What are commodities? Definition and examples

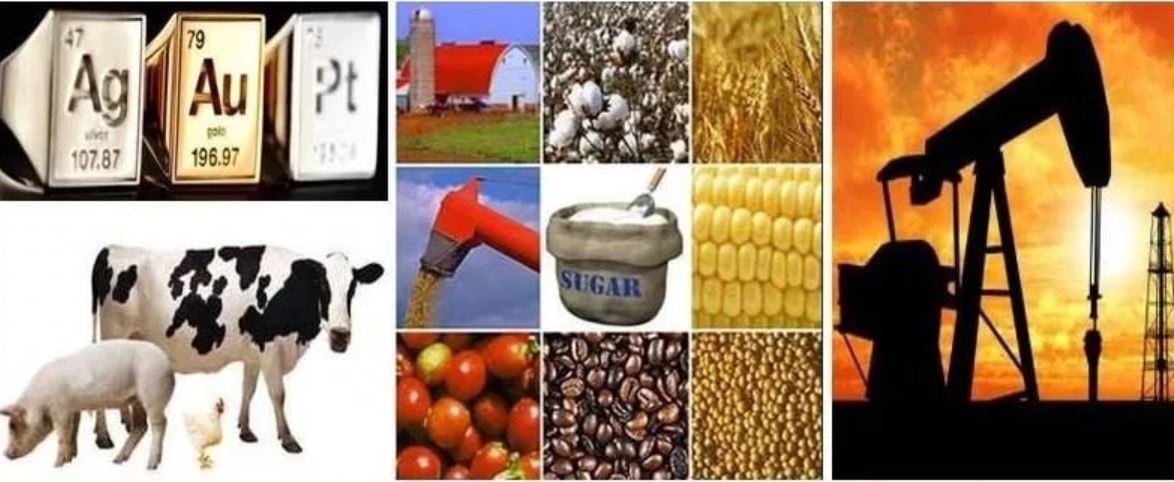

Commodities are primary agricultural products and raw materials. In other words, things that mining companies, oil and gas companies, and farmers produce or extract. Iron ore, for example, is a commodity, and so are sugar and grains.

Some mass-produced unspecialized goods or services are also commodities, such as computer memory or chemicals.

According to the Cambridge Dictionary, a commodity is:

“A substance or a product that can be traded in large quantities, such as oil, metals, grain, coffee, etc.”

Commodities – prices

A commodity is typically a good or service that we trade solely on its price, rather than its features or quality.

For example, everybody, when buying electricity, looks purely at its price – not its quality. All electricity is basically the same quality.

What is the commodity market?

If you want to buy or sell a commodity, you go to a commodity market.

It is similar to the equity market. However, in the equity markets, traders buy and sell shares (stocks).

There are more than 50 commodity markets in the world. They facilitate investment trade in nearly one hundred primary commodities.

The commodity market has a major bearing on everybody’s day-to-day life. It determines, for example, the price of electricity. Electricity prices affect all of us.

Futures contracts are the oldest way of investing in commodities. Investors secure futures contracts with physical assets.

The derivatives market allows investors to engage in speculation or hedging by trading in commodity options and futures without the need for physical delivery.

Modern financial instruments such as exchange-traded funds (ETFs) have expanded access to commodity investments, allowing even individual investors to gain exposure to commodity price movements.

Two types

There are two main types of commodities:

- Agricultural Goods: such as wheat, corn, sugar, and cocoa. An agricultural good is a soft commodity.

- Raw Materials: such as oil, silver, and gold. A raw material is a hard commodity.

Commodity traders have four narrow categories:

- Agricultural Foodstuffs: including soybeans, wheat, corn, cocoa, coffee, and cotton. Sugar is also in this category.

- Livestock and Meat: examples include lean hogs, pork bellies, eggs, poultry, live cattle, and feeder cattle.

- Metals: including copper, zinc, nickel, platinum, silver, and gold.

- Energy: such as crude oil, gasoline (UK: petrol), and heating oil. Natural gas is also in the ‘energy’ category.

Compound nouns

There are many commodity-related compound nouns (terms consisting of two or more words), such as “commodities market.” Let’s have a look at some of them, understand their meanings, and see how they can be used in a sentence:

-

Commodity Trading

The act of buying and selling commodities in the commodity markets or exchanges.

Example: “Commodity trading can be highly volatile, requiring a good understanding of market trends.”

-

Commodity Exchange

An organized, regulated market that facilitates the trading of commodity contracts and related investment products.

Example: “She decided to invest in silver through the commodity exchange.”

-

Commodity Futures

Standardized contracts to buy or sell a specific commodity at a predetermined price at a specified time in the future.

Example: “Commodity futures are often used by farmers to hedge against the risk of price fluctuations.”

-

Commodity Broker

A professional or firm that arranges transactions in commodity contracts on behalf of clients for a commission.

Example: “The commodity broker advised his clients to diversify their portfolio with agricultural commodities.”

-

Commodity Index

An index, often used as a benchmark, that tracks the price and performance of a basket of commodities.

Example: “Investors watched the commodity index to gauge the overall health of the raw materials market.”

-

Commodity Fund

An investment fund that primarily invests in physical commodities or commodity-based securities.

Example: “His financial advisor recommended adding a commodity fund to his investment portfolio for better diversification.”

-

Commodity Analyst

A financial specialist who studies commodity markets to provide guidance on commodity investments and trends.

Example: “The commodity analyst published a report predicting an upswing in metal prices due to market shortages.”

-

Commodity Pool

An investment structure where multiple investors pool their resources to trade commodity futures and options, similar to a mutual fund for commodities.

Example: “By joining a commodity pool, small investors could access strategies and markets that may be out of reach individually.”

Two Videos

These two interesting video presentations, from our sister YouTube channel – Marketing Business Network, explain what ‘Commodities’ and ‘Futures Market’ are using simple, straightforward, and easy-to-understand language and examples.

-

What are commodities?

What is a Futures Market?