Consumer confidence – definition and meaning

Consumer Confidence is an economic indicator economists use to measure how consumers feel. In other words, how optimistic, pessimistic, or neutral they feel about the state of their country’s economy. It also reflects how consumers feel about their personal financial situation.

Academics and economists closely monitor how confident consumers feel. So do banks, retailers, manufacturers, builders, investors, and government agencies. In fact, it is one of the main drivers of business and government planning.

What is a consumer?

A consumer is a person or economic entity that buys something and does not sell it on. In other words, they are the end users.

Consumer purchase goods and services for personal use, and not for resale or manufacture. A consumer is an individual who decides whether to buy a product or a service.

How confident consumers feel affects economic decisions. How we feel about the stability of our incomes and jobs influences our spending behavior. Hence, consumer sentiment serves as one of the major indicators for the overall state of a nation’s economy.

Consumer confidence and domestic demand

If consumers are very confident, they will buy lots of goods and services. In other words, they will spend a lot of money.

However, if their confidence is low, they will spend less and save more. In other words, domestic demand depends on how confident consumers feel.

A month-to-month pattern in consumer confidence reflects how we perceive our ability to retain our jobs. It also reflects how difficult or easy we think it would be to find another job.

This is directly linked to how we rate the current state of the economy and our personal financial situation.

When an economy expands, consumers become more confident. Conversely, when the economy shrinks, they become less confident.

Sometimes, however, GDP may be expanding while consumer confidence declines. GDP stands for gross domestic product.

For example, if the central bank raises interest rates consumers may become less confident. They may lose confidence even if the economy is expanding.

Consumers lose confidence because an interest rate hike means more expensive mortgage and other loan repayments.

Higher loan repayments result in less disposable income. Put simply; when interest rates rise, people have less spare cash – they spend less.

Consumers do not always have access to the most up-to-date data on the situation of the economy. Studies have suggested that the consumer confidence index is a lagging indicator of stock market performance.

Consumer confidence influences planning

If consumer confidence is falling, manufacturers, for example, will reduce their inventory of certain goods in advance. Inventories of expensive and durable goods will shrink first. Businesses may also postpone investment plans.

If banks expect consumers to spend less, they will prepare for fewer mortgage and personal loan applications. They will also prepare for a decline in credit card usage.

Lower mortgage activity means demand for construction will subsequently fall. Hence, builders also monitor consumer confidence closely.

If the government expects consumer spending to fall, it will prepare for a reduction in future tax revenues.

On the other hand, if consumer confidence is rising, businesses and the government will prepare for growth.

Manufacturers will expect demand for their goods to rise. So they will increase production, inventories, and investment.

Larger companies may hire more workers. Builders will prepare for greater construction growth rates, and government agencies will prepare for larger tax revenues.

Advancements in data analytics and predictive modeling are enhancing the ability of economists to forecast consumer behavior with greater accuracy, which can lead to more effective business strategies and economic policies.

Consumer confidence data

-

United States

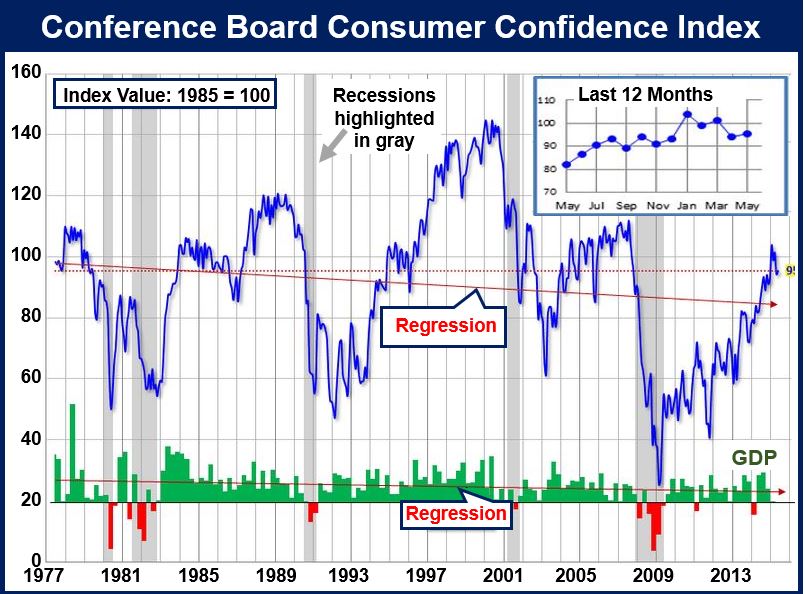

The non-profit business group – The Conference Board – has been publishing the Consumer Confidence Index (CCI) every month since 1967. The Conference Board assesses the overall confidence, relative financial health, and spending power of the average American consumer.

It also publishes the Present Situation Index and the Expectations Index.

Thomson Reuters publishes the Michigan Consumer Sentiment Index (MCSI), which the University of Michigan produces.

-

United Kingdom

Since 1995, the GfK NOP has published the Consumer Confidence Barometer every month.

Based in Germany, GfK Group SE is the fourth biggest market research organization in the world. The company has been providing similar data across Europe for several decades.

-

Canada

The Conference Board of Canada has been publishing its Index of Consumer Confidence since 1980.

According to Cambridge Dictionaries Online, consumer confidence is:

“The degree to which people feel confident about how well the economy is doing, which influences how much money they are willing to spend.”

Emerging trends, such as the growing influence of social media on shopping habits, are beginning to have a noticeable impact on consumer confidence and spending patterns.

Do not confuse the term with the Consumer Price Index (CPI), which measures price changes of consumer goods and services.

Compound nouns

“Consumer Confidence” is a compound noun, i.e., it is a term consisting of multiple words. There are many compound nouns containing the word “consumer.” Below, you can see some of them, their meanings, and how they can be used in a sentence:

-

Consumer Behavior

Consumer behavior refers to the study of how individual customers, groups, or organizations select, buy, use, and dispose of goods, services, ideas, or experiences to satisfy their needs and desires.

Example: “Marketers analyze consumer behavior to tailor their advertising strategies effectively.”

-

Consumer Goods

Consumer goods are tangible items produced for personal use by the general public.

Example: “The supermarket’s sales report indicated an increase in consumer goods purchases this quarter.”

-

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care, typically purchased by households.

Example: “The Consumer Price Index (CPI) is often used to assess inflation levels in an economy.”

-

Consumer Surplus

Consumer surplus is the difference between the total amount that consumers are willing and able to pay for a good or service and the total amount that they actually do pay.

Example: “A big end-of-year sale on electronics resulted in a significant consumer surplus for shoppers.”

-

Consumer Electronics

Consumer electronics refer to electronic devices intended for everyday use, particularly in private homes.

Example: “The latest consumer electronics show unveiled a new generation of smart home devices.”

-

Consumer Rights

Consumer rights are the legal and moral duties of protection granted to purchasers of goods and services against unfair practices.

Example: “The new policy emphasized the importance of consumer rights, ensuring refunds for defective products.”

-

Consumer Advocacy

Consumer advocacy is the movement seeking to protect and inform consumers by requiring such practices as honest packaging and advertising, product guarantees, and improved safety standards.

Example: “Consumer advocacy groups have been pivotal in the push for healthier food labeling standards.”

Two Videos About Consumers

These two YouTube videos come from our sister channel, Marketing Business Network or MBN. They explain what the terms “Consumer Confidence Index” and “Consumer Behavior” mean using easy-to-understand language and examples:

-

What is the Consumer Confidence Index?

-

What is Consumer Behavior?