Let’s say that you put some money into a savings account and watch how it is grows over time. You may notice that the investment grows at a higher rate in some years than others.

It can be difficult to determine the annual growth rates if the growth rates are compounded each year. This is precisely where the Compound Annual Growth Rate (CAGR) comes in handy.

CAGR gives you a single, average yearly growth rate that includes the effects of compounding to make the comparison easier. It is a way of calculating the growth rate of an asset, investment or any business metric over a specific period.

The term ‘compound’ indicates that the growth rate in one year is based on the value of the previous year. The annual growth rate is not shown as a simple average but as CAGR, which shows the average annual growth rate as if the investment or the value had been growing at a constant rate every year.

Note: While it’s often associated with compounding investments, CAGR’s formula and concept can be used any time you want to express a consistent “annualized” rate of growth over a period.

If someone says, “My investment yielded a CAGR of 5% over 5 years,” it means that on average the investment value grew by 5% every year taking compounding into account.

Compounding

Compounding is when any interest or growth you gain in one period is added to the principal (the original amount) so that in the following period, you earn growth (or interest) on a now larger total amount. This “growth on growth” effect can significantly accelerate total returns.

Without Compounding

- You invest $100. Each year, you earn a fixed $10 (which is 10% of $100). After 3 years, you have $130.

• With Compounding

- You invest $100. During the first year, you earn 10% of $100 = $10, ending with $110.

- In the second year, you earn 10% on $110 = $11, ending with $121.

- In the third year, you earn 10% on $121 = $12.10, ending with $133.10.

With compounding, the total is higher ($133.10 vs $130) over the same period because each year’s growth is calculated on a larger principal.

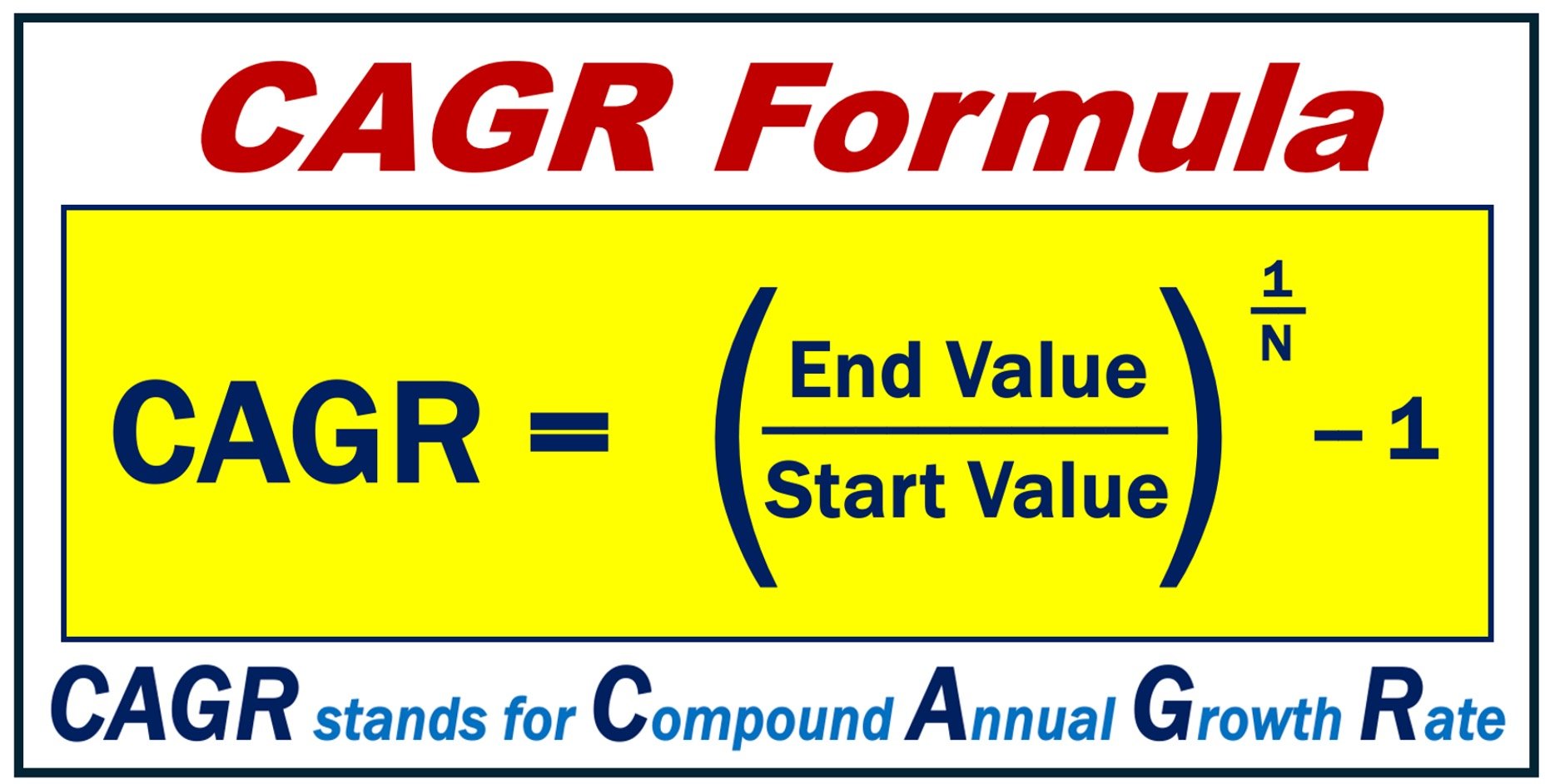

The CAGR Formula

The CAGR is described by the following formula:

\( \text{CAGR} = \left(\frac{\text{Ending Value}}{\text{Beginning Value}}\right)^{\frac{1}{n}} – 1 \)Where:

Ending Value is the final value of the investment.

Beginning Value is the initial value of the investment.

n is the number of periods (usually years).

- Then to convert the decimal to a percentage, multiply by 100.

Why do we use CAGR?

CAGR is widely used in finance, business, economics and even in academic research because it standardizes growth rates across the time. Let’s look at some of the common applications:

Investment Analysis

Investors use CAGR to determine how various assets like stocks, mutual funds, portfolios etc. perform over a certain period.

Business Growth

Organizations track growth in revenue, profit, market share, and other critical business metrics using CAGR. A company with a growing revenue and profit CAGRs is a sign of a stable business.

Industry Analysis

Analyses can be made to determine the CAGR of various industries to identify which sector is growing fastest.

Project Evaluation

When businesses or governments are considering a new project, they may look at CAGR to determine the potential growth rate of the project and whether the project is worthy of investment.