Core Inflation is the rate at which prices rise, excluding food and energy, because their prices fluctuate a lot. This type of inflation represents the long-term tendency of prices – the underlying inflation trends over time.

J.P.Morgan Wealth Management has the following definition of the term “Core Inflation”:

“Core inflation is a measure of inflation that excludes volatile price components such as food and energy prices. It is intended to provide a more stable, long-term view of inflation, and it is often used to guide *monetary policy decisions.”

*Monetary policy is the responsibility of central banks and includes the setting of interest rates and the management of money supply to stabilize a country’s currency and control inflation.

Core and Headline Inflation

When the inflation rate includes food and energy, we call it Headline Inflation. Headline inflation is more susceptible to short-term fluctuations.

When people talk about “inflation” without specifying which type, they are most likely referring to “headline inflation.” It is also the most commonly reported figure in newspapers, TV, and other forms of communication because it reflects changes that we as consumers experience.

Buying food and paying our utility bills is a routine part of our daily lives, directly impacting our budgets.

Why Does Core Inflation Matter?

By leaving out energy and food, whose prices are unpredictable, core inflation gives us a clearer picture of which way prices are going. This is helpful for:

- Central Banks

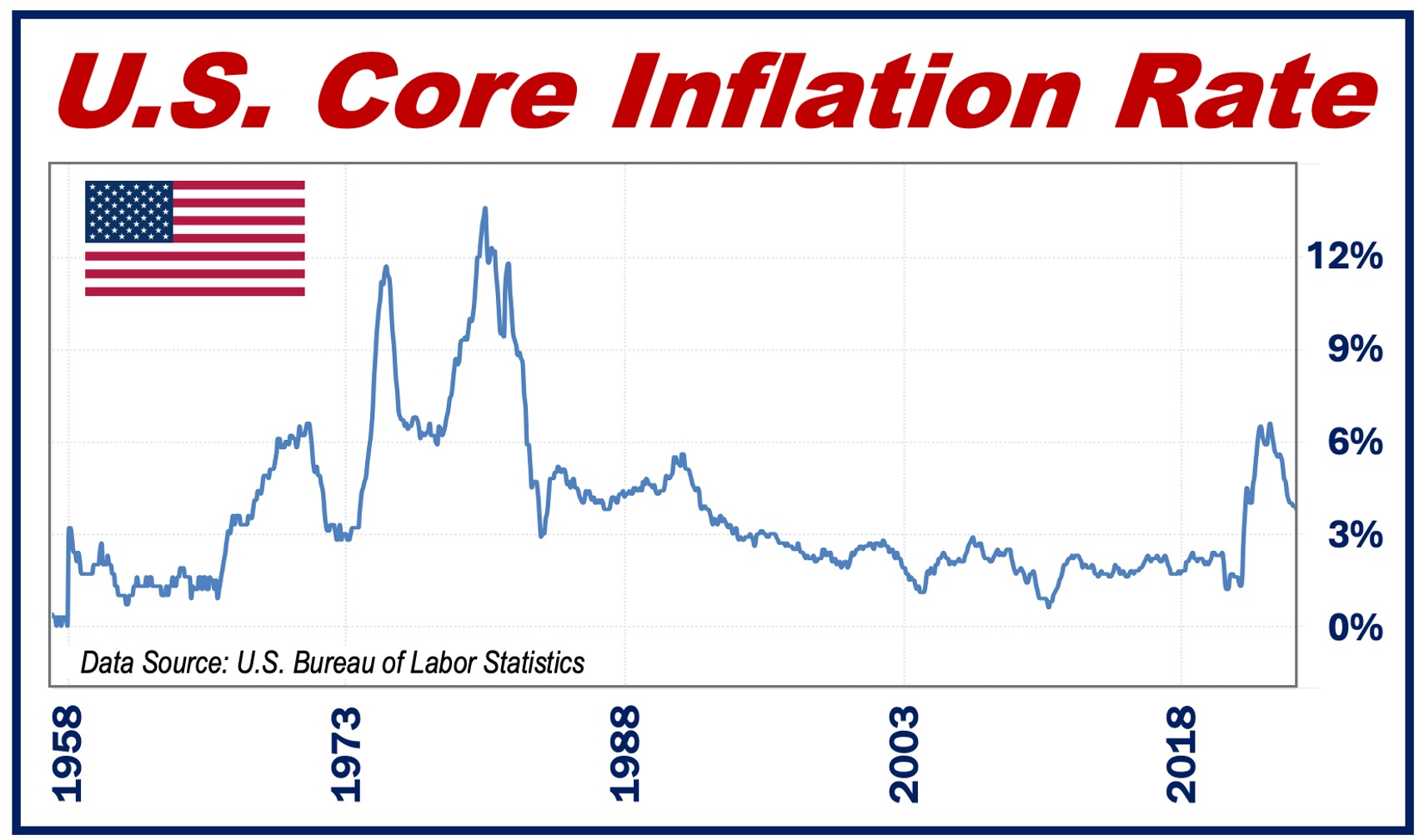

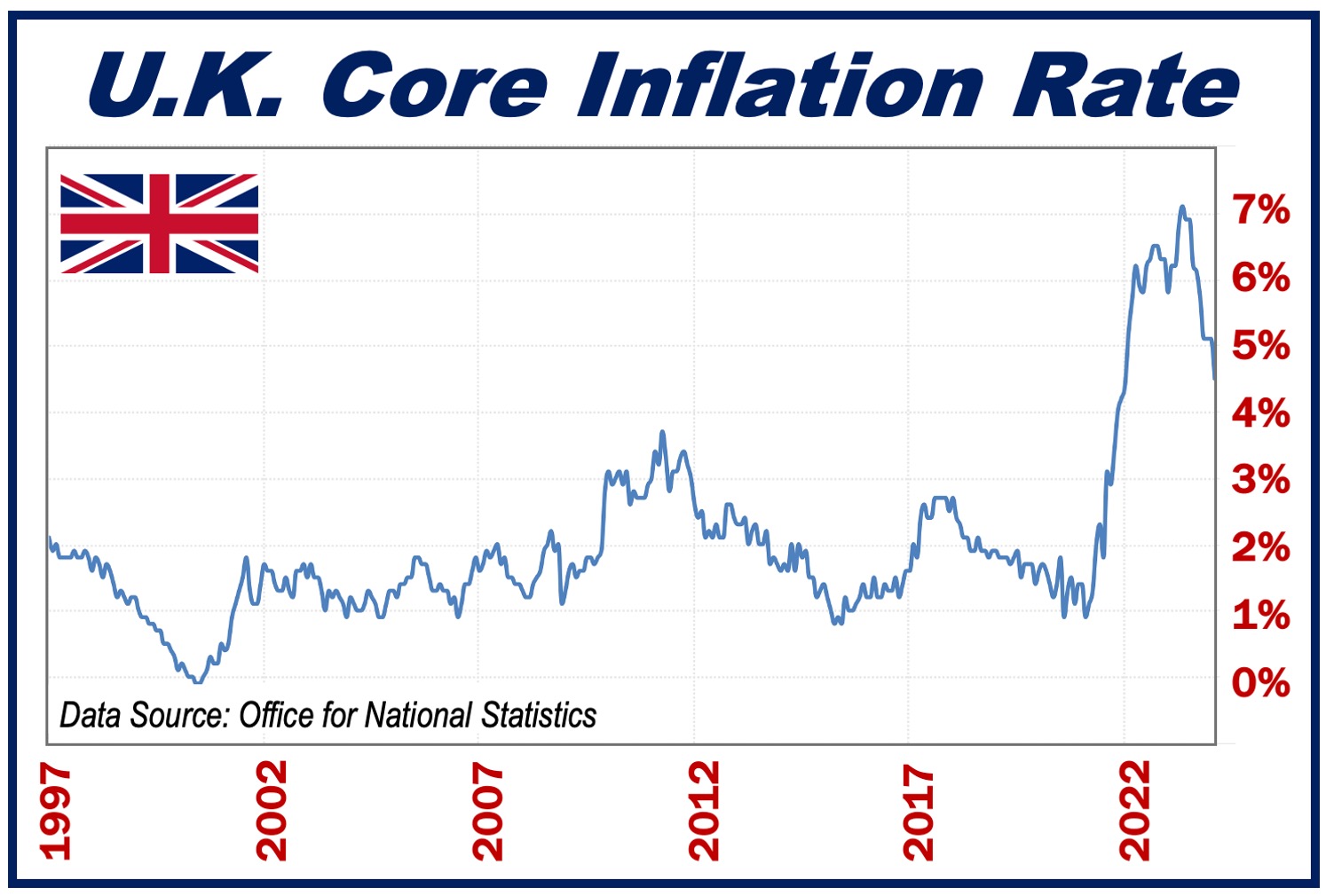

As mentioned earlier, central banks use this price data to make decisions about interest rates, which affect how much it costs to borrow money.

