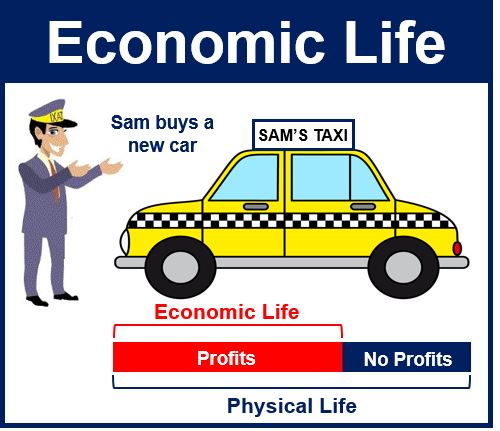

Economic Life, also known as Service Life, Useful Life, or Depreciable Life, refers to how long an asset generates more income than it costs to maintain and operate i.e. how long it remains profitable to keep. Technological advancements can significantly shorten an asset’s economic life by introducing more cost-effective or higher-performing alternatives into the market.

When it costs too much to keep repairing so that no profit is made, it has reached the end of its economic life.

A taxi driver’s car has reached the end of its economic life when it no longer provides him or her with a decent income because the costs of repairing and running it are too high.

Economic life may also be defined as “the time after which money is saved by abandoning and replacing an asset.”

An asset’s economic life might be measured in years or other units. For example, the economic life of a bus or truck might be 300,000 miles.

Economic versus physical life

An asset’s economic life is different from its physical life. A racehorse may generate profits for its owner for perhaps ten years – that is its economic life. However, if healthy it should live from 25 to 30 years – that is its physical life.

When determining whether to invest in new equipment, companies need to estimate the economic life (assuming a normal level of usage and preventive maintenance) of what they are about to buy.

Businesses need to put enough money aside to cover the cost of replacements when assets reach the end of their useful and profitable lives.

The concept is used as the basis for the length of time over which deprecation is charged against an asset.

Companies calculate the economic life of complete plants (whole factories). When making the calculation, they have to evaluate whether it will be replaced by a similar factory, or a new one will be created with greater capacity employing state of the art technology. The new plant may even be built in another country.

Consumers understand the concept of economic life

Most of us, as individual consumers, are familiar with the concept of an asset having an economic or useful life. We eventually decide to get rid of a car for a new model when the cost of maintaining it has become too high, because repairs are more frequent and extensive, and it has started attracting increased taxes and higher insurance premiums.

We may also dislike having to drive an aging car at slower speeds, and spending less time using it because it is always at the mechanic’s under repair.

Eventually, we decide that the benefits we get from having the vehicle do not justify the running costs and inconveniences.

Economic life may be suddenly shortened

Imagine you are a self-employed taxi driver and you bought a new car 12-months ago. You had calculated that its economic life would be 3 years.

However, last month a (fictitious) company called Super-Efficient Taxicabs launched a new type of cab that can do 120 miles to the gallon of gas (UK: petrol) and costs the same to buy as yours did.

Your car does 30 miles per gallon, i.e. your fuel costs are four times as high as the new cab’s.

Seven taxi-driver friends have just bought the new vehicle and tell you about their super-low fuel costs and explain how their incomes have improved.

You may now feel that your cab is no longer providing you with a decent living, when you compare your costs with those of your peers. In other words, your cab’s 3-year economic life has just been reduced to one year.

Market innovations and advancements in technology can precipitate a reassessment of an asset’s economic life, as newer assets may offer greater efficiency and lower operational costs.

Price fluctuations may also alter the economic life of an asset. A dairy farmer may suddenly find that the profitable lifespans of his cows have been reduced after the global price of milk plummeted by 50%. Some of his older cows may no longer be generating profits.