A credit default swap (CDS) or credit derivative contract is a financial contract. In the contract, the credit default swap seller must pay the buyer in the case of a third party credit default. The term ‘default’ refers to a debtor’s failure to pay back a loan.

Multi-billionaire Warren Buffett called these contracts ‘financial weapons of mass destruction.’

A credit default swap is insurance protection against third party borrowers defaulting on their debts.

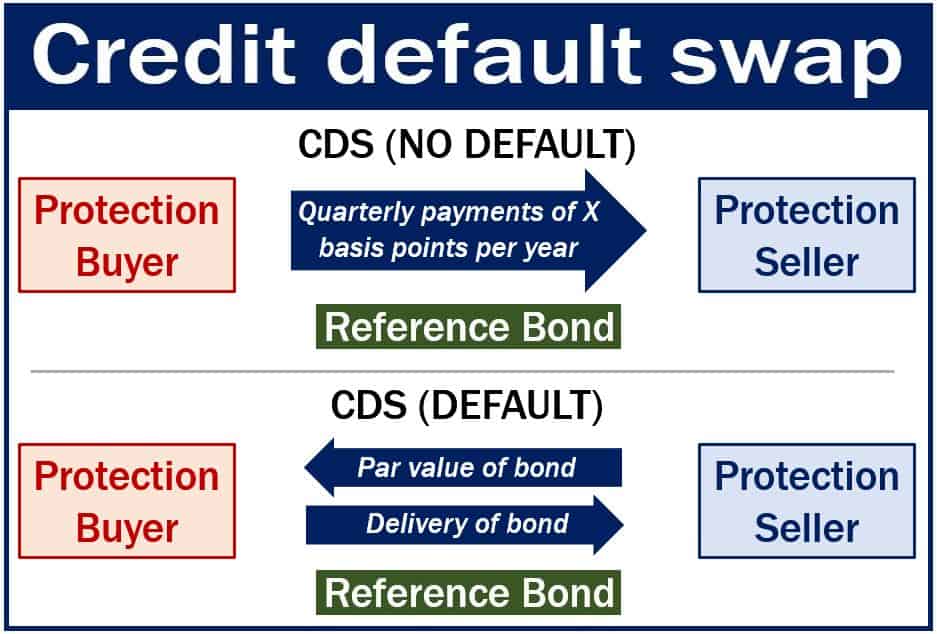

If a credit default occurs, the credit default swap seller usually pays the buyer the face value of the product. The seller subsequently assumes the ownership of the fixed income security in the form of a CDS.

If there is no credit default, then the buyer of the credit default swap must make quarterly payments to the seller. The payments continue until the CDS reaches maturity.

Credit default swaps essentially allow market participants to hedge credit risk.

The credit default swap market is currently not under any government regulation.

With the CDS market available, banks and hedge funds can lend out billions of dollars and not worry about their reserves as security.

Credit default swap – popularity post-2008

During the 1990s and up to the global financial crisis of 2008, credit default swaps became extremely popular. In fact, many people say they became too popular.

A market that banks had initially dominated to hedge risk in their corporate books soon spread to traders. They grabbed the opportunity to use the CDS as a way to speculate on the market’s future movements.

By 2005, traders and banks were also using CDSs to bet and hedge on the future performance on several types of mortgage securities.

When the housing bubble popped and mortgage values dropped, investors who had written CDS protection on mortgage-related investments were in trouble. They were on the hook for billions of dollars’ worth of payouts on the CDS contracts they had sold.

The American taxpayer bailed out giant insurer AIG. Tracy Alloway wrote in Bloomberg.com “and CDSs’ reputation as ‘financial weapons of mass destruction’ was apparently sealed.”

After the global financial crisis, the popularity of CDSs fell significantly. Also, new regulations effectively reduced big banks’ ability to deal in the products.