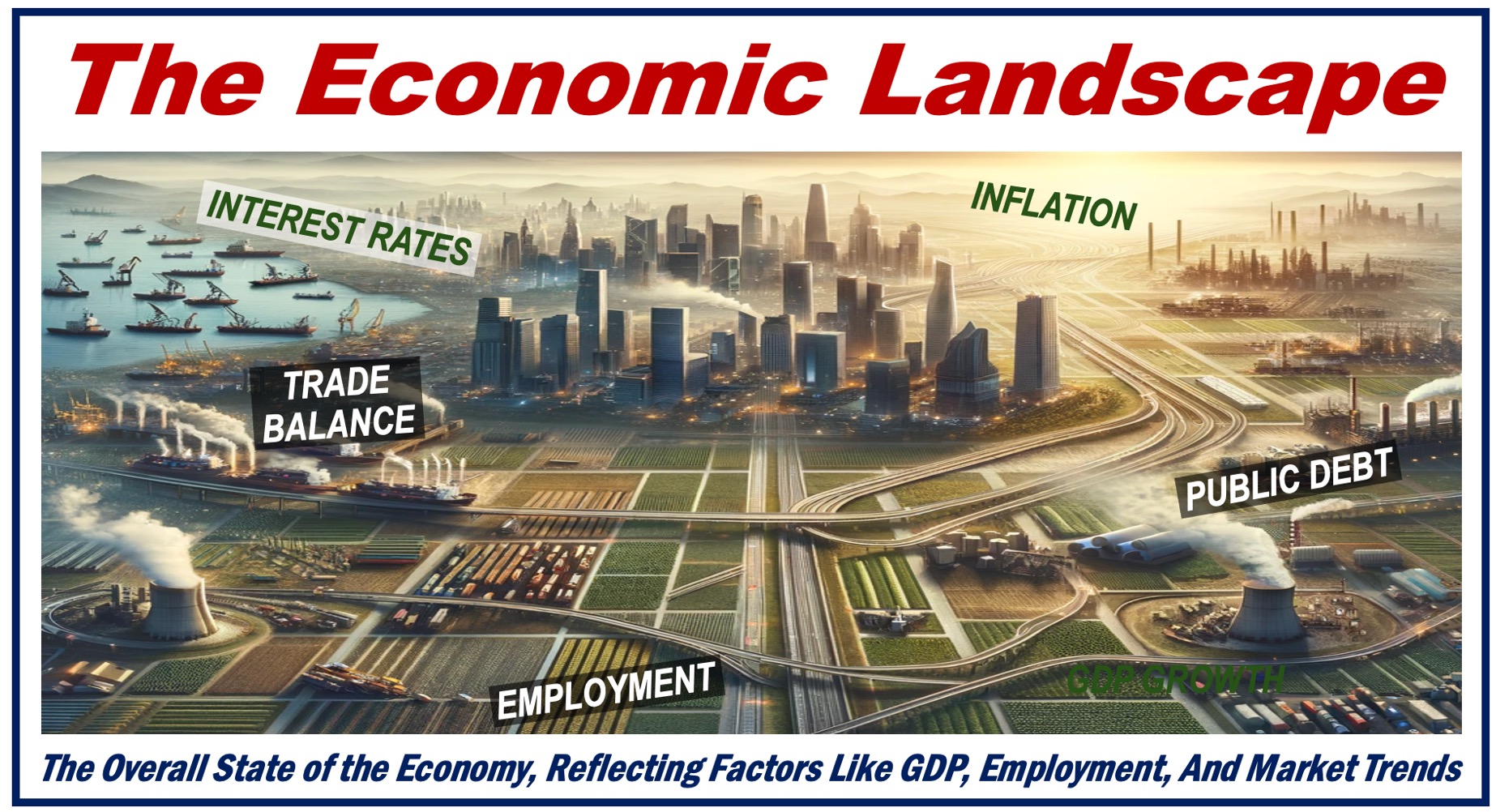

The overall condition of a country’s economy at a certain point in time can be referred to as its Economic Landscape. It is a broad term, similar to the “economic environment” and includes several factors.

The economic landscape may refer to overall economic conditions in a country, a region such as the European Union, or the world.

Businesspeople, investors, financial traders, analysts, portfolio managers, economic researchers, policymakers, and individuals need to understand the economic landscape as it influences decision-making and future strategies.

Put simply, the economic landscape is the overall picture of how an economy is organized: its industries, businesses, and various economic activities.

You can think of the economy as a giant puzzle and the economic landscape is the image you see once every piece fits together, showing how different sectors work in harmony to drive the economy.

Economic factors

Several factors make up the economic landscape. Let’s take a look at the main ones:

Employment rate

Indicates the percentage of the labor force that is employed. When the employment rate is high, demand is high, which is good for the economy, as long as inflation is controlled. When fewer people have jobs, demand falls and GDP growth slows or even reverses (shrinks).

GDP (gross domestic product) growth rate

Measures the increase in economic activity and output. GDP stands for all the products and services that an economy produces or supplies in a given period, which is usually one month, quarter, or year.

Inflation rate

Tracks the rate at which general prices for goods and services are rising. Moderate inflation is ideal – very high or very low inflation is not good.

Sector health

Involves the performance of key areas like manufacturing, services, and agriculture.

Trade balance

The difference between a country’s imports and exports. A trade surplus means that the country is exporting more than it is importing. Policymakers aim for either a trade surplus or a reduction in the trade deficit. A trade deficit is the opposite of a trade surplus.

Interest Rates

Central banks determine the cost of borrowing money, which affects consumer spending and business investment. If interest rates rise, borrowing becomes more expensive, so consumers spend less and businesses invest and spend less, and the economy slows down. When interest rates fall, the opposite happens.

Consumer Confidence

Reflects how optimistic people are about the economy, influencing their spending choices. When confidence rises, so does consumer spending, which boosts the economy.

Public Debt

The total amount of money the government owes, which can affect economic growth and inflation.

Fiscal Policy

Government spending and tax policies that can stimulate or restrain economic growth.

Market forces

The economic landscape, at its core, reflects the interplay of market forces in the marketplace. The term “market forces” refers to the influences of supply and demand on prices and the allocation of resources.

When demand exceeds supply, prices usually rise, which can lead to inflation. Conversely, if supply exceeds demand, prices typically fall, which can lead to deflation.

Economic landscape – a dynamic place

Most components of the economic landscape do not remain the same for very long.

Change may be caused by new technology, political decisions, global events, trade embargoes, shifts in international trade policies, monetary policy adjustments, and changes in consumer behavior.

Summary

The economic landscape is a multifaceted concept comprising many components, offering insights into the current state of the economy and its potential direction.

By examining and monitoring such indicators as GDP growth, inflation, and employment rates, you can gauge the current economic conditions. This enables you to make informed decisions for the future at a personal, corporate, or national level.