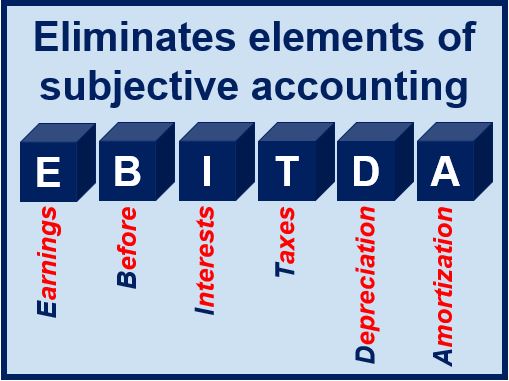

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization.

It is the income generated by a company before accounting for taxes, depreciation, interest payments, and amortization.

EBITDA = Revenue – Expenses (excl. interest, taxes, depreciation and amortization)

EBITDA provides an accurate picture of the cash flow of a company and its ability to repay its debts. As far as lenders are concerned, it gives them a better idea of what kind of risk the borrower is, than looking at its profits.

EBITDA eliminates the effects of financing and accounting decisions, i.e. distortionary accounting and financing effects on company’s earnings do not factor into this earnings measure.

EBITDA eliminates the effects of financing and accounting decisions, i.e. distortionary accounting and financing effects on company’s earnings do not factor into this earnings measure.

It is a proxy for a company’s current operating profitability, revealing how much profit it makes with its current assets and its operations on the products it produces and sells.

EBITDA margin refers to EBITDA divided by total revenue.

A negative EBITDA suggests a business has a fundamental problem with profitability and cash flow. However, a positive EBITDA does not always mean that the company is generating cash, because it doesn’t take into account any changes in capital expenditures, working capital, interest, and taxes.

Investors and lenders are especially interested in EBITDA in cases where businesses have large amounts of *fixed assets, i.e. they are subject to heavy depreciations charges, such as manufacturing companies. As EBITDA is essentially the income a business has free for interest payments, it is of interest to creditors.

* Fixed assets are things a business owns that help it produce and earn income, but are not resold such as machinery, buildings, vehicles, equipment, etc.

The earnings measure is also examined carefully when a company has a large amount of acquired intangible assets and is consequently subject to large amortization charges, such as companies that have purchased a brand or recently made a large acquisition.

Accountants say it is not a useful measure to evaluate a small company without large loans.

Video – What is EBITDA?