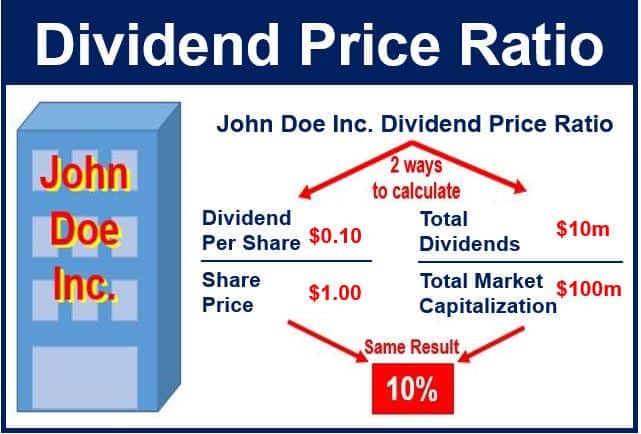

The dividend price ratio, also known as dividend yield, is a share’s dividend as a percentage of its share price, or a business’ total annual dividend payments divided by its market capitalization (as long as share numbers during the period studied are constant).

Along with the payout ratio, dividend yield is one of the two most commonly used dividend policy ratios.

To calculate the dividend price ratio, you divide the yearly dividend per share by the price per share.

Investors look at dividend yield to measure how much cash flow they are getting for each dollar invested in an equity position, i.e. how much bang they are getting for their bucks.

An example of dividend price ratio

Imagine you buy 100 shares of John Doe Inc. at $20 per share,, and the commission cost is $10.

Your total costs will be $20 x 100 + $10, or $2010 ÷ 100 or $20.1 per share. In 2015, John Doe pays dividends totaling $1 for each share held.

John Doe’s dividend price ratio for this purchase is:

Dividend Price Ratio = $1 ÷ $20.1 x 100 or 4.97%.

Many investors and investing companies have a minimum dividend price ratio, below which they are not interested in the firm. For example, dividendgrowthinvesting.com says its minimum is the current 10-year average inflation rate.

According to Cambridge Dictionaries Online, dividend price ratio is:

“The dividend a company pays out to shareholders as a percentage of the share price.”

Why the dividend price ratio is important

The dividend price ratio is important because it is a measure of an investment’s productivity, a bit like an ‘interest rate’ we earn on an investment.

A stock’s dividend yield may also be a sign of a company’s stability. In most cases, only profitable businesses pay out dividends. Some companies, however, do not pay dividends for several years. Apple Inc., for example, did not pay out any dividends until 2012, when it was over 30 years old.

Many investors only seek out a firm that has paid out hefty dividends for long periods. So, if its share price goes down for some reason, the appeal of the dividend payouts combined with the company’s stability may somewhat make up for the price decline.

When people buy shares they do so for two reasons: growth and income. Over the past decade, most blue chip companies in the London Stock Exchange had very little growth, but paid out good dividends.