Diversification is a business strategy in which a company enters a field or market different from its core activity – it spreads out rather than specialize. Some business leaders believe that capital should be allocated in a way that reduces exposure to any one particular asset or risk. Others, however, believe specialization is the only effective way forward in today’s economy.

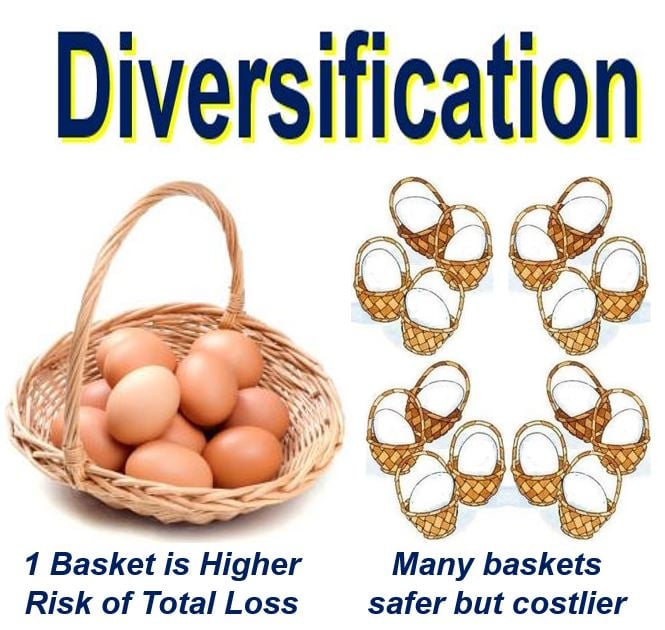

Historically, diversification has been pursued in order to reduce the risk of relying on just one or a few income sources – not putting all your eggs in one basket.

By diversifying, commercial enterprises can avoid seasonal or cyclical fluctuations by producing goods or delivering services with varying demand cycles. It is sometimes a route to faster growth.

If you put all your eggs in one basked, you run the risk of losing everything at once. However, lots of baskets are more expensive, and keeping an eye on all of them requires more work.

If you put all your eggs in one basked, you run the risk of losing everything at once. However, lots of baskets are more expensive, and keeping an eye on all of them requires more work.

Diversification may be geographical

Spreading your risk may not only involve getting into new sectors, but also expanding geographically. If you operate in many regions or countries you are less likely to be severely affected by one downturn, unless of course, the crisis is global.

An economic downturn in the US economy may not affect the UK’s or Japan’s in the same way. Therefore, having investments in Japan and the UK gives the American company or investor a cushion of protection against losses when there is a downturn in the domestic economy.

In banking, diversification means spreading loans over a wider variety of quality borrowers – while maintaining the same level of exposure, the financial institution can maintain or improve earning levels.

Portfolio diversification

In investing, diversification means widening your portfolio – it is one of two techniques to reduce risk – the other is hedging.

California’s economy is rich and stable because of diversification. There are many different revenue streams. Without diversification, an economy can never thrive successfully in a sustainable way. (Image: adapted from lao.ca.gov)

California’s economy is rich and stable because of diversification. There are many different revenue streams. Without diversification, an economy can never thrive successfully in a sustainable way. (Image: adapted from lao.ca.gov)

Several studies and mathematical models have demonstrated that if you maintain a well-diversified portfolio of twenty-five to thirty stocks, you will get the most cost-effective level of risk reduction. Investing in more than thirty may reduce your risk further, but your yields will probably be lower.

Efficient diversification attempts to maximize portfolio expected return for a given level of risk.

Diversification means spreading the risk

If you put all your eggs in one basket and then drop the basket you will lose all the eggs. However, if you place each egg in a different basked, you are much less likely to lose them all in one go. The idiom makes sense, doesn’t it?

However, if you have twenty eggs, making twenty baskets is much more expensive than just one or two. Also, the chances that one will be dropped increases if you have more baskets.

Some business leaders argue that rather than making more baskets we should focus on improving the one(s) we have – making it (them) stronger and more reliable.

Warren Buffett, an American business magnate, investor and philanthropist, considered by many as the world’s most successful investor, once said: “Wide diversification is only required when investors do not understand what they are doing.” (Image: twitter.com/warrenbuffett)

Warren Buffett, an American business magnate, investor and philanthropist, considered by many as the world’s most successful investor, once said: “Wide diversification is only required when investors do not understand what they are doing.” (Image: twitter.com/warrenbuffett)

Diversification is out – specialization is in

The tendency among large multinational corporations since the turn of the century has been to specialize – sell off their non-core sections and allocate resources in one direction. This is very evident in the pharmaceutical industry.

Big pharma has been under assault from generic drug manufacturers, legal challenges to patents on best-selling drugs, and the rise of low-cost drug makers based in emerging markets.

In order to survive, the largest drug companies are building dominant positions in narrower business lines or pursuing medications that target rare diseases.

In the world of drug makers, diversification is out and specialization is in.

Diversification at national level

A diversified economy is one that has several different revenue streams which enable the country to sustain growth because there is no reliance on one particular type of revenue.

The world’s ‘advanced economies’, including the USA, Canada, most of Europe (especially Western Europe), Japan, South Korea, and Australasia have diversified economies.

Venezuela, Russia and Saudi Arabia, on the other hand, are too reliant on the exports of oil and gas – they do not have many other revenue streams. This means that when oil prices tumble, as they have done over the past couple of years, they suffer disproportionately compared to other nations.

The diversification provides countries with the reliability and security that they need so that if one revenue stream fails, it knows there are several other options for revenue.

Video – What is diversification

In this Darden MBA video, Prof. Rich Evans, who teaches Finance at the University of Virginia, talks about diversification and what it means.