into financial statements, understand business models, and evaluate management teams. You need to understand companies inside out.

Risk

Bottom-up investing is suitable if you prefer a hands-on approach to investing, enjoy research, and have a good eye for detail. This strategy can be very rewarding.

However, as with any type of investment approach, it carries risk. Not every company you analyze and decide to invest in will succeed.

Summary

Bottom-up investing is a detailed, company-focused approach. It contrasts with top-down investing. For those willing to put in the research, it can lead to significant rewards.