If prices are rising too fast, they will raise interest rates to slow things down. Conversely, if inflation is very near or below zero, they will lower rates to stimulate spending.

- Businesses

When setting the prices of their own products or services, companies use core inflation as a guide.

- Wage Setting

Employers, workers, and trade unions look at the underlying inflation rate when negotiating pay raises to keep up with rising prices.

How is Core Inflation Calculated?

There isn’t a single way to calculate it. Economists and governments use different methods. Here are the most common approaches:

- Exclusion Method:

Starts with the overall inflation rate and directly removes prices of volatile categories like food and energy. Used by many countries, including the UK, US, and the Eurozone. - Weighted Average Method:

Assigns different weights to items based on their importance, reducing the impact of food and energy price swings. - Trimmed Mean Method:

Sorts all price changes, then removes a percentage from both the highest and lowest ends, focusing on the middle range.

The main idea in the three methods is to isolate the underlying price trends by filtering out volatile items like food and energy prices.

What to Remember

- Even if food and energy are major parts of your budget, core inflation doesn’t measure that – it is not about personal spending.

- Core inflation is just one piece of the puzzle. Policymakers and businesses look at many other indicators as well.

- A low, steady rate of inflation is generally seen as a sign of a healthy and growing economy. A little inflation is OK!

Final Thoughts

Core inflation is a measure of the underlying trend in prices. It helps give a clearer picture of how the economy is doing. The information is particularly useful for central banks, employers, businesses, and other policymakers.