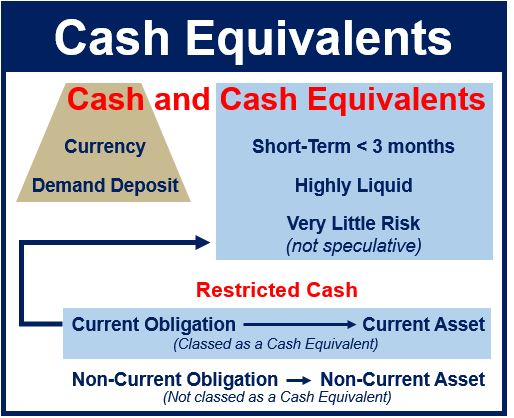

Cash equivalents are the most liquid assets there are. In other words, they are assets that we can rapidly convert into cash. Examples include Treasury bills, marketable securities, money market funds, and short-term government bonds. Foreign currency is a cash equivalent and so is commercial paper.

They mature within three months, unlike short-term, medium-term, and long-term investments. Short-term investments mature at up to 12 months, while long-term investments mature later (five years or more).

A cash equivalent must also have an insignificant risk of change in value. We do not classify common stock as a cash equivalent because a stock’s value changes. However, preferred shares that investors acquired just before their redemption date may be.

Sometimes a company may have cash that is not showing up in ‘Cash and Cash Equivalents.’ It does not show up because we have restricted it for some non-current obligation and it will be a non-current asset.

Put simply, cash equivalents are investment securities that are highly liquid, have a high credit quality, and are very short-term.

Cash equivalents in the balance sheet

In a company’s balance sheet, accountants group cash equivalents with cash. We also call them near money.

The terms near money or quasi-money refer to highly liquid assets that we can quickly turn into cash. Near money is any non-cash asset that is extremely liquid but which we cannot use directly for transactions.

Cash and cash equivalents will appear on the balance sheet as the first item in the list of current assets. We list them first because they are very liquid. We state line items in their order of liquidity.

Examples

To qualify as a cash equivalent, the risk of any change in its value must be extremely low. For that reason, we do not classify common stock as a cash equivalent (stock prices can fluctuate significantly even within a short time). However, preferred shares that investors acquired immediately before their redemption date (i.e., just a few weeks or days before they are set to be redeemed by the issuer) could be considered cash equivalents if there is negligible risk that their value will change.

Here are some other examples:

Treasury Bills (T-Bills)

Short-term government debt securities issued by a national government.

They often mature within three months.

Extremely safe due to government backing (assuming a stable government with a high credit rating).

Money Market Funds

Mutual funds that invest in short-term, high-quality debt.

They aim to maintain a stable net asset value (e.g., $1 per share), thus minimizing fluctuation.

Commercial Paper

Unsecured, short-term debt instruments issued by corporations.

Typically matures within 270 days (often under 90 days to be classified as a cash equivalent).

Issued by corporations with high credit ratings, so the default risk is minimal.

Short-term Government Bonds

Like T-Bills, but could be other forms of government debt that mature within three months.

Marketable and easily converted to cash.

Certificates of Deposit (CDs)

Bank-issued, short-term deposit accounts with a fixed interest rate.

If they mature within three months and carry no significant penalty for early withdrawal, they can be considered cash equivalents.

Bankers’ Acceptances

Short-term credit investments created by a non-financial firm and guaranteed by a bank.

Commonly used in international trade.

Very liquid and low-risk when they are close to maturity.

Foreign Currency

Only if you can rapidly convert it to your local currency at a stable exchange rate.

For instance, U.S. dollars, euros, or other major global currencies are often very liquid.

Conversely, currencies of economies with strict exchange controls or volatile exchange markets (e.g., Venezuelan bolívars) may not be regarded as cash equivalents.