A chartered accountant is the most highly qualified accountancy professional in many countries across the world. The term refers to professional accountants whose qualifications give them the authority to carry out specific activities in the accountancy spectrum. In these countries, other accountants who are not chartered cannot carry out those activities on their own.

The UK, Ireland, Australia, New Zealand, India, Canada, South Africa, Singapore, Pakistan, and some other Commonwealth countries have chartered accountants. The equivalent professional in the United States is a CPA (Certified Public Accountant), while other nations have PAs (Public Accountants).

A chartered accountant is qualified, for example, to audit financial statements, file a company’s tax return, and register finalized accounts at Companies House in the UK and its equivalent in other nations.

Accountant vs. chartered accountant

Accountant

An accountant provides an exact and ongoing record of a company’s, individual’s, or other entity’s financial transactions. In other words, they take care of their employer’s daily financial transactions.

Accountants may work for individuals or expansive associations. They may focus on payroll, implementing cash, paying suppliers, P&L (profit and loss), reconciling the books at the end of the financial year, and tax deductions.

They will have sat several exams; people generally view them as qualified professionals.

Chartered Accountant

These people will have gone through significantly more training than their non-chartered counterparts. They focus on providing comprehensive and accurate records of all of an individual’s or business’ financial transactions.

When a person’s or company’s financial situation is complex, they will benefit from having a chartered accountant. They will find it much easier to determine how to move forward.

Apart from accounting, these professionals need to have a thorough understanding of finance and business. They should also be flexible so that their services match those of their clients or employers.

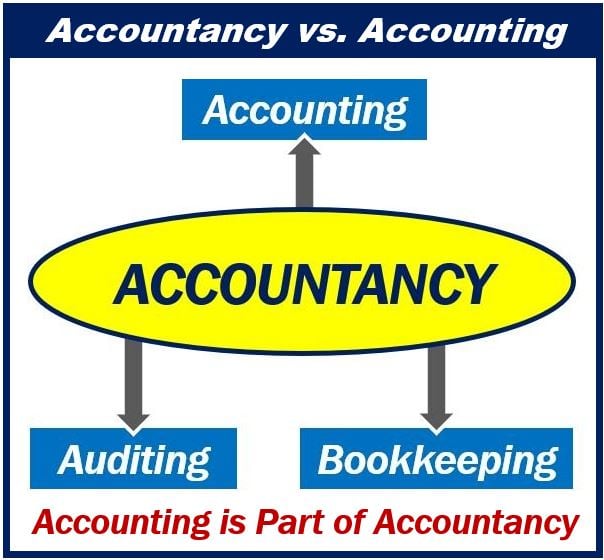

Accounting vs. accountancy

Many people commonly use these two terms interchangeably. However, there meanings are different.

All of it: When we are talking about the entire field, we should use the word accountancy. Accountancy includes auditing, bookkeeping, and accounting.

Part of it: Of the three principles of accountancy, accounting is one, the other two are bookkeeping and auditing.