The debt ceiling, debt limit, or statutory debt limit is the total amount of money the U.S. Treasury can borrow. We also use the term ‘debt ceiling’ when talking about our own or a business’ debt limit. It is the maximum amount we allow ourselves to borrow. This article focuses on the term when it refers to the borrowing limit for the U.S. Treasury.

The U.S. Congress sets the debt limit.

If the government does not have enough money from taxes, it needs to borrow to pay its bills. However, in many countries, there is a limit on how much it can borrow. That limit is the debt ceiling.

Without a debt limit, government spending could get out of control. Inflation, for example, could go through the roof.

The US debt limit was reset to $18.113 trillion in March 2015. This was about $1 trillion more than where it stood in February 2014.

The U.S. government has hit the debt ceiling several times. So that it can keep paying its bills, the Treasury uses ‘extraordinary measures’ which buy it more time to increase the ceiling.

Debt ceiling doesn’t authorize new spending

According to the U.S. Treasury, the debt ceiling only authorizes the government to borrow for spending that lawmakers have already approved.

In other words, it aims to meet existing legal obligations such as tax refunds. Examples of other obligations are interest on the national debt, military salaries, Social Security benefits, and Medicare.

The debt ceiling was created in 1917 under the Second Liberty Bond Act. The Act places a limit on the monetary value of bonds the U.S. can issue.

U.S. government is a huge borrower

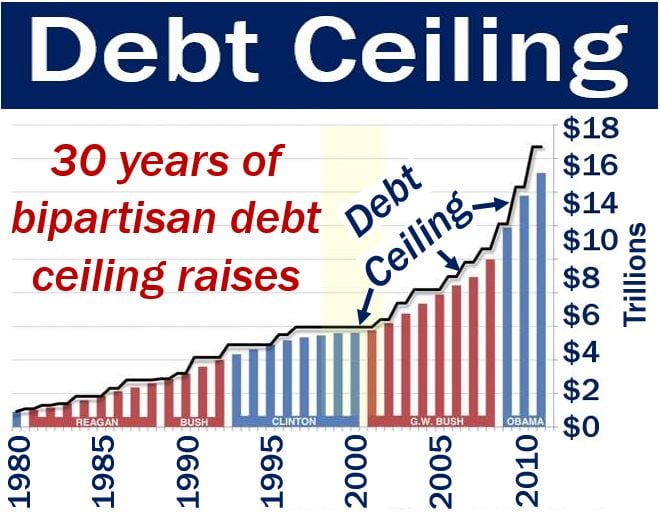

Since the 1980s, US government borrowing has been progressively growing. Not only is the amount increasing, but also borrowing as a proportion of the national economy is rising.

When the 2007 financial crisis hit, government revenue fell significantly. There was, therefore, a further increase in the gap between income and expenditure.

The 2007 financial crisis developed into what people today call The Great Recession. Federal finances deteriorated considerably as the government tried to stimulate the economy and stabilize things.

The financial sector, especially, deteriorated significantly.

To get the US economy back on its feet, the government had to spend even more than usual.

Put simply; the U.S. Treasury had to spend more while its income had dropped.

According to Trading Economics, the US recorded a government debt-to-GDP of 101.53% in 2013. This contrasted with the average of 60.81% from 1940 to 2013. GDP stands for Gross Domestic Product.

In 1946, government debt-to-GDP reached a record high of 121.7%, and a record low in 1974 of 31.7%. US government debt jumped considerably after the 2008 financial crisis.

Debt ceiling and the President

American Presidents do not have the power to raise the debt ceiling on their own.

Members of the two houses of Congress must approve a new debt limit. The two houses of Congress are the Senate and the House of Representatives

Raising the debt ceiling

The U.S. Treasury says that Congress has always acted when the debt limit needed to be raised.

Congress has acted 78 times since 1960 to revise the definition of the debt ceiling. Lawmakers either permanently raised it or approved temporary extensions.

Under Democratic and Republican presidents, Congress revised the debt ceiling 29 and 49 times respectively.

Negotiating the debt ceiling today

It is becoming progressively harder to negotiate a new debt ceiling. In 2010, the Republicans gained control of the House of Representatives from the Democrats.

Since then, negotiating the debt ceiling, as well as a wide range of other legislation has become much more difficult. Budget fighting between the two parties, unfortunately, has become the norm.

Republican lawmakers say that America has been borrowing too much for too long. They insist that the government must bring spending under control. Controlling spending is vital for the short-, medium-, and long-term economic well-being of the country.

During the last debt ceiling negotiations, the Democrats agreed to try to cut spending.

The Democrats say that there are too many Americans with no health insurance coverage. In fact, fifty million US citizens have no health insurance coverage.

Democratic lawmakers believe the government should spend more; bringing healthcare to more people.

If Congress failed to raise the debt ceiling

The U.S. Treasury writes:

“Failing to increase the debt limit would have catastrophic economic consequences. It would cause the government to default on its legal obligations – an unprecedented event in American history.”

In fact, failing to raise the debt limit would precipitate another financial crisis. It would threaten the jobs and savings of Americans. The United States would slide into a deep economic hole, says the US Treasury.

However, Jeffrey Dorfman writes in Forbes that reaching the debt ceiling does not mean the government would default on its debt obligations.

The 14th Amendment states that defaulting is illegal. In other words, the government could not default even if it wanted to.

If Congress failed to raise the debt ceiling, the government would have to prioritize its expenses. In other words, it would reduce spending in some departments and programs to meet debt obligations.

The government could also place debts in order of priority. It could then delay payments regarding the ‘less urgent ones.’

Delaying payments could mean Medicare doctors, veterans, soldiers, and seniors would have to wait for their money. In fact, many of them would have to wait a long time.

Dorfman wrote “In simple terms, the government would have to spend an amount less than or equal to what it earns. Just like ordinary Americans have to do in their everyday lives.”

Video – The Debt Ceiling

This Wall St. Journal Digital Network video explains what the debt ceiling is. It also tells us what can happen if Congress cannot agree to raise borrowing limits